AUDUSD

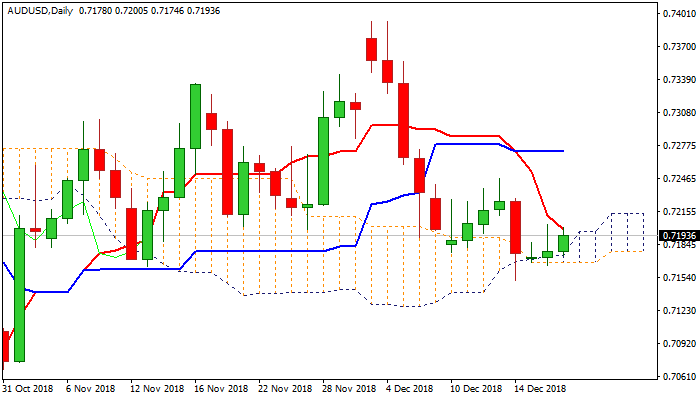

The Australian dollar attempts again at falling 10SMA (0.7199) which capped Tuesday’s action, but was so far unable to break higher.

Near-term outlook remains mixed, following double-Doji (Mon/Tue) and strong downside rejection last Friday, as the action was contained by daily cloud, but recovery attempts so far lacked strength for stronger advance, as daily studies are weak.

The pair is looking for a catalyst to provide clearer direction signal, with Fed policy decision due later today, seen as key event.

Dovish tone from Fed would pressure the greenback and signal stronger recovery of the Aussie.

Initial bullish signal could be expected on sustained break above 10SMA, with further boost expected from lift above 100SMA (0.7218) and reversal signal on break and close above converged 20/30SMA’s (0.7240).

On the other side, sustained break below pivotal supports at 0.7167/63 (daily cloud base / Fibo 61.8% of 0.7020/0.7393) will be negative signal and could be sparked by hawkish steer from Fed.

Res: 0.7199; 0.7207; 0.7218; 0.7240

Sup: 0.7167; 0.7163; 0.7151; 0.7108

Interested in AUDUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.