The Swiss franc decline has been accelerating since last week. Bitcoin rushed above the important resistance at $5300. EURUSD stays close to 1.1250 in anticipation of the further signals. Oil rewrites 6-months highs.

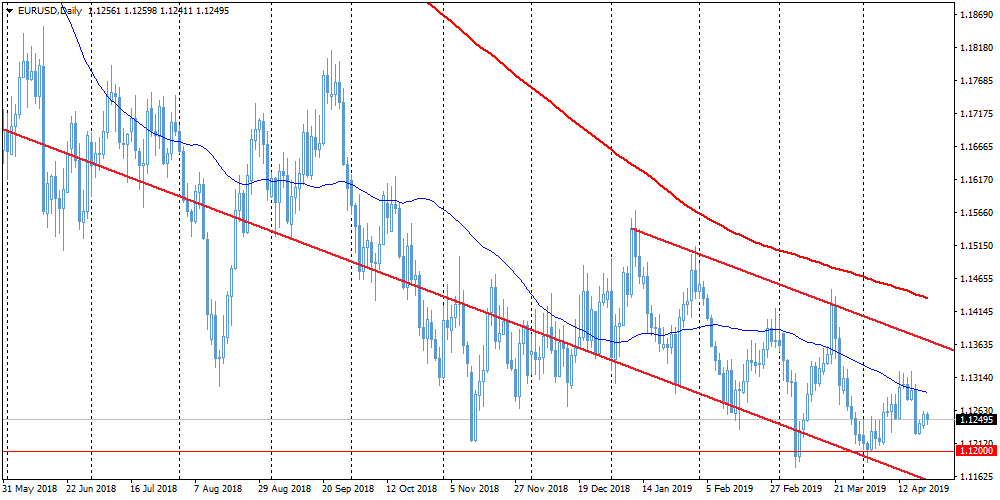

EURUSD

The most important currency pair on Forex market stay near 1.1250 in anticipation of further signals. Among the macroeconomic publications can be singled out another portion of disappointing U.S. data. Existing home sales decreased by 4.9% against expected drop by 3.8%. Last week also marked the fall of Building permits and Housing starts, contrary to expectations of growth. Today, the New Home Sales are in the markets' focus. Weak statistics can bring the pressure back to the dollar because of fears that the weakness of the housing market is evidence of a weakening of economic activity.

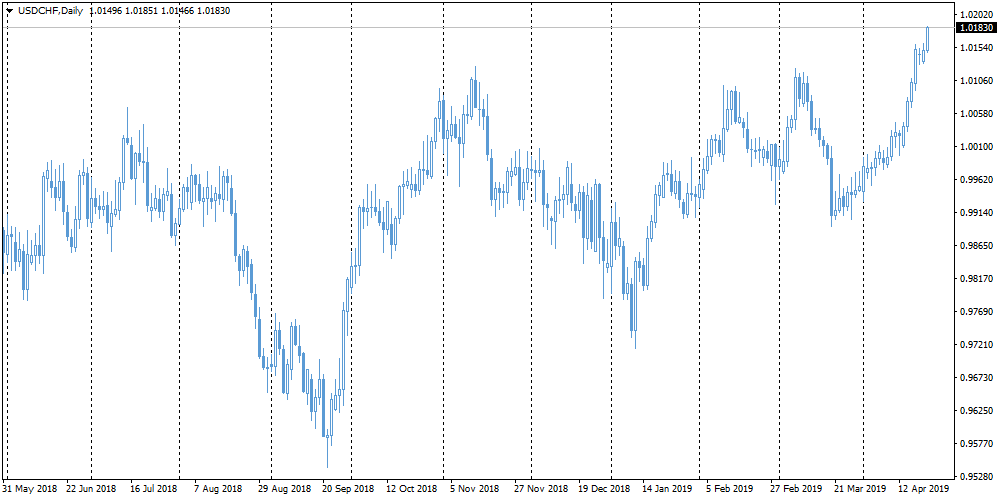

USDCHF

The Swiss franc has been falling over the last month, increasing the decline since the beginning of last week. USDCHF is growing for the fifth week in a row to January 2017 highs, adding 2.6%. The franc was under pressure because of increased traction in risky assets. Moreover, the Swiss currency suffered from the worsening of the eurozone. The third factor is that the pair went beyond the established trading range, that triggered the stop orders and increased the pair growth. The impact of these factors can put in the sight of market players levels near 1.03, which the pair reached at the end of 2016.

