Market Overview

There has been a significant jump in Treasury yields ahead of the FOMC meeting. This is now having an impact on the dollar which is looking to build a near term recovery. The dollar has been under pressure in recent weeks, but the better than expected flash PMIs were followed by record levels of Consumer Confidence yesterday helped to add 9 basis points to the US 10 year yield. This has resulted in the dollar picking up from multi-month lows and for a “bullish hammer” candles stick pattern. Will this now be a sustainable turnaround for the greenback. The near term prospects certainly lie with the FOMC tonight. No change is expected on monetary policy and the meeting could be one of the less memorable. However there is support coming in for the dollar nonetheless. Oil continues to climb, to six week highs as a decline in API inventories give further cause for optimism after it was announced by OPE that Nigeria would join in with the production curbs once it reached 1.8m barrels of output.

Wall Street closed higher last night with the S&P 500 +0.3% as equities cross markets rallied yesterday. Asian moves overnight have been broadly higher, with the Nikkei +0.5%. European markets are more cautious with markets ticking slightly lower. In forex there is a theme of mild dollar strength, but in truth the markets look to be consolidating in front of the Fed tonight. In commodities, gold continues to slip back in the wake of yesterday’s correction, whilst oil continuing to climb.

Traders will be focused on the FOMC tonight, however in the European morning the prelim look at UK GDP for Q2 is at 0930BST. The consensus is expecting a mild pick up in UK growth to +0.3% from Q1’s rather meagre +0.2%, although clearly the UK is hardly shooting the lights out on growth recently. US New Home Sales are at 1500BST and are expected to show a 0.8% improvement to 615,000 (from 610,000). However the FOMC monetary policy decision at 1900BST is the key driver of market moves today. The Fed is not expected to change rates or even announce the beginning of its balance sheet reduction. Although there are some that believe it possible to announce quantitative tightening this month, the Fed is unlikely to do so on a month without a press conference or change in economic projections. There could be minor changes to the FOMC statement, perhaps even on the dovish side to account for the disappointment in falling inflation of recent months.

