The Aud took a hit in late Asia/early Europe and has been to a low of 0.7447 briefly, ahead of a bounce to current levels and now awaits the important Q1 Wage Price Index.(exp 0.6% qq, 2.6% yy) and the WBC Consumer Confidence .

1 hour/4 hour indicators: Mixed.

Daily Indicators: Turning Neutral

Weekly Indicators: Turning lower

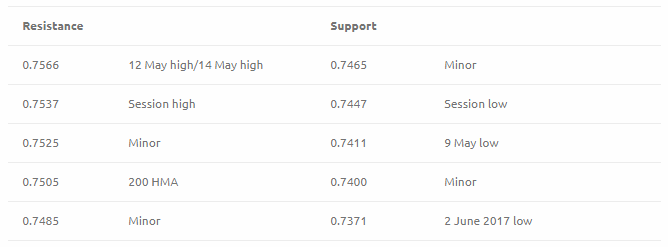

Preferred Strategy: While the hourlies are trying to correct higher the 4 hour charts suggest that we are in for another test of the 0.7445/50 level. Below there would then head towards the 9 May low of 0.7411. This is an 11 month low and decent buying interest should arrive at 0.7400/10. Below 0.7400, there really is not too much to hold it up ahead of Fibo support at 0.7385, the 1 June 2017 low at 0.7371 and the May 2017 low of 0.7328.

If the Wage Price Index comes in above expectations, a squeeze could take us back to 0.7485/0.7505, which I think would be a decent area to re-sell the Aud. Above here opens up 0.7525, ahead of the Tuesday high of 0.7537 although this seems unlikely to be visited today.

Sell AudUsd @ 0.7500. SL @ 0.7540, TP @ 0.7400

Economic data highlights will include:

Q1 Wage Price Index, WBC Consumer Confidence , China House Price Index – Apr

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.