AUDUSD

The Aussie maintains bid tone on Friday and recovers the most of previous day’s losses, after dips were repeatedly contained by the top of thickening daily cloud which continues to support.

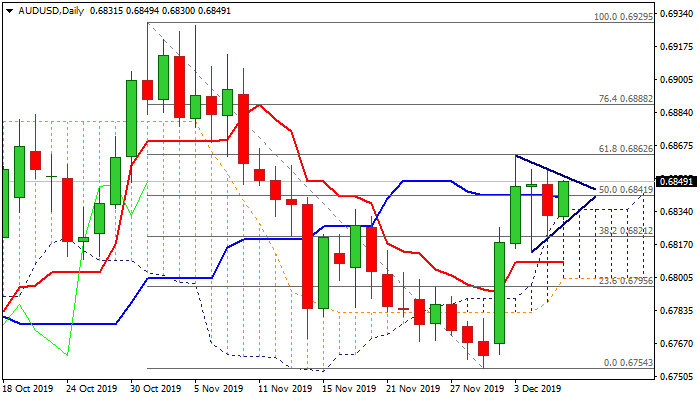

Weaker US dollar contributed to fresh advance, but the action in last three-days remains directionless and moving within a triangle.

Rising bullish momentum and MA’s in bullish setup on daily chart are supportive, but overbought stochastic threatens of limiting recovery.

Triangle’s upper border line lays at 0.6851 and break higher is needed to open way for renewed attack at key Fibo barrier at 0.6862 (61.8% of 0.6929/0.6754), clear break of which is needed for bullish signal and extension of bull-leg from 0.6754 (29 Nov low).

On the other side, pivotal supports lay at 0.6834/28 (daily cloud top / triangle’s support line), with break here to weaken near-term structure and shift focus towards key supports at 0.6800/0.6795 (daily cloud base / Fibo 61.8% of 0.6754/0.6862 recovery leg).

US jobs data are key event today, with strong figures to deflate Aussie, while downbeat results would spark fresh acceleration higher.

Res: 0.6851; 0.6862; 0.6888; 0.6906

Sup: 0.6841; 0.6834; 0.6820; 0.6800

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.