- AUD/USD at a brink of breaking lower after faltering at a critical resistance area.

- RBA’s rate cut to fresh record lows little can do for the Aussie.

The AUD/USD pair has reached a fresh multi-week high of 0.7043 this Thursday, only to collapse Friday and close the week in the red in the 0.6960 price zone. The catalyst was a stronger-than-anticipated US Nonfarm Payroll report, which diminished odds for aggressive easing in the US, resulting in equities and gold edging sharply lower, and dragging the Aussie alongside.

The RBA cut rates for a second consecutive month this past week, leaving the cash rate at a record low of 1.0%. The movement was largely anticipated by market’s participants and had a limited effect on the price of AUD/USD, as not only most of it was already priced in, but also because the fact that the Fed has also anticipated rate cuts coming, offsets any possible positive effect the Australian cut may have.

The US Nonfarm Payroll report skewed the scale in dollar’s favor as the substantial bounce in jobs’ creation undermined speculation that the US Central Bank will cut rates twice before year-end, instead confirming the latest words from Chief Powell, suggesting just one “´preventive” cut coming.

Adding to the AUD weakness, Chinese data released these days were most discouraging, with manufacturing output in contraction territory in June, according to Markit and the official estimates. Services activity in the world second largest economy also was worse-than-expected. Furthermore, Australian Retail Sales increased a measly 0.1% MoM in May.

Growth concerns and global trade tensions, despite the US and China, resumed trade talks, remain in the eye of the storm, triggering sentiment-related trading through central banks’ decisions on monetary policy.

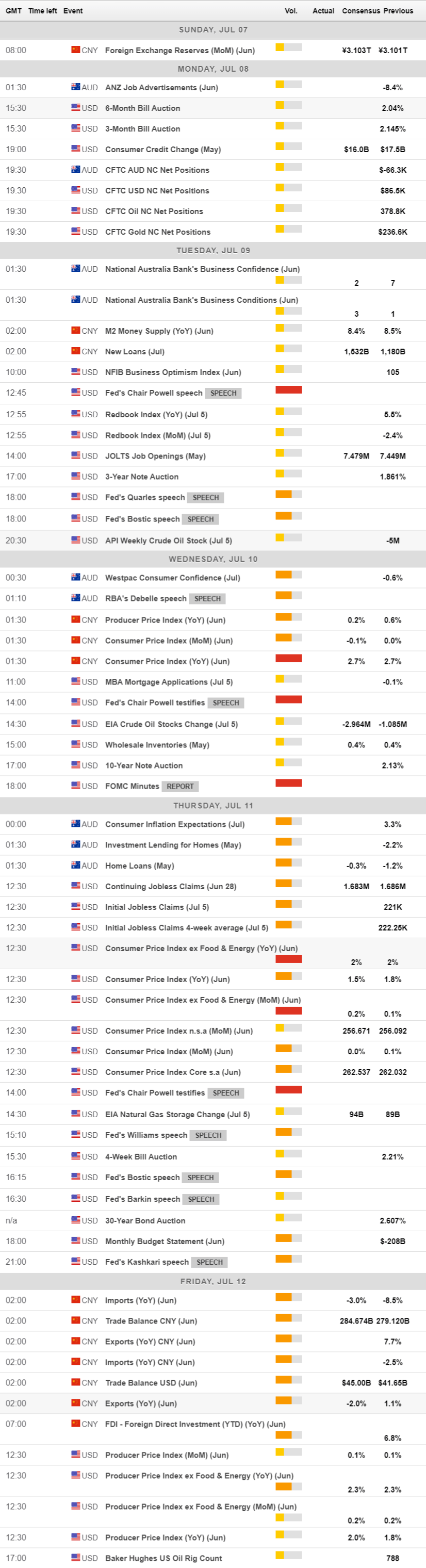

Australian Consumer Confidence as measured by NAB and Westpac for June will be out next week, none expected to impress. The country will also release Consumer Inflation Expectations for July, previously at 3.3%. China, in the meantime, will publish updates on inflation and trade.

