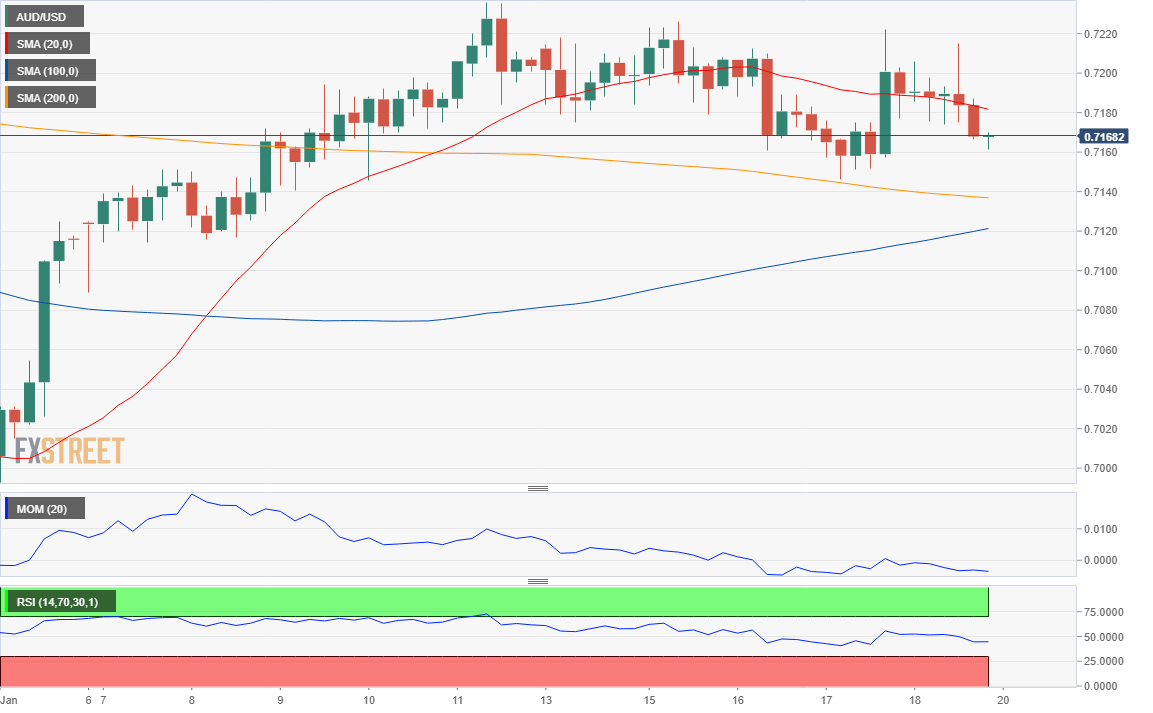

AUD/USD Current price: 0.7168

- Aussie to respond to trade war headlines and Chinese growth data.

- Bulls' conviction will ease further on a break below 0.7155, a relevant Fibonacci support.

The Aussie couldn't grab momentum from positive trade war headlines, neither from solid Wall Street's advance, usually bullish factors for the commodity-related currency that this time, benefited the greenback. The AUD/USD pair spent the week hovering around the 0.7200 level, ending it with modest losses at 0.7165. Attempts to extend gains beyond the 0.7200 level were rejected on approaches to the previous weekly high of 0.7234, as bulls lost conviction on concerns about a global economic slowdown. Not even resurgent oil prices or gold ones were enough to trigger some gains, somehow indicating that the pair could turn south. There are two main factors that could determine the pair's direction at the beginning of the week: trade war headlines and Chinese Q4 GDP. US President Trump said over the weekend that progress has been made with China, although he repeated that there are no plans on lifting tariffs on imports from the Asian country. As for China's growth, the market is expecting a quarterly growth of 1.4%, while the YoY figure is foreseen at 6.4% vs. the previous 6.5%. Worse-than-expected numbers will put risk-off on the table, with the greenback then poised to extend its gains against the AUD.

The pair holds above the 61.8% retracement of its December/January decline at 0.7155, which limits the downside at the time being. The daily chart shows that the 100 DMA heads marginally lower a couple of pips above the mentioned Fibonacci level, while the 20 DMA advances around 0.7110. The Momentum indicator keeps heading north, despite being in overbought territory, although the RSI has already begun easing, now at around 52. In the 4 hours chart, the pair trades within directionless moving averages, the Momentum is directionless around its 100 level, while the RSI eases around 43, all of which skews the risk to the downside.

Support levels: 0.7155 0.7110 0.7070

Resistance levels: 0.7190 0.7220 0.7260

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory near 1.0650

EUR/USD clings to modest daily gains at around 1.0650 in the American session on Wednesday. The US Dollar struggles to gather strength amid a modest improvement seen in risk mood and helps the pair hold its ground.

GBP/USD stabilizes at around 1.2450 after UK inflation data

GBP/USD consolidates its daily gains near 1.2450 after recovering toward 1.2500 with the immediate reaction to stronger-than-expected inflation data from the UK. The renewed US Dollar weakness also helps the pair hold its ground.

Gold fluctuates near $2,390 as markets keep an eye on geopolitics

Gold trades in a relatively tight range near $2,390 in the second half of the day on Wednesday. In the absence of high-tier data releases, investors keep a close eye on headlines surrounding the Iran-Israel conflict.

XRP tests $0.50 resistance after Ripple CLO clarifies that no pretrial conference took place with SEC

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

World economy: To cut or not to cut (simultaneously)?

US inflation March figure, again higher than expected, put an end to the scenario of a simultaneous first rate cut by the Fed, the ECB, and the BoE in June.