Today was the last trading day of the 2nd quarter. And the DOW ended the quarter with its best performance since 1987!

After the open, stocks rallied all morning long.

There was a pause in the rally ahead of Fed Chair Jerome Powell & Treasury Secretary Steven Mnuchin’s testimony. Their testimony before the House Financial Services Committee started at 12:30pm ET.

In Powell’s prepared remarks, the Fed Chair stated that “path to recovery is extraordinary uncertain.”

But without any surprises from Powell and Munchin, the major indices took off again.

Stocks closed out the last day of the second quarter in smashing style.

The DOW had its best quarter since 1987. The S&P had its largest rally in a single quarter since 1998, and the NASDAQ saw its best quarterly performance since 1999.

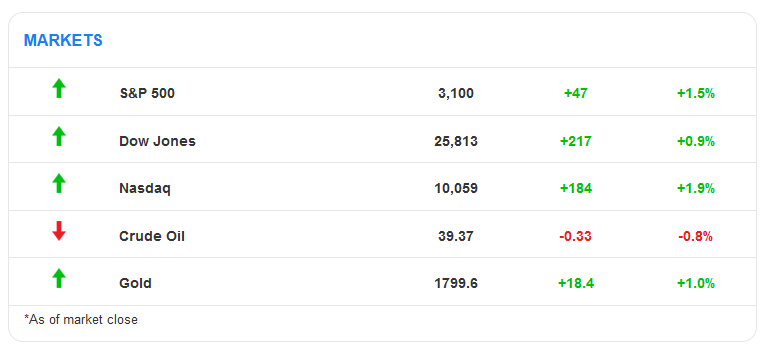

Here’s where the major markets ended the day:

Micron (MU) shares gained +4.8% after a better than expected quarterly earnings. The report showed that there is a strong demand from cloud clients. And as the ever-increasing cloud expands, so will the need for microchip suppliers. Development of 5g networks and next-generation game consoles are also pushing this stock higher.

Uber (UBER) finished +4.9% higher after news surfaced that the company is in talks to buy Postmates. Due to the effects of coronavirus, companies like Uber are trying to capitalize on the increased need for food delivery. A potential deal could value Postmates at $2.6 billion.

Tesla (TSLA) shares landed on the moon today. Setting new all-time highs, the company’s net worth surpassed $201 billion. Tesla closed +7.0% higher ahead of its second-quarter earnings report. Tesla is now the second most valuable car company, closing in on Toyota’s $214 billion market cap.

Looking at the economic calendar, all eyes will be on the economic calendar this week with Initial Jobless Claims Report on Wednesday and the closely watched Jobs Report on Thursday. Both reports are moved up a day because of Friday’s bank holiday.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.