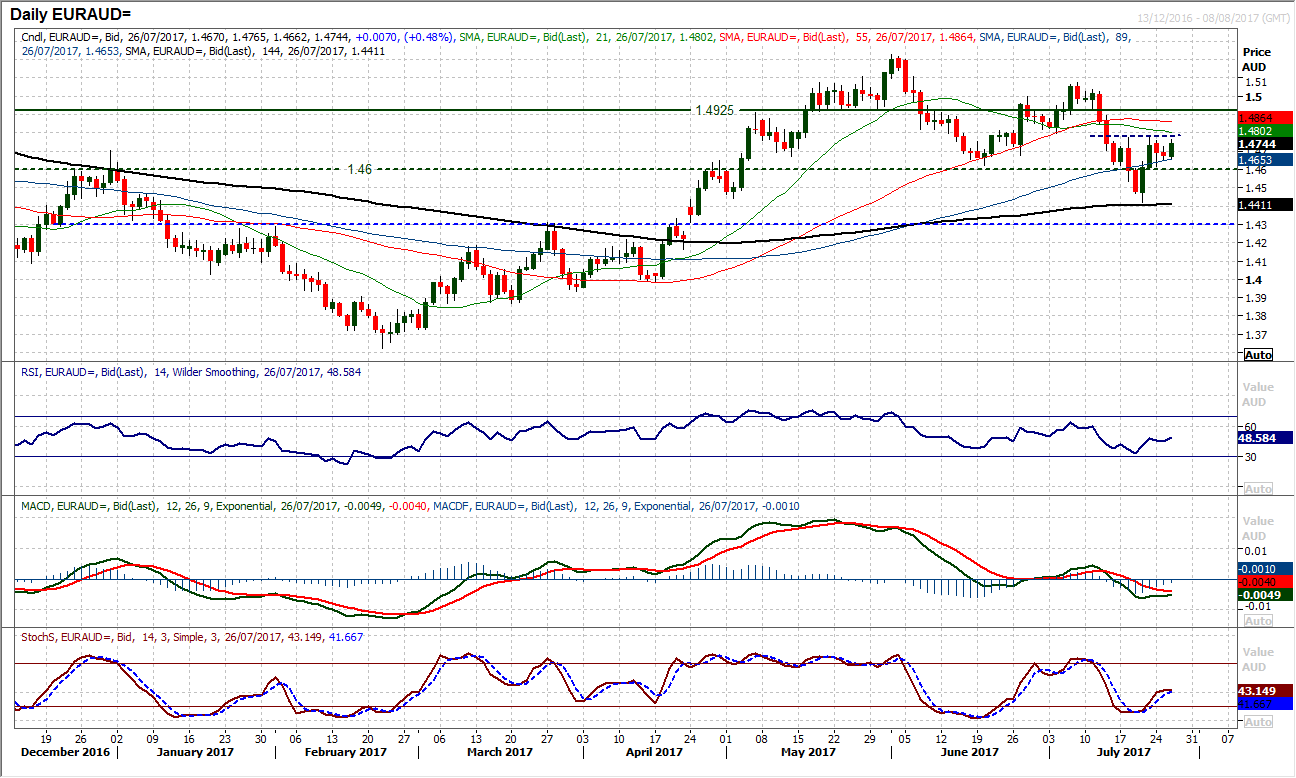

Chart of the Day – EUR/AUD

With the market having completed a big break below the long term key pivot at 1.4600 the outlook is under pressure. However in reclaiming 1.4600 so quickly there is a potential for this to have been a false break. There are now some key levels that will be watched to suggest what the medium to longer term implications of last week’s drop to 1.4420 is. The resistance of last week’s high at 1.4775 has again come in as resistance and is currently preventing the bulls from regaining real control. Furthermore, the long term key pivot at 1.4600 held on Monday’s bear candle, and will be seen as a key barometer. The medium term momentum configuration suggests that there is still a corrective outlook, with the RSI and Stochastics lines rolling over under 50, and the MACD lines struggling under neutral. However, the hourly chart momentum is more neutrally configured with the market beginning to improve. The resistance at 1.4775 stand in the way of a small completed head and shoulders base pattern. The initial resistance at 1.4727 is adding to downside pressure. A breach of 1.4600 re-opens the low at 1.4420.

