The Australian dollar advanced 1.8% since Asian opening on Tuesday, making the biggest daily advance in the new month and hit new April’s high

Risk sensitive currency was supported by rise in global equities that boosted appetite for riskier assets, with RBA’s decision earlier today to keep interest rates at the record lows, contributing to positive tone.

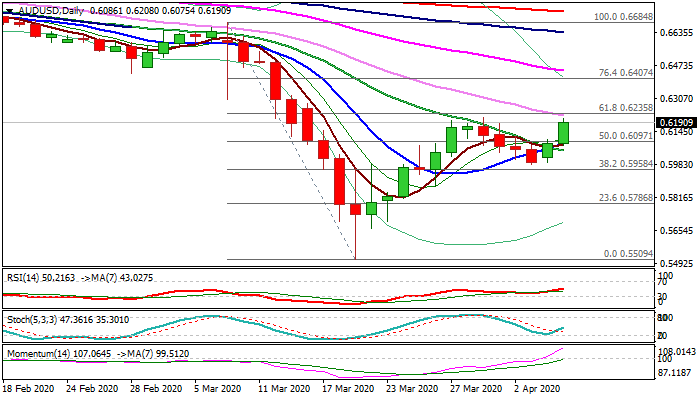

Rising bullish momentum; north-heading stochastic / RSI on daily chart and formation of 10/20DMA’s bull-cross also support the action, which pressures key barriers at 0.6212/22 (31 Mar correction high / falling 30 DMA) and nearby key Fibo level at 0.6235 (61.8% of 0.6684/0.5509).

Close above these levels is needed to signal continuation of recovery leg from 0.5509 (19 Mar low) which was interrupted by shallow 0.6212/0.5980 correction.

Thick 4-hr cloud (0.6096 / 0.5956) and broken rising 10DMA (0.6085) strongly underpin today’s action.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.