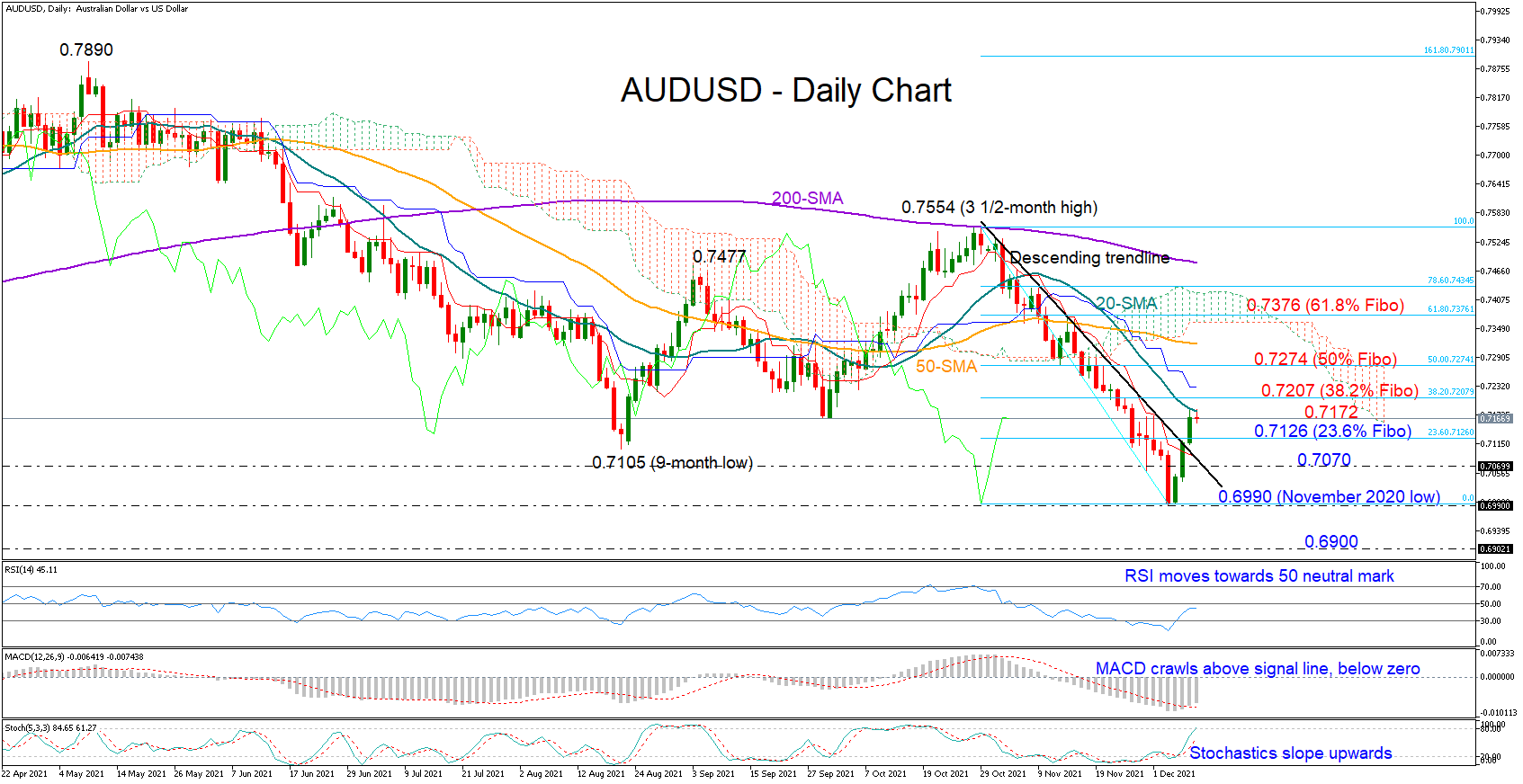

AUDUSD surged above the steep 6-week-old descending trendline and the restrictive red Tenkan-sen line on Wednesday, raising hopes that the downward pattern has finally found a bottom and it’s time for a bullish reversal.

The momentum indicators witness improvement in buying sentiment as the MACD is distancing itself above its red signal line, the Stochastics slope upwards, and the RSI is ramping up to meet its 50 neutral mark. Yet, today’s resistance around the 20-day simple moving average (SMA) at 0.7180 and the 38.2% Fibonacci barrier positioned near the 0.7200 psychological mark, could feed some caution among traders in the near term.

A decisive close above 0.7200 may lead the price straight to the 50% Fibonacci of 0.7274, a break of which could initially see a test around the 50-day SMA before stretching towards the 61.8% Fibonacci of 0.7376.

On the downside, a step below the 23.6% Fibonacci of 0.7126 could immediately seek support around the broken ascending trendline seen at 0.7070. Should the bears claim that territory too, all eyes will turn again to the 0.6990 bottom Failure to change course here could bring the 0.6900 mark under examination ahead of the 0.6830 handles taken from June’s 2020 limitations.

Summarizing, AUDUSD is facing an improving bias in the short-term picture, with the bulls aiming for a close above 0.7200 to stage another extension higher.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.