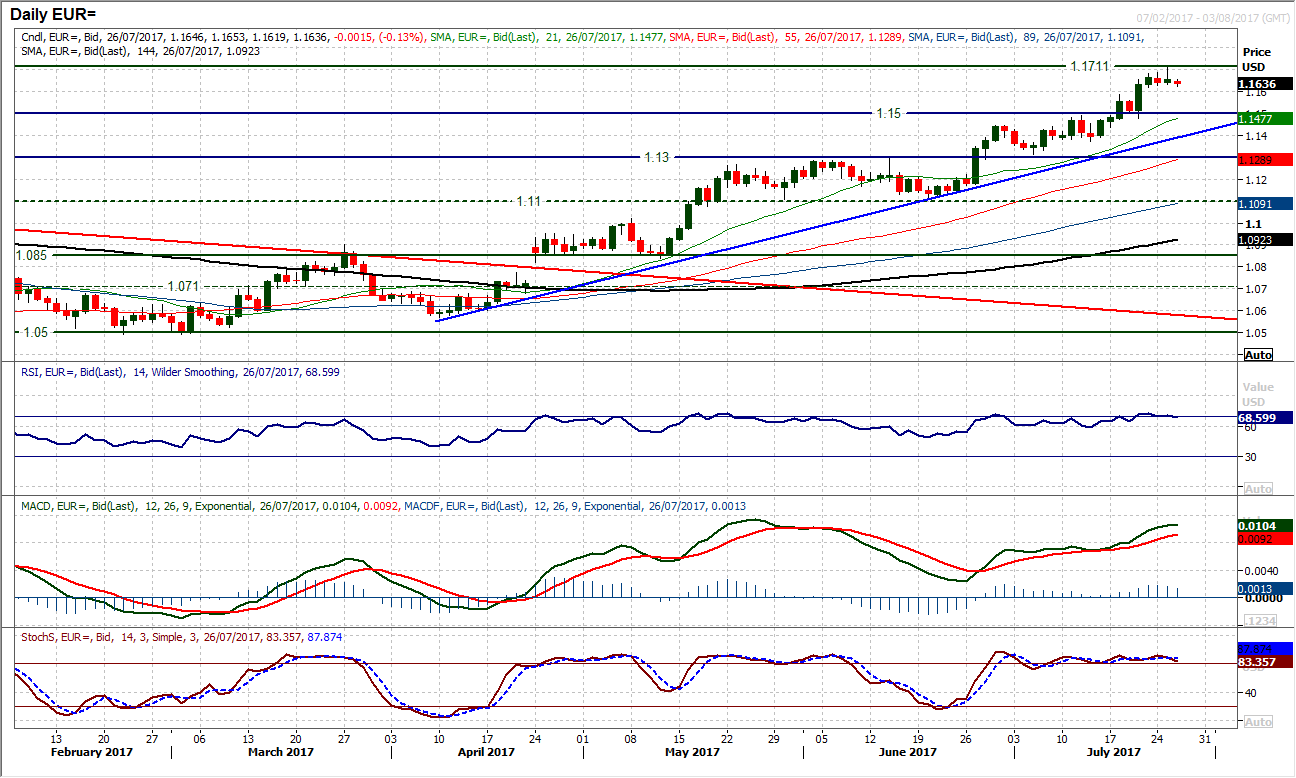

EUR/USD

The bulls have had their wings clipped a touch in the past few sessions as the market has developed a consolidation in front of the FOMC. It was interesting to see yesterday’s bull move higher turn back right at the key August 2015 high of $1.1711 as it retreated back into the consolidation. The candlestick that has been left will have been of mild disappointment for the bulls, but in truth this is the market biding its time in front of the FOMC. Momentum indicators remain strongly configured and would suggest that any corrective move from the FOMC tonight is likely to be bought into. The latest key breakout around $1.1490 would be a good entry point here, with the three month uptrend at $1.1390 today. The medium term outlook continues to suggest upside pressure on the $1.1711 above which there is little real resistance until above $1.1200.

