The BOE voted unanimously to leave policy unchanged today, in light of a broadly similar economic assessment compared to August. Further preparation for negative rates is likely to be taken as a vindication of market expectations and brings more downside risk to gilt yields. The same can be said for GBP as Brexit-related pressures compound.

Unanimous decisions to keep policy unchanged

The Bank of England unanimously decided to keep the Bank Rate at 0.1% and the size of its asset purchase facility (APF) unchanged today.

The absence of any dovish dissent in favour of an increase in the APF might have come as a surprise to some, but it is consistent with a committee that saw overall slightly less adverse economic developments than it expected in August. Risks, it noted, remain skewed to the downside.

Among the positives, the committee noted stronger than expected consumption, and slightly higher inflation. However, the tone was prudent to say the least. The phasing out of the Coronavirus job retention scheme is posing a key risk to the job market, although the Bank did not see a case to alter its forecast that the unemployment rate would peak at 7.5% in either direction.

No near-term policy signal, but negative rates expectations hotting up

There was little in this assessment to validate near-term expectations of more easing at the November meeting. The central bank's main scenario is premised on the UK signing a comprehensive trade deal with the EU before 2021. In light of recent developments, this assumption is likely to be challenged by investors, thus resulting in more dovish pricing than today's MPC might imply.

Given already high expectations of further easing, the debate about which tool the MPC might use has also gathered a lot of attention.

We remain confident that an increase in the APF is more likely in the near-term but, in its minutes, the MPC noted that the Bank is exploring plans to take interest rates below zero if necessary. It added that 'The Bank of England and the Prudential Regulation Authority will begin structured engagement on the operational considerations in 2020 Q4'.

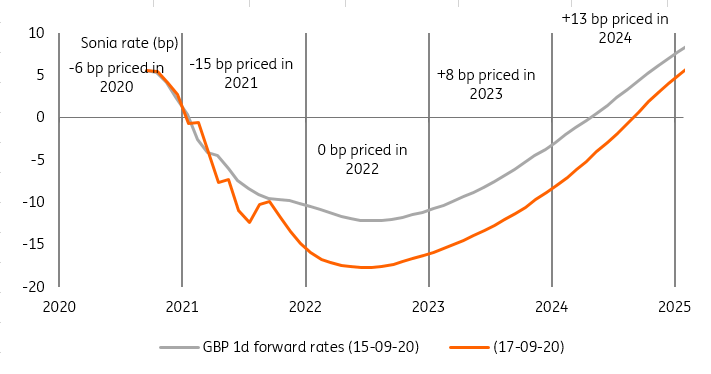

2021 Sonia forwards are pricing NIRP with near-certainty

Rates: let's go negative!

From the point of view of the rates markets, the escalation in the Bank's communication around negative interest rates policy (NIRP) is likely to be seen as a vindication of existing expectations. The timeframe for the implementation/operational study and engagement confirm that these would be more of a 2021 story.

Perhaps due to the worsening Covid-19 curve and to looming Brexit risk, the yield curve has already made up its mind about the odds of further easing, at least judging from the shape of Sonia forwards. To be consistent, we think gilt yields would have to drop significantly, likely below 0% for a time in 2021 to reflect negative Bank rate.

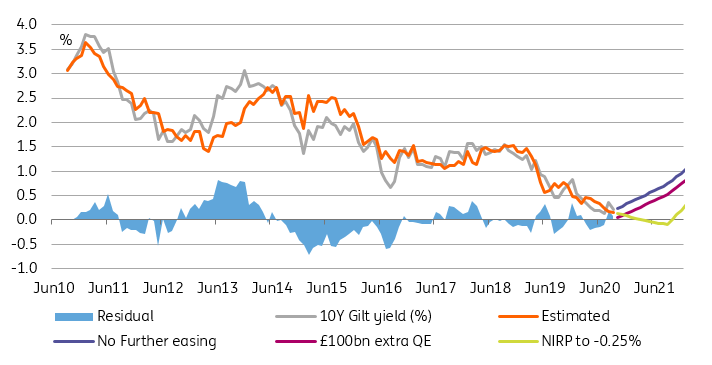

An increase in QE would also do the trick to lower GBP interest rates, but the impact is likely to be more limited. We show in the chart below the impact on the path of the 10-year gilt yield of a £100bn increase in the APF, and of a 25 basis point cut to the Bank rate.

As 2021 approaches, we think gilt will converge to zero, provided expectations of a more dovish central bank are not disappointed.

10-year gilt skewed to the downside, but NIRP is a lot more impactful

Source: Bloomberg, ING

Pouring more oil into GBP fire

GBP took a hit as official discussed the effectiveness of negative interest rates. The market has already been pricing a modest chance of negative rates and today’s meeting confirms this bias.

While clearly negative for GBP, we continue to see the UK-EU trade negations as the chief driving factor of GBP in coming weeks, with the success or the failure to agree on a (reasonable) trade deal also determining the odds of BoE negative interest rates.

This means that the potential GBP negative from the failed UK-EU trade negotiations would be further exaggerated by the BoE likely moving rates into negative, as we discussed in Sterling unprepared as UK-EU trade deal hopes fade.

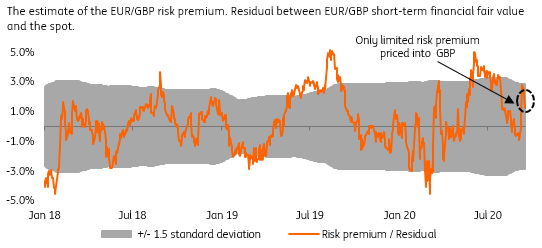

Limited risk premium priced into GBP

The damage to GBP has been done, and we don’t see the recent softening in the UK government stance by giving parliament a veto over some measures of the bill as substantial enough to reverse or change the decreased perceived odds of success in the trade negotiations.

The odds of further negative headline news (or the lack of) trade negotiations are high and with GBP not exhibiting enough risk premium (only 1.5% based on our financial fair value model, vs 5% risk premium pricing in late June – see chart above). we see more downside risks for GBP.

We expect EUR/GBP to re-test the 0.9300 level again this month.

Read the original analysis: Bank of England: No policy change but keeping its options open

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.