AUD/USD

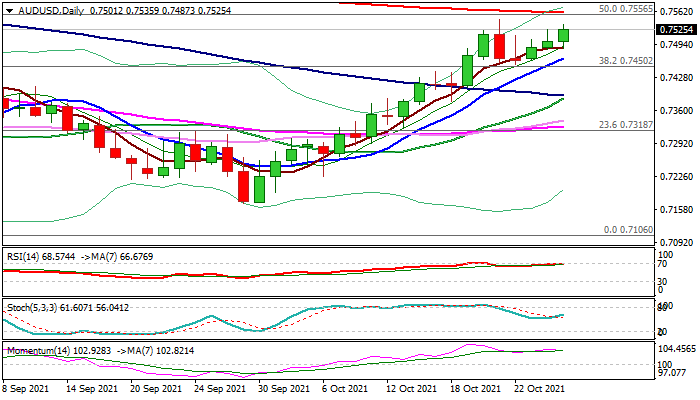

The Australian dollar remains in a steady ascend for the third straight day, approaching new nearly four-month high (0.7546) posted on Oct 21, on renewed attack at key barriers at 0.7556/58 (50% of 0.8007/0.7106 / 200DMA).

Bulls regained traction after stalling on approach to these barriers, with subsequent shallow pullback so far seen as better buying opportunity.

Strong Australia’s Q3 inflation data (core CPI jumps to six-year high at 2.1% vs 1.8% f/c, while monthly and annualized inflation numbers came in line with expectations, 0.8% and 3% respectively) boost expectations for

RBA’s earlier than expected rate hike, as the central bank was behind the curve on inflation and would be pushed to start tightening earlier, probably in July 2022.

Daily studies are in bullish setup but losing positive momentum that warns of extended consolidation before bulls resume.

Firmly bullish weekly techs and signs that the Aussie is on track for a monthly rise of 4% vs its US counterpart (the biggest monthly advance since December 2020) adds to positive signals.

Rising daily Tenkan-sen, which tracks the action since Oct 1, offers solid support at 0.7462.

Res: 0.7546; 0.7558; 0.7595; 0.7662.

Sup: 0.7487; 0.7462; 0.7450; 0.7390.

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.