Brent crude oil futures rose above $60 a barrel for the first time in over a week on Wednesday after a data report showed a larger-than-expected drop in U.S. crude inventories, but ongoing worries about a possible global recession capped gains.

Brent crude had gained 32 cents, or 0.5%, to $60.35 a barrel by 0403 GMT, after settling 0.5% higher on Tuesday.

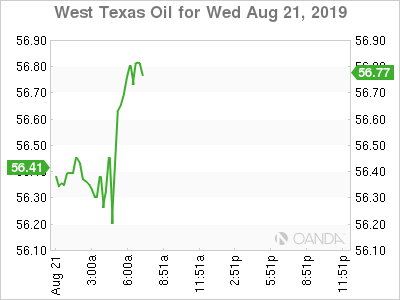

U.S. crude was up 25 cents, or 0.45%, at $56.38 a barrel.

U.S. crude oil stocks fell by 3.5 million barrels in the week to Aug. 16, data from industry group the American Petroleum Institute (API) showed on Tuesday. Analysts polled by Reuters had expected a fall of 1.9 million barrels.

“Crude prices should see support from a bullish API stockpile report that could signal the largest Cushing draw since February 2018, if the EIA validates it,” said Edward Moya, senior market analyst at OANDA in New York.

Inventory numbers from the government’s Energy Information Administration (EIA) are due at 10:30 a.m. EDT (1430 GMT) on Wednesday, and will be more closely watched than usual given the nearing of the end of peak U.S. driving season, analysts said.

“With Canadian heavy crude restrictions being extended, we should see U.S. refiners … struggle to fill the void from lowered shipments from Mexico and Venezuela,” he said, referring to Canadian province of Alberta extending mandatory curtailments on crude production by an extra year.

Tensions in the Middle East remained in focus as U.S. Secretary of State Mike Pompeo said on Tuesday that the United States would take every action it can to prevent an Iranian tanker in the Mediterranean from delivering oil to Syria in contravention of U.S. sanctions.

Oil prices were also buoyed by data showing lower exports in June from Saudi Arabia, the world’s top oil exporter.

Saudi Arabia plans to keep its crude exports below 7 million barrels per day (bpd) in August and September despite strong demand from customers, to bring the market back to balance, a Saudi oil official told Reuters earlier this month.

But uncertainty over the global economic outlook amid the U.S.-China trade war capped gains in the oil markets.

“The trade-related tug of war in the oil market will probably extend until we get some semblance of clarity from the next round of U.S.-China trade discussion,” Stephen Innes, managing partner, VM Markets, said in a note.

Traders are also awaiting this week’s U.S. central bank’s annual Jackson Hole seminar, where substantive comments from Federal Reserve Chief Jerome Powell are expected.

“The biggest risk to crude prices is if Powell disappoints at Jackson Hole and doesn’t signal more easing will be coming,” said OANDA’s Moya.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.