Futures on S&P500 exceeded 2900 and is only 1.2% below all-time highs. Meanwhile, we can mention now 3 bullish signs for EURUSD. Oil stuck to $71 as growth momentum was passed.

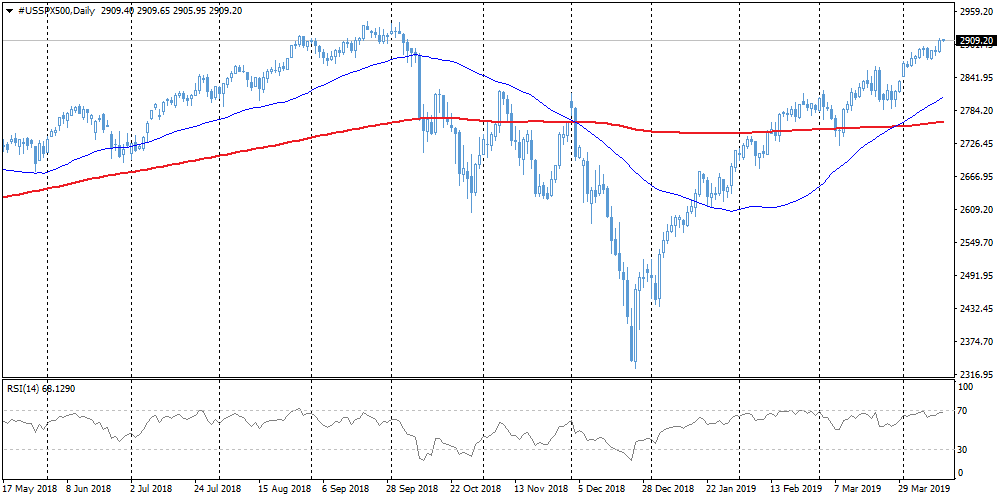

Stocks

The global market is growing. Futures on S&P500 exceeded 2900 and is only 1.2% lower than the historical highs reached at the end of September last year. Chinese China A50 reached its highs in 14 months and then declined amid profit-taking. Behind the growth of markets are optimistic expectations for the US and China trade deal, the shift of the Brexit date and the improvement in data from China last week.

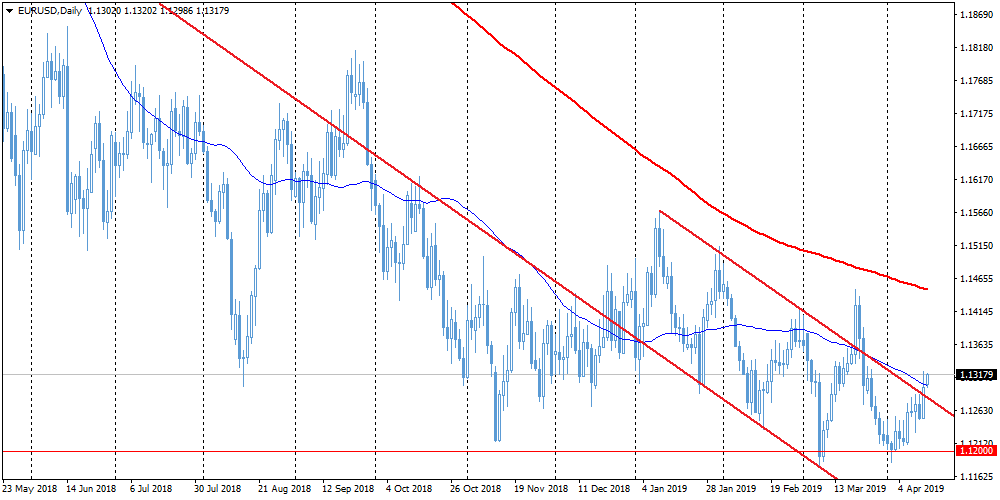

EURUSD

Improving Chinese statistics helped the single currency to get a new portion of support from 1.1200. On the technical analysis side, the single currency enjoys several positive signals that tune it to further growth. Firstly, it is the strengthening of purchases in the process of decline to 1.1200. Secondly, growth above 1.1300 allows speaking about breaking the resistance of the downward trend from the beginning of the year. Thirdly, the pair has been trading above the 50-day moving average since the beginning of the week, which also strengthens purchases from participants closely following medium-term trends.

