The US and China are reportedly moving closer to a trade deal, despite the recent heated rhetoric according to a Bloomberg article.

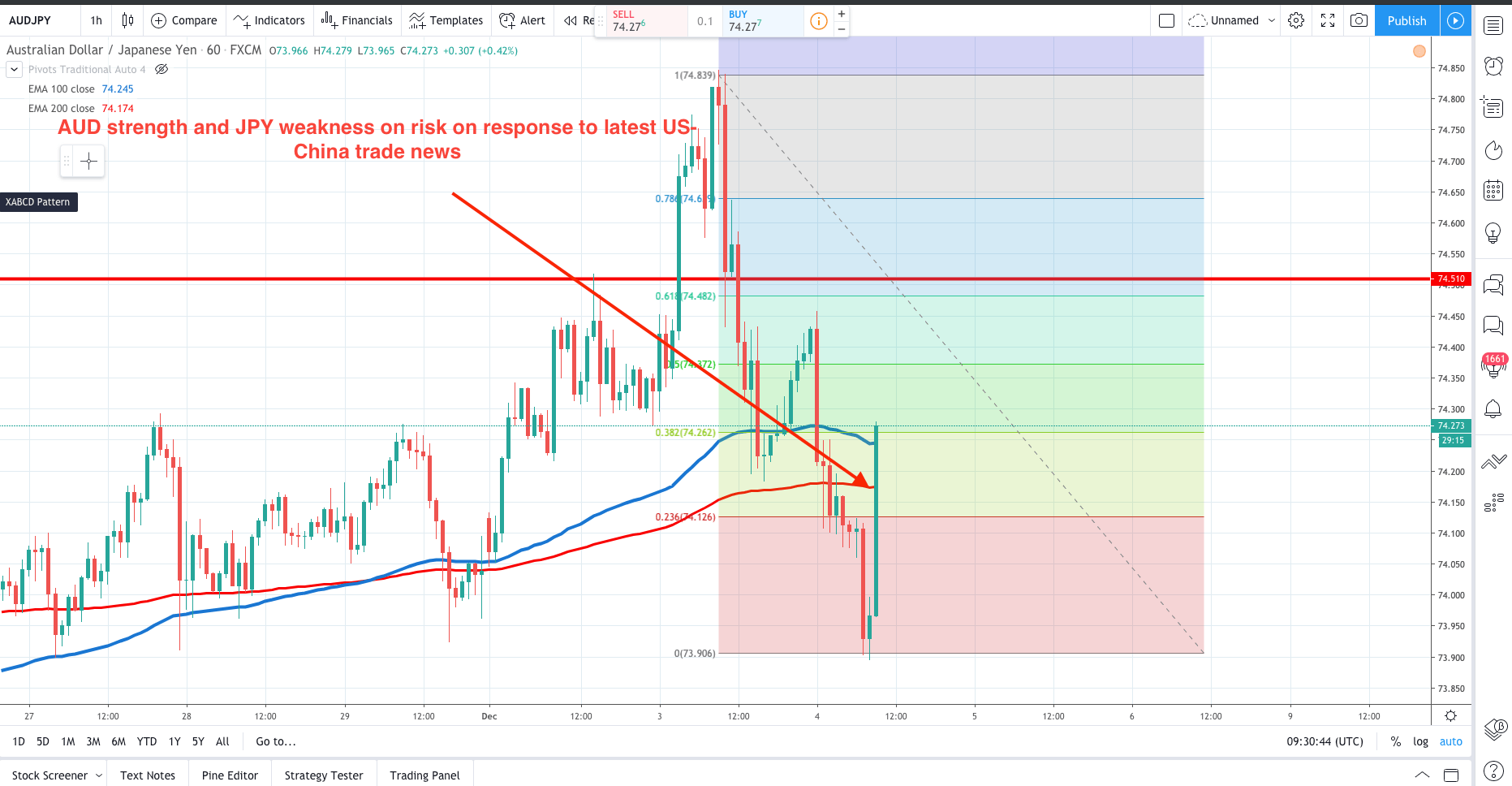

This has moved the market to a risk on response with AUD, NZD, CAD strength and JPY, CHF and gold weakness. The positive US-China trade news is a risk for AUDJPY sellers. This is positive news for the US-China trade deal.

However, some comments: Which sources are these? Always be aware of reports quoting ‘sources’. We need to get some confirmation about which sources for a true return to risk on. Watch out for breaking news with more detail.

Here is what to look for on changing risk sentiment:

-

If Risk on sentiment expect: AUD, NZD, CAD strength and JPY, CHF weakness.

-

If Risk off sentiment expect : JPY, CHF strength and AUD, NZD, CAD weakness.

AUDJPY and gold buyers sellers should be cautious now as we could be seeing a return to a ‘risk on’ trading session. Watch for more US-China headlines

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.