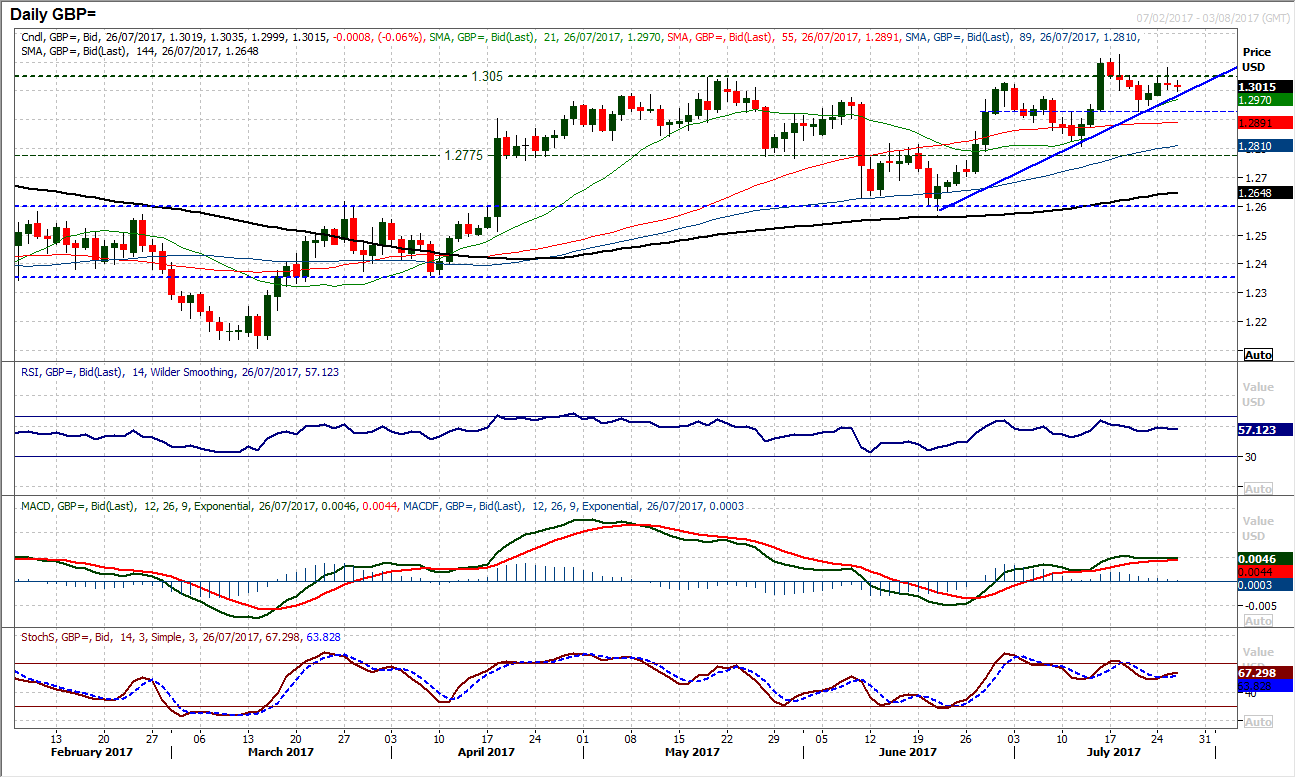

GBP/USD

With the dollar stabilising towards the end of yesterday the Cable bulls have just had their enthusiasm reined in a touch. Yesterday’s candle subsequently turned into a mild disappointment despite having initially looked to break clear of $1.3050 again. Medium term momentum remains bullish with the RSI holding in the high 50s, the MACD lines positive and the Stochastics having turned higher. The five week uptrend remains intact but the market is now consolidating in front of the FOMC. For now the market is in wait and see mode with little real indication from the Asian session. The UK GDP data could also drive near term direction but all eyes are essentially on the Fed. The key support remains $1.2930, with resistance now $1.3083.

