US and Chinese trade negotiators kicked off another round of talks today after President Trump labeled last week’s discussions in Beijing “very productive.” Today and tomorrow feature lower-level officials to the table, with higher-level policymakers including US Trade Representative Lighthizer, Treasury Secretary Mnuchin, and Vice Prenier Liu He, coming to the table on Thursday and Friday.

The talks are picking up pace ahead of Trump’s March 1 deadline for more than doubling tariffs on $200B of Chinese imports, though the President has recently suggested that he could postpone that decision for another 60 days if he’s satisfied with this week’s progress.

Ultimately, it will almost certainly take another summit between Presidents Trump and Xi to reach an official deal, and the earliest they could realistically meet at this point would be the middle of March. That said, the extension of last week’s talks and ongoing dialogue this week has traders expecting the increase in tariffs will be delayed by the end of next week, with some sort of agreement following in either late March or early April. Of course, markets have been wrongfooted by political developments countless times in recent quarters, so traders will remain glued to their monitors for headlines out of Washington in the coming days.

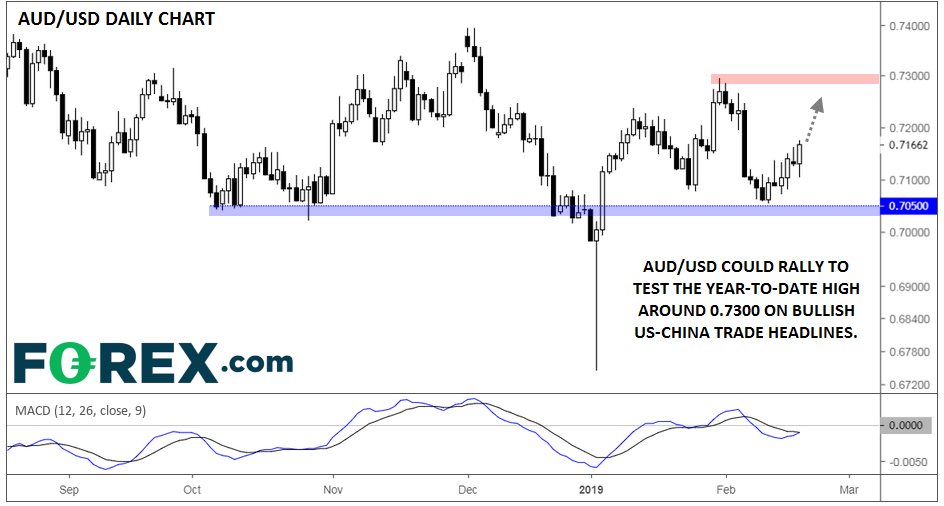

For more on the US-China trade talks and their impact on the global stock / commodity markets, see my colleague Fawad Razaqzada’s report “Sentiment dominated by US-China trade and dovish central banks” from earlier today. When it comes to FX, AUD/USD is one of the best pairs to watch to gauge sentiment toward global trade. After a swooning on dovish RBA comments earlier this month, rates stabilized near previous support in the 0.7050 area.

The pair has rallied 100 pips since then, and with the MACD indicator about to cross back into a bullish configuration, the rally may have further to run on positive trade headlines. Adding to the bullish evidence, AUD/USD is showing a bullish engulfing candle so far today, signaling a shift toward bullish momentum. A formal delay to the tariff deadline and an official summit between the US and China could boost the pair toward the year-to-date highs around 0.7300 next.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.