AUD/USD

The Australian dollar extends advance in the fourth straight day on Monday and rose to the highest since Feb 26.

Extension of Friday’s post-NFP acceleration was boosted by weaker dollar over fading hopes that the US central bank would start tightening policy earlier than expected and higher prices of metals.

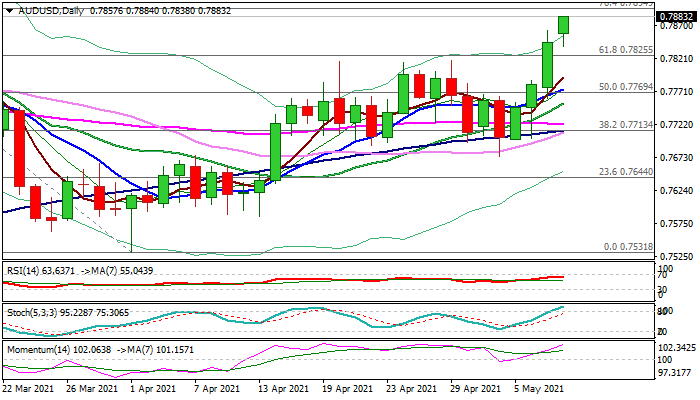

Bulls eye target at 0.7894 (Fibo 76.4% of 0.8007/0.7531) the last obstacle on the way towards key 0.8000 resistance zone which was briefly touched in February, for the first time in three years.

Friday’s close above pivotal Fibo barrier at 0.7825 (61.8% of 0.8007/0.7531) generated positive signal, with near-term action being supported by bullish daily studies.

Corrective dips are expected to provide better levels to re-enter bullish action, with solid supports at 0.7825/15 (broken Fibo barrier/late Apr higher platform) to ideally contain downticks.

Caution on extension below rising 10DMA (0.7774) that would put bulls on hold.

Res: 0.7894; 0.7923; 0.7956; 0.7973

Sup: 0.7849; 0.7825; 0.7815; 0.7774

Interested in AUD/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.