The Australian dollar stands at the front foot on Wednesday, as comments of US President Trump over Huawei case boosted risk assets, but upside action was so far limited.

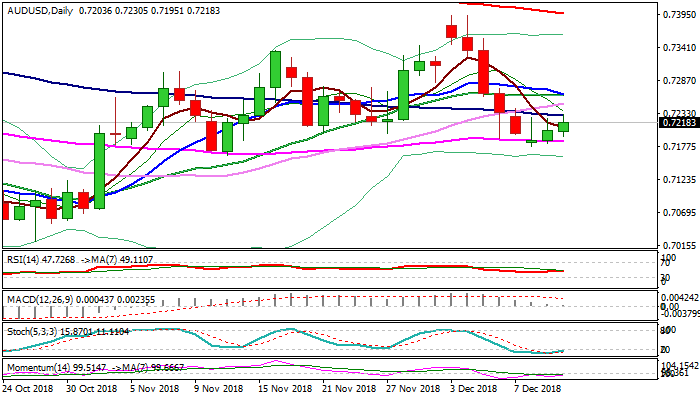

Initial resistance at 0.7228 (100SMA/Fibo 23.6% of 0.7393/0.7177) capped recovery, with long shadows on daily candles of past three days suggesting that recovery attempts face strong headwinds and may stall.

Bearishly aligned daily techs support the notion. Repeated failure at 0.7228 would increase risk of return to 0.7177 (10 Dec low) and possible attack at key near-term support at 0.7163 (Fibo 61.8% of 0.7020/0.7393/daily cloud base), loss of which would generate strong bearish signal. Only lift and close above upper pivots at 0.7260 zone (Fibo 38.2% of 0.7393/0.7177/converged 10/20SMA's) would neutralize bearish threats and open way for stronger recovery.

Res: 0.7228; 0.7260; 0.7285; 0.7311

Sup: 0.7195; 0.7177; 0.7163; 0.7139

Interested in AUDUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.