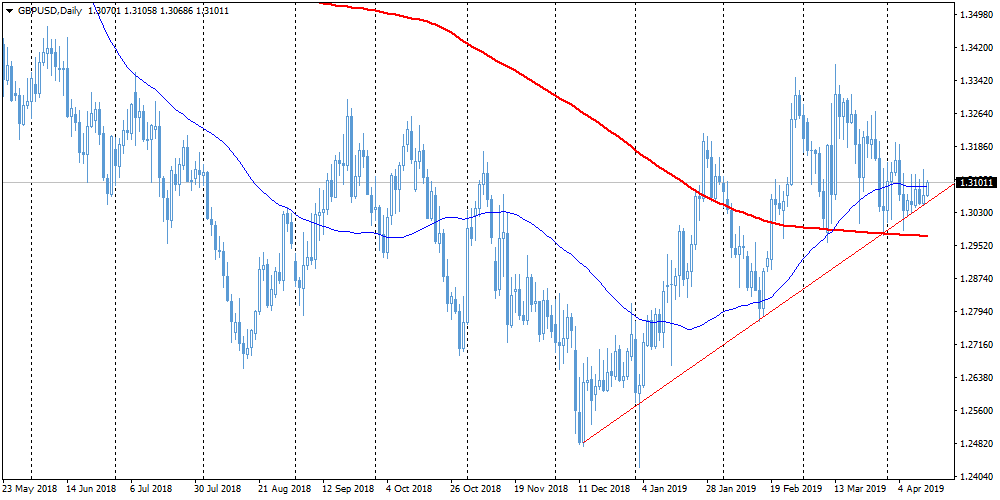

GBPUSD

The British currency cautiously grows after European lawmakers allowed Britain to remain in the EU until the end of October, with the possibility of further delay. This news took away some of the risks against the chaotic Brexit, reducing the pressure on GBP. Growth in stock markets supports buying, raising GBPUSD to 1.3100. As in the case of EURUSD, the pair is trading near the 50-day moving average, consolidating above this level can provide an increase in purchases.

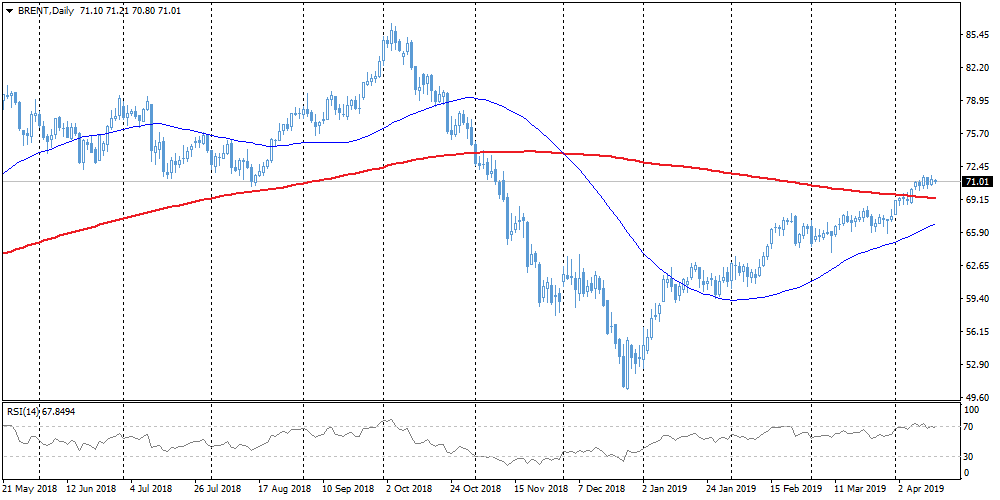

Brent

Oil got stuck around $71 per barrel of Brent, losing growth momentum from the second half of last week. It is alarming that oil does not show growth in conditions of increasing optimism in the markets. In addition, data on the number of working drilling rigs in the United States again showed a decline, which usually acts as a factor of prices support, but not this time. It seems that this growth impulse is exhausted. An important technical impulse indicator - RSI - fell below 70, returning from the overbought area. This is often followed by increased pressure.

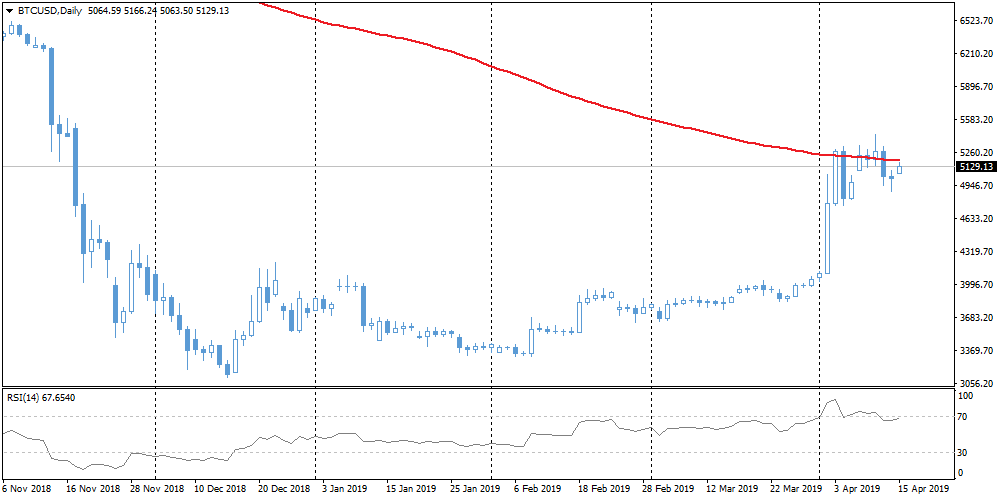

Bitcoin starts the week with a gain of around 2.5% to $5180, receiving support after a short-term decline below $5,000. The market has settled, and now it may be ready for the next sharp movements. Cautious buying after a downturn to $5,000 feed hopes for a return to a positive trend. Among the important levels that can turn into increased volatility, you should pay attention to $5,200 (MA200) and previous highs at $5417.

Trade Responsibly. CFDs and Spread Betting are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.37% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider. The Analysts' opinions are for informational purposes only and should not be considered as a recommendation or trading advice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.