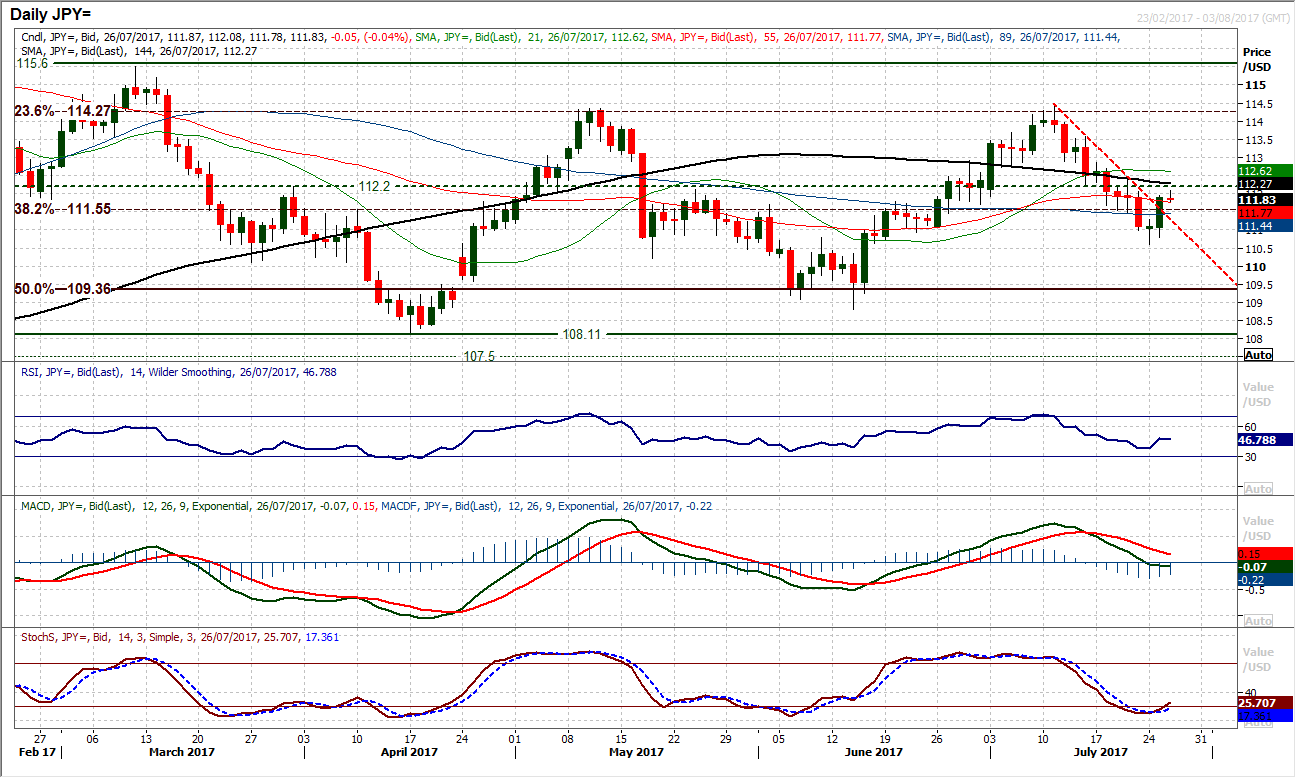

USD/JPY

The major chart that saw the US dollar rebound significantly yesterday is Dollar/Yen. With a strong bullish candle, a “morning doji star” three session candlestick pattern has flipped the near term outlook and improved the outlook. This comes with a decisive move back above 111.55 and now the market is looking higher once more. The Stochastics are turning higher and the MACD lines are bottoming around neutral, whilst the RSI is also ticking higher. Is this a bottom now in place at 110.60? A closing breach of 112.40 would be the first confirmed breach of an old lower high within the downtrend and would be a key positive development. It will be interesting to see how the market reacts to 111.55 support today as a close bwlow would begin to question the rally again.

