The Australian Dollar is on the back-foot once again, unable to sustain its recent gains as the market liquidated longs in response to a disappointing Australian Q3 GDP. Sellers are now in control of the price ahead of the US NFP.

As Valeria Bednarik, Chief Analyst at FXStreet, reports: "The economy grew 0.6% in the third quarter, missing market's expectations of 0.7%, while the annual rate stood at 2.8%, below forecasts for 3% growth. The slower rate of growth was attributed to consumer spending advancing at its slowest pace since 2008, which means that RBA's hands will remain tied for longer."

Looking at the state of valuations, from a daily perspective, the depressed levels in the Aus vs US 10yr yield spread, last at 0.175%, somehow justifies that sentiment towards the Australian Dollar dissipated. The yield curve between the two countries, however, is far from supporting sustained losses, as it holds around the 0% (when discounting the 10y-2y); that said, it is starting to retreat, having broken the last base, which may increase the interest to sell on rallies.

Reading at the daily tick accumulation to gauge how much volume existed, the bearish candle formation was on low volume, suggesting that the setback in the Aussie didn't have a great deal of selling commitment, judging by vol average standards in this market. Hwever, judging by the close of the daily candle in NY, the lack of profit--taking is a sign that an immediate attack towards recent trend lows is on the cards.

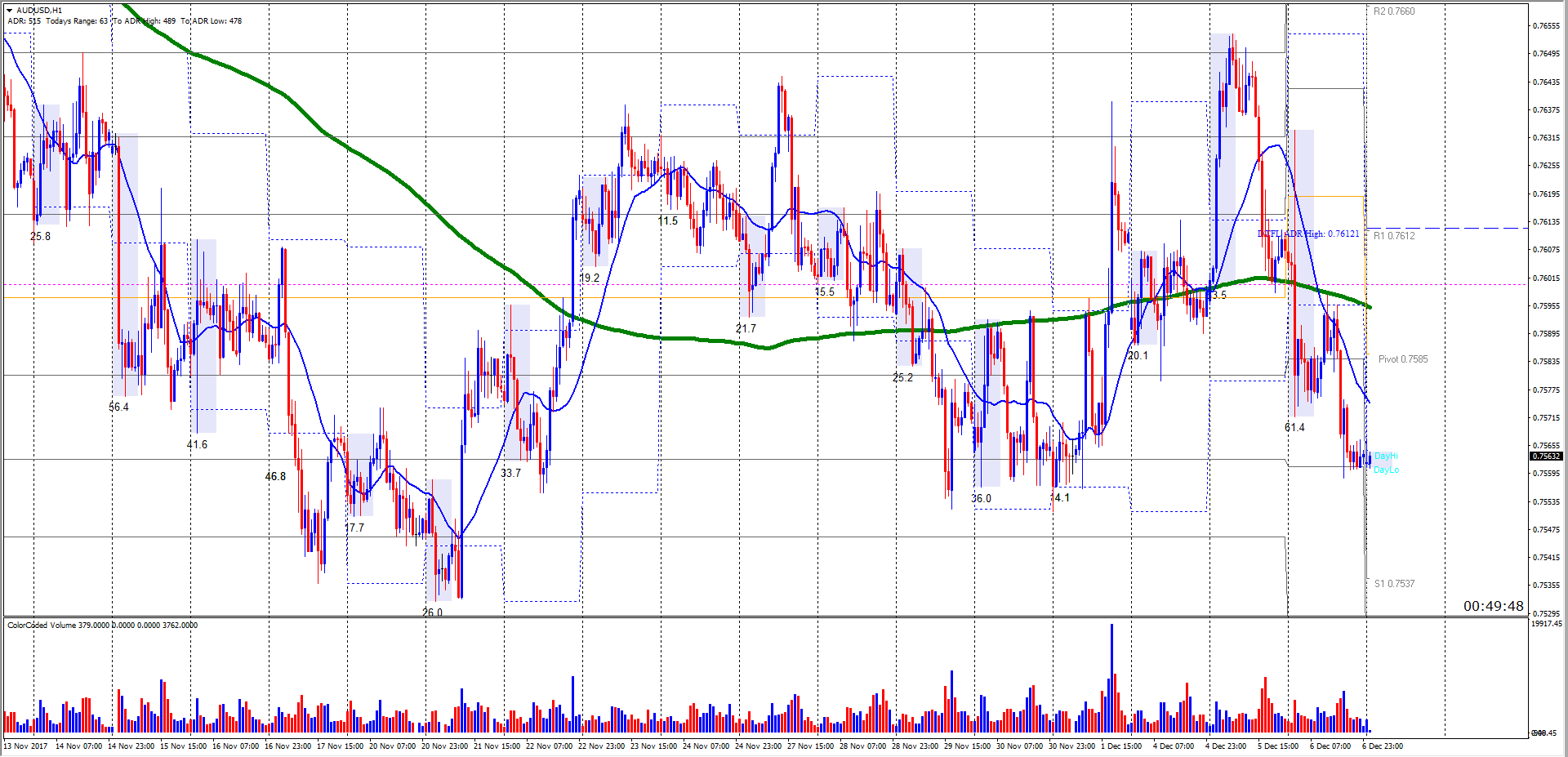

As per technicals and levels, the 20-hourly MA crossed the 200-hourly MA on the release of the Aus Q3 GDP miss, communicating that sellers have now the upper hand, for an expected move to 0.7560, which is precisely where the rate landed. The next key support is found between 0.7550 mid-round number, which should attract bids given the buoyant yield curve, ahead of 0.7530, Nov 20 lows, and ahead of 0.75 psychological barrier. On the upside, buyers have to take control by lifting prices and accept them above 0.7580, which coincides with todays daily pivot; such scenario would potentially lead to 0.76 as next key target, where large offers are expected to rest. Note, all short-term technical studies should be thrown out of the window in 24h when the US NFP is release.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.