- Australia is expected to have lost 125K job positions in May.

- Wages’ growth has continued to slow significantly in the first quarter of the year.

- AUD/USD is still bullish and could retake the 0.7000 threshold.

Australia will release May employment data this Thursday, and the country is expected to have lost 125K job positions, an “improvement” from the previous -594.3K. The unemployment rate is foreseen ticking higher to 7% from 6.2% in April, while the participation rate is foreseen at 63.7%.

As it happens worldwide, dismal employment figures are the result of the strict lockdown measures imposed to prevent the spread of the coronavirus pandemic that continues to take its toll. Between April and May, most major economies have been almost paralyzed, resuming economic activity in June. With that in mind, speculative interest won’t be much impressed with the poor figures.

Wages falling further

Australia publishes wage growth quarterly basis and apart from the monthly employment report. According to the latest available data, the Wage Growth Price Index rose by 2.1% in the first quarter of 2020, and when compared to the first quarter of 2019. That’s below the annual average of 2.2% for the five years to December 2018. In the five years to December 2013, the average annual growth was 3.3%. Salaries have been slowing significantly, in spite of the RBA’s valiant efforts.

Even further, the Melbourne Institute estimated that annual pay growth has fallen into negative territory for the first time in over 20 years, as total pay growth over the year to June 2020 was -0.7%.

According to a special document prepared by the Parliament of Australia, “the major causes of the slowdown in wage growth cited by both the Reserve Bank of Australia (RBA) and Treasury include the presence of excess capacity in the labor market (demonstrated by stubbornly high rates of underemployment); a steady decline in inflation and inflationary expectations; and a decline in the terms of trade since the end of the mining boom.”

RBA says the economy will need support for some time

The Reserve Bank of Australia has released the Minutes of its latest meeting earlier this week. Policymakers agreed that the target for the three-year yields would be maintained until progress is made towards the bank’s goals of full employment and the inflation target. The same applies to the cash rate, which will remain at record lows until the bank sees progress on employment and inflation. The outlook is highly uncertain, according to the document, and the effects of the coronavirus pandemic on the economy will likely be long-lasting.

Australia has had a limited number of contagions and deaths and seems to have COVID-19 under control, but that was not for free. The Q1 GDP has shown that the country’s economy contracted by 0.3%, the first time within recession levels in almost 30 years. And it barely measures the beginning of the crisis. Q2 figures are expected to paint a much worse picture. In this scenario, and keeping in mind the developments over the last few years, a pick-up in the employment sector is far from sight.

AUD/USD possible scenarios

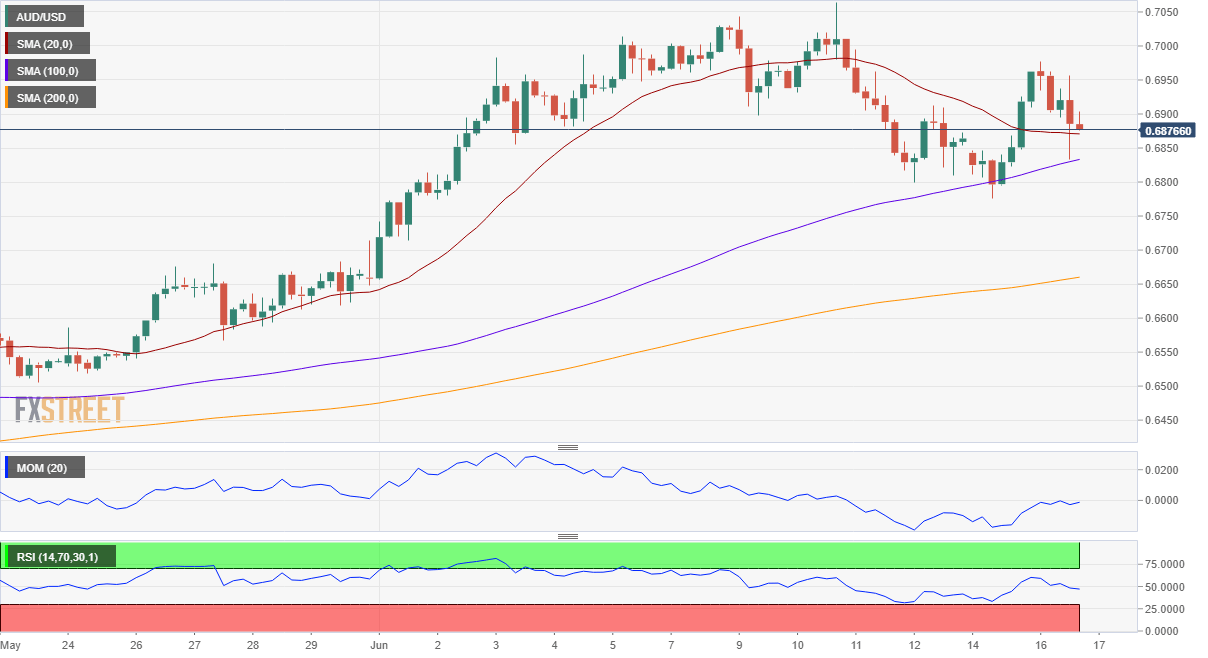

After collapsing in Mach, the AUD/USD pair has been in bullish mode, topping at 0.7063 last week. The pullback from the level has been quite limited, mostly because of the RBA’s confident stance on economic recovery. Now trading around 0.6800, the long-term picture suggests that bears are still side-lined. The broad dollar’s weakness reinforces the technical picture.

Upbeat numbers will likely boost the pair towards the critical 0.7000 threshold, although gains beyond this last may be short-lived. A slump on a disappointing outcome could see the pair falling towards 0.6830 first, and to the 0.6770 price zone later, where bulls are expected to take their chances. A bearish extension below this last will be possible if dismal numbers couple with risk-aversion.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.