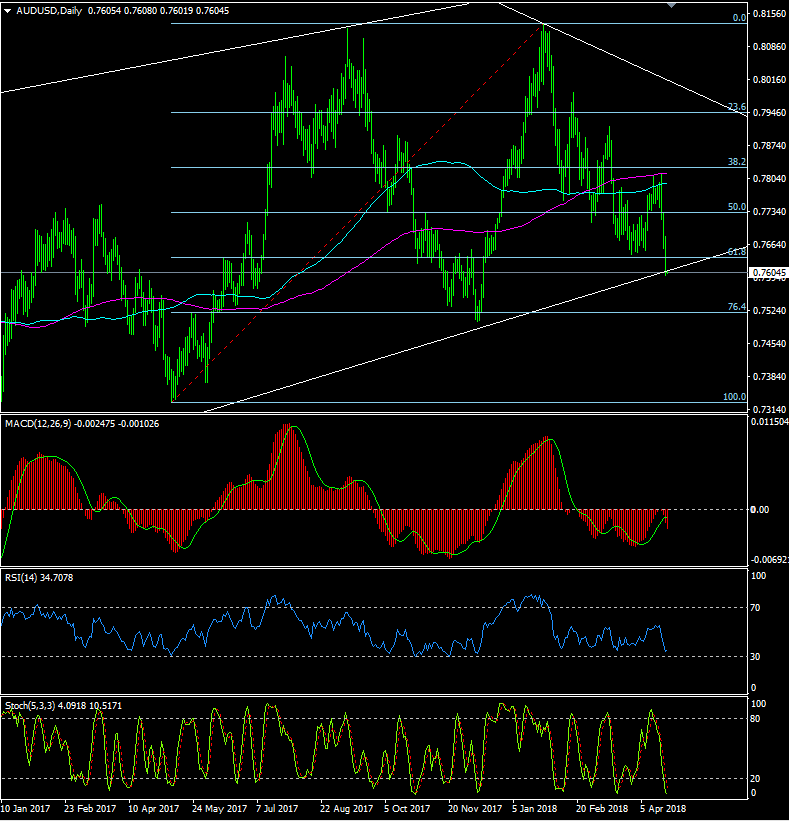

The Aud had another tough session on Monday in falling to a low of 0.7600 where it has closed the day, currently sitting right on the rising trend line support commencing in Jan 2106.

Strong US bond yields did much of the damage and will keep the pressure on the downside, although the focus will today turn to the Australian Q1 CPI (exp 0.5%qq, 2.0%yy, Trimmed Mean; 0.5%qq, 1.8%yy, where a soft reading would keep the pressure firmly on the downside.

1 hour/4 hour indicators: Mixed. –Turning lower.

Daily Indicators: Neutral

Weekly Indicators: Neutral

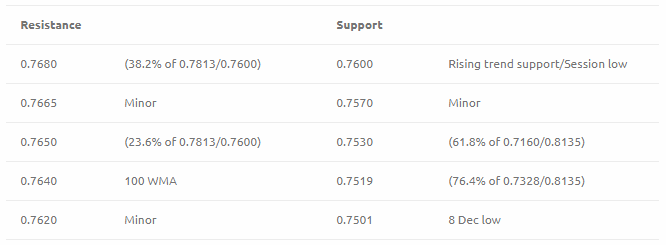

Preferred Strategy: The Aud as seen some decent damage done on Monday, in taking out several important layers of support, and currently sits right on the major rising trend line at 0.7600. Below this would then move towards a minor level at 0.7570 ahead of Fibo support at 0.7520/30 and the early December low of 0.7501.

On the topside, resistance will be seen at 0.7602 (minor) and at 0.7640/50, which if seen today would be a reasonable sell level I suspect. Above 0.7650 would allow a run to 0.7665 and to 0.7680 although this looks rather doubtful.

Selling rallies is preferred.

Sell AudUsd @ 0.7635. SL @ 0.7685, TP @ 0.7525

Economic data highlights will include:

CPI

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.