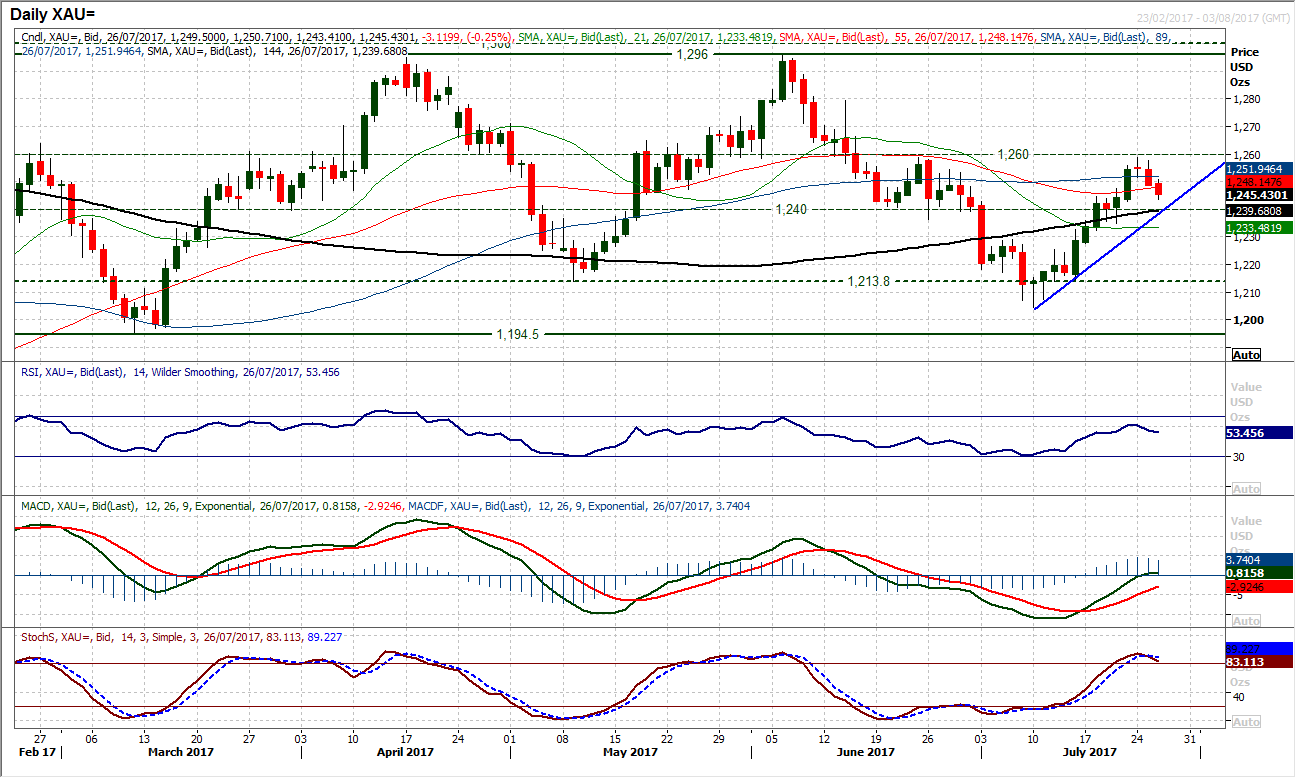

Gold

Within the medium term range, the pivot at $1260 and $1240 are key areas of consolidation. It is interesting to see that once more $1260 has capped a move and turned it back. The bear candle yesterday and seemingly another bearish one today have pulled the reins on the recovery. However, now we see that the pivot around $1240 is the one to watch. Will the buyers return once more to pll gold higher again? The momentum indicators are turning over, with the MACD and RSI losing impetus, whilst the Stochastics are close to a confirmed bearish signal. There is the support of the uptrend that has been in place since the market bottomed, coming in today around $1237 and this now needs to be watched too. However the market would be far more concerned by the loss of $1240 if it were to be seen on a closing basis. The FOMC will be key tonight.

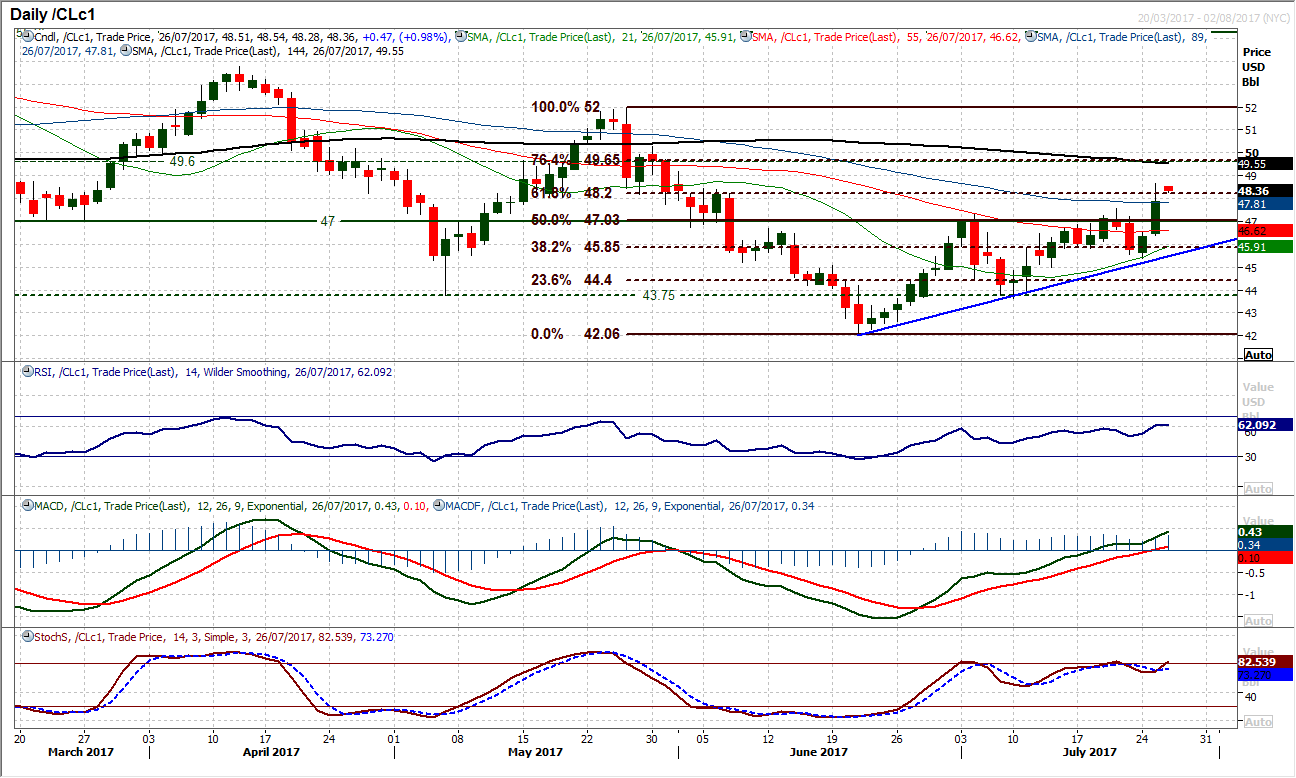

WTI Oil

The bulls have taken off again in the wake of the suggestion that Nigeria will partake in the OPEC production cuts. This has driven a sharp upside break through the key pivot resistance at $47.00 and comes with an intraday move to a new seven week high and a close breach of $47.00. Momentum indicators are regaining some impetus once more with the RSI at a nine week high. The move opens the resistance band $48.20/$48.40. The hourly chart reflects the strength of the breakout and corrections are a chance to buy. The $47.00 old pivot is now supportive for a pullback, with yesterday’s close at $47.90 now gap support this morning.

