Oil prices are well bid as OPEC and Russia said they were about halfway toward clearing a global oil glut and warned against complacency as rebalancing gathers pace.

At the time of writing, Brent oil was trading 0.66% or 37 cents higher on the day at $56.40/barrel, its highest level since April.

Key takeaways from OPEC meeting

- The meeting concluded without any recommendation to extend output cuts

- Implementation of the pledged 1.8 million barrels a day of production cuts remains high

- OPEC members, Russia and several other producers have cut production by about 1.8 million barrels per day (bpd) since January.

- OPEC believes oil demand is rising at a "high pace".

- Kuwait Minister said, "stock levels in industrialized OECD states in August that were 170 million barrels above the five-year average, down from 340 million barrels in January."

Material evidence that adds credence to OPEC's optimism

Brent oil in backwardation - “There is no doubt that the oil market is moving in the right direction,” the Organization of the Petroleum Exporting Countries noted with satisfaction in its most recent bulletin published on Wednesday.

As per Platts report, "The Brent crude futures spread for December 2017/December 2018 traded on the Intercontinental Exchange flipped to backwardation last week for the first time in three months amid growing optimism that global oil market rebalancing will drive the price structure higher.".

Backwardation is an inverted market situation in commodities and foreign exchange trading, where the prices for deliveries in the near future (spot prices or front-month contracts] are higher than those for later deliveries.

It is caused by excess of demand over supply. The global oil output cut deal has curbed supply to an enough extent so as to push the market into backwardation.

OPEC's status quo adds credence to ongoing rebalancing

OPEC's decision to maintain the status quo today will reinforce expectations that the oil market is rebalancing and that US shale is no longer a threat as it was widely believed to be earlier his year.

The trouble in the first half of this year was an irrational perception on trading floors that every barrel of output cut by OPEC was subsidizing Shale barrel. OPEC's decision to refrain from extending output cuts at today's meeting is likely to squash the irrational perception and keep oil prices well bid as we move into the fourth quarter.

Technicals - Bullish continuation pattern

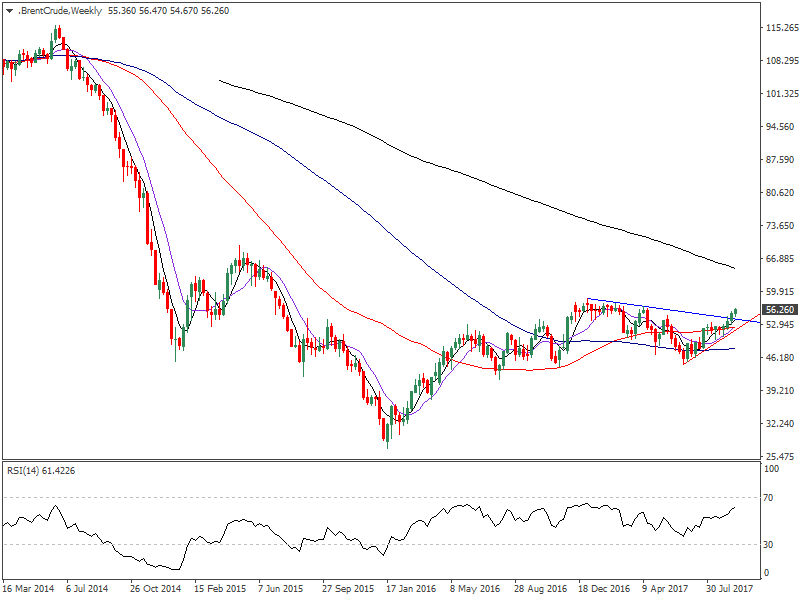

Weekly chart

- The chart above shows an upside break of the symmetrical triangle, which is a continuation pattern, i.e. the rally from the January 2017 low of $27.08.

- The RSI is nicely positioned above 50.00 [bullish territory] and sloping upwards.

- The weekly 50-MA and weekly 100-MA have bottomed out.

View

- Brent oil is likely to test the weekly 200-MA, which is seen sloping downwards to $62.00 levels over the next three months or so.

- In the short-run, a minor pull back cannot be ruled out, especially if Brent fails to take out the January high of $58.50. However, the bullish-to-bearish change is seen only if prices drop below the trend line sloping upwards from the June low and July low.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.