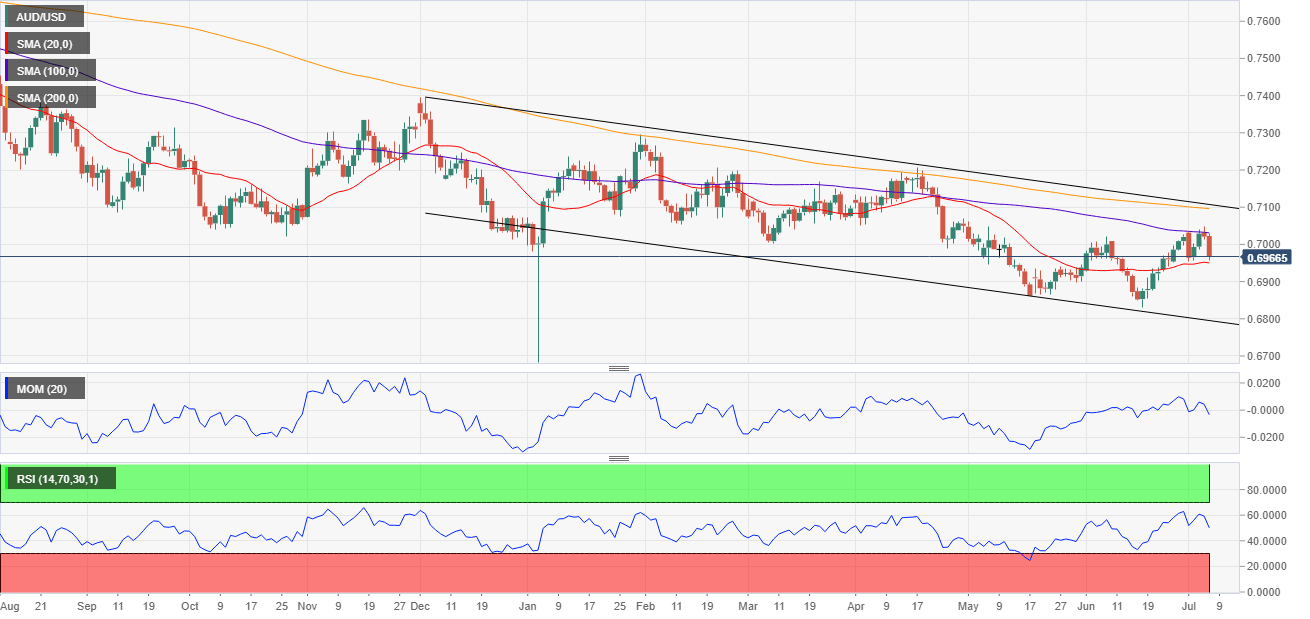

AUD/USD Technical Outlook

With the pair ending the week below 0.7000, bulls´ hopes are probably diluting by more than what the price reflects. In the weekly chart, the AUD/USD pair faltered around a bearish 20 DMA, while the 100 DMA is crossing below the 200 DMA some 400 pips above the current level, indicating that in the long-term, bears lead. Technical indicators in the mentioned chart retreated after failing to surpass their mid-lines, indicating the same.

In the daily chart, the pair retreated from the 100 DMA, holding a few pips above a directionless 20 SMA. Technical retreated from their highs, the Momentum holding well into positive ground buy the RSI crossing its mid-line into negative ground, all of which indicates that the pair is at a brink of a bearish breakdown.

Multiple intraday lows in the 0.6950 region and the 20 DMA also there, provide an immediate support ahead of 0.6880. Below this last, the 0.6800/20 area comes next. 0.7000 and 0.7050 are the immediate resistances, although the pair would need to surpass 0.7070 to spook bears.

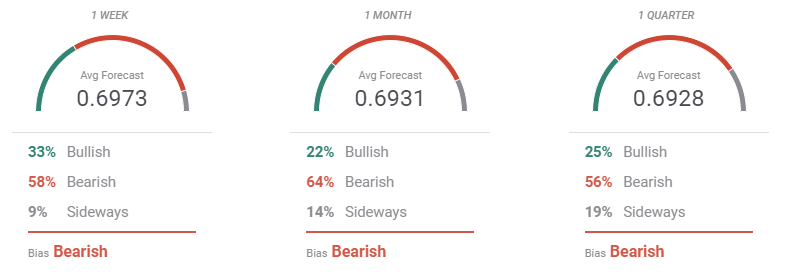

AUD/USD sentiment poll

According to the FXStreet Forecast Poll, the AUD/USD pair is done with raising, seen bearish in the three time-frames under study, although in all the cases, the average target is in the 0.69 area. When compared to the previous week, the change in sentiment seems little relevant, as the number of bears has increased just modestly.

Within the Overview chart, it is clear that most targets are well below the current price, with a few exceptions, mostly from banks, seeing such high targets that distort the average. Still, the pair seems to have more chances to reach 0.68 than 0.72 in the upcoming weeks.

Related Forecasts:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.