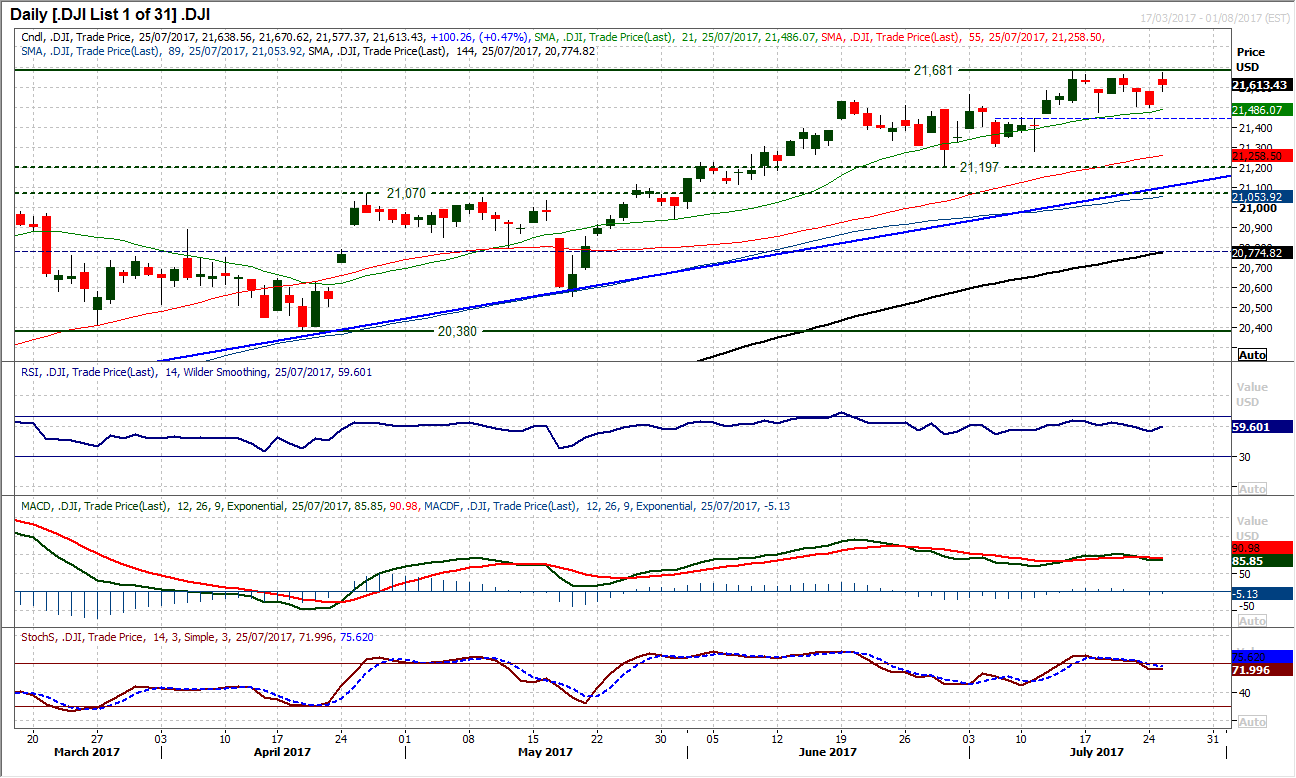

Dow Jones Industrial Average

The bulls jumped back into the driving seat once more as the market pushed strongly higher. The support at 21,471 has subsequently been bolstered and momentum indicators ticking higher again. The question is now whether the market will pushed through to an all-time high above 21,681. Although the market was more than half a percent higher, yesterday’s candle was actually mildly corrective from the open higher into the close, suggesting that there was indecision as to whether to push the market on through the resistance. The bulls will point to a gap being bullishly filled at 21,577 and this puts the buyers in control. I discussed the prospect of a small top pattern below 21,471 yesterday, but equally if there is a closing break above 21,681 there would be a 210 upside protection target towards 21,890.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.