The US Federal Reserve said it would keep the policy accommodative until inflation moderately overshot 2% for some time. Most Fed members see the Federal funds rate at 0% until atleast 2023. Fed members see the inflation returning to close to 2% levels by 2023 and unemployment rate close to 4% by 2023. The Fed would also maintain the current pace of asset purchases of USD 120bn per month until necessary.

Though the policy is as dovish as it can get, the market was already expecting this. As we have been highlighting for a while now, a lot of the dovishness is already priced in. The threshold therefore in terms of what the Fed would have to say or do is extremely high for the US Dollar to weaken from here. In terms of impact, the US Dollar has strengthened post the policy. The Euro is now at 1.1750, the lower end of its recent trading range. US yields are almost unchanged. US equities which were trading with gains of around 1%, gave up gains post policy. Prior to the policy, US August retail sales had come in weaker than expected (0.6% MoM against expectations of 1%)

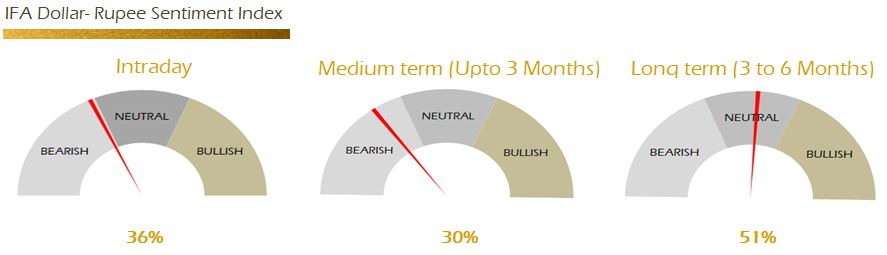

With no major surprises from the Fed policy and the US Dollar broadly stable globally, the Rupee should continue to trade the 73.00-74.00 range a while longer. While several inflows are queued up, we expect the RBI to continue accumulating reserves and that should limit down side. The Yuan is continuing to strengthen and that should limit USD strength against Asian currencies. USDINR is likely to trade 73.50-73.85 intraday with up side bias.

Bank of England rate decision is due today. While the BoE is expected to keep rates on hold, its expectations regarding pick up in economic activity will be important. Market will look for clues as to how it sees EU-UK negotiations and what would be its reaction function in case of a no deal Brexit scenario. US weekly jobless claims also due today.

Strategy: Exporters have been advised to cover on upticks towards 74.00. Importers are advised to hold. The 3M range for USDINR is 72.50 – 74.50 and the 6M range is 72.50 – 75.40.

This report has been prepared by IFA Global. IFA Global shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. IFA Global nor any of directors, employees, agents or representatives shall be held liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. No liability whatsoever is accepted for any loss arising (whether direct or consequential) from any use of the information contained in this report. This statement, prepared specifically at the addressee(s) request is for information contained in this statement. All market prices, service taxes and other levies are subject to change without notice. Also the value, income, appreciation, returns, yield of any of the securities or any other financial instruments mentioned in this statement are based on current market conditions and as per the last details available with us and subject to change. The levels and bases of, and reliefs from, taxation can change. The securities / units / other instruments mentioned in this report may or may not be live at the time of statement generation. Please note, however, that some data has been derived from sources that we believe to be reliable but is not guaranteed. Please review this information for accuracy as IFA Global cannot be responsible for omitted or misstated data. IFA Global is not liable for any delay in the receipt of this statement. This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject IFA Global to any registration or licensing requirements within such jurisdiction. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. IFA Global reserves the right to make modifications and alterations to this statement as may be required from time to time. However, IFA Global is under no obligation to update or keep the information current. Nevertheless, IFA Global is committed to providing independent and transparent information to its client and would be happy to provide any information in response to specific client queries. Neither IFA Global nor any of its directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The information provided in these report remains, unless otherwise stated, the copyright of IFA Global. All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and copyright IFA Global and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.