- Litecoin is now in the final steps of the technical formation that might take the price to $700

- BTC/USD keeps developing the head and shoulders formation, with a final bearish movement. Entry opportunity now

Our trading week in the Crypto sphere starts with an analysis on three of the main Cryptocurrencies. Each and every day the Crypto traders are more conscious that money doesn't come easy: position-taking needs to be looked really carefully to develop winning trading strategies.

Litecoin is our first focus, as it is looking to capitalize on the Litepay project. On the other hand, Bitcoin is still in the scenario presented last Friday, still looking for another bearish leg, after which it should offer a good buying opportunity.

LTC/USD 4-hour chart

Litecoin set a low at $182.25 last Friday, which drew the second shoulder of the H&S formation. After that, the pattern has been fully completed. LTC price is moving inside a range targeting several resistances, the main one around the $230 mark. The bullish projection of the current formation sets a potential mid-term target at $700.

MACD in the Litecoin chart is trading inside the positive area, although not by much. The indicator keeps a bullish profile, but with not much inclination, so it should follow a quiet bullish development instead of widespread action.

Directional Movement Index is much more clear and shows buyers in control. D+ is moving above ADX, indicating strength. Meanwhile, ADX is still trading below 20, the level that measures the trend strength. The absence of trend supports the idea of quiet bullish action for the upcoming trading sessions.

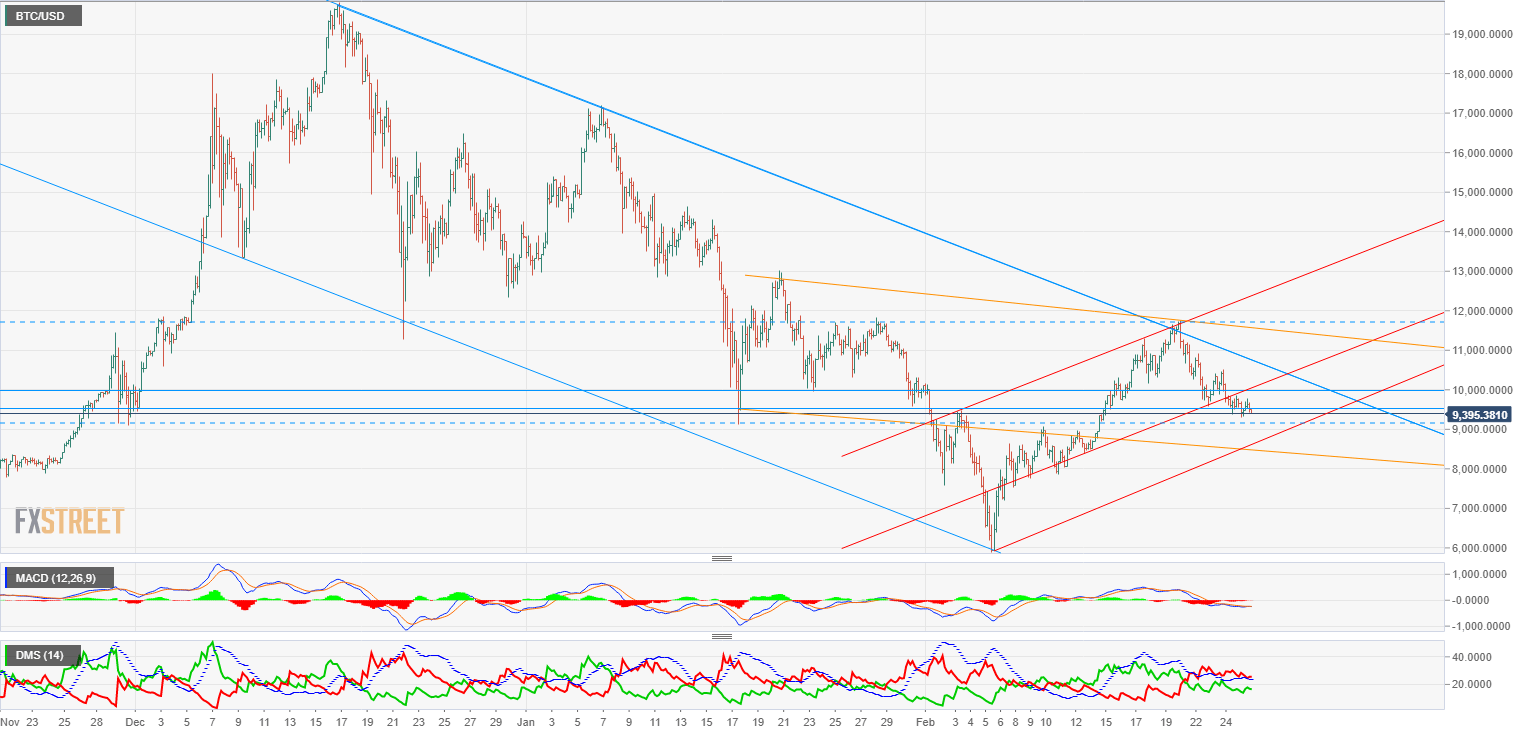

BTC/USD 4-hour chart: Entry opportunity in Bitcoin

BTC/USD could offer a good buying opportunity this week. Bitcoin price is still developing the last leg of the current head & shoulders pattern, that should take the price back to the $8350/$8430 area. That zone is where the price should take a turn back to the upside and follow Litecoin's path. Consider that area as a buying opportunity, with a tight and clear stop below the price area.

MACD in the Bitcoin chart is looking very flat, with a certain bearish inclination. This setup matches with a possible extension to the downside, targeting the $8400 area. It's possible that the price slides down to $8000. Below that level, a change of scenario would be confirmed, so that's a good area to place your stops.

Directional Movement Index shows a descent both in the buyers and sellers numbers, with the latter ones still moving above ADX, so there is still room to look for lower price levels. It will be important to follow this indicator if we are looking to go long, as we need a significant increase in the buying numbers, such as has happened in Litecoin.

Last Friday, we published a Bitcoin price projection for this week that still looks perfectly valid.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.

-636552386711241085.png)