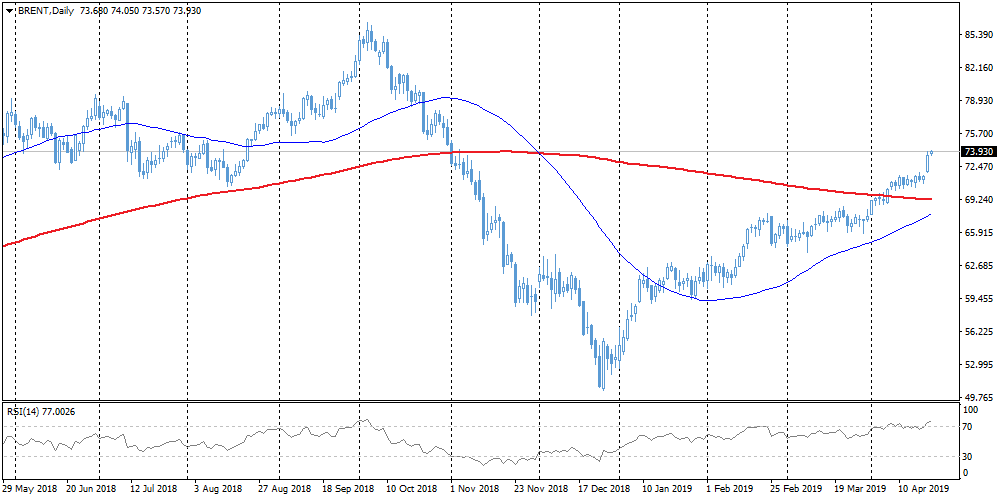

Brent

Oil adds about 3% this week, rewriting almost 6 months. Brent this morning has touched $74.00 per barrel, and the American WTI has exceeded $66 on fears around possible oil deficit after supply worries around Iran and Venezuela. The relative strength index is near the maximum levels since October last year, when oil prices were near their peak levels. High values RSI increases worries about further growth, increasing the chances of corrective rollback after the growth stops.

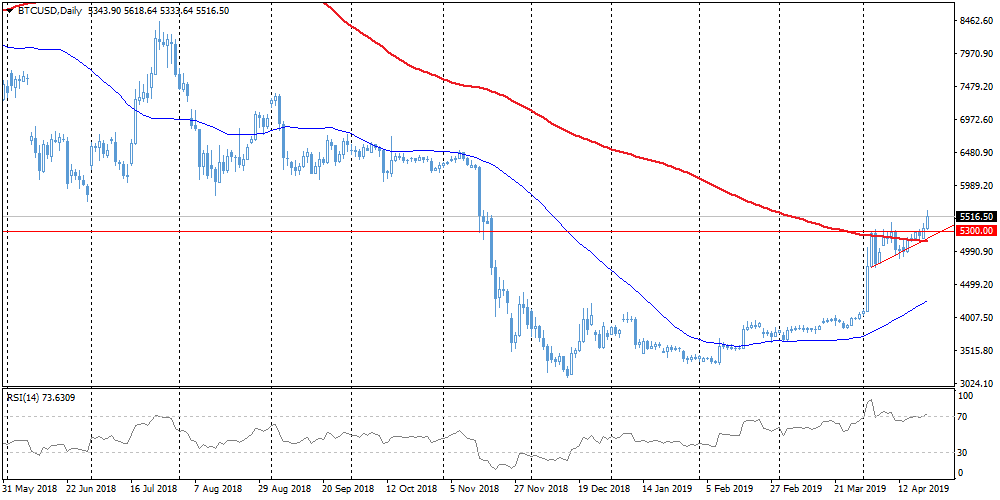

Bitcoin

Over the past day, Bitcoin has confirmed that the technical analysis works pretty well in the crypto market. The course of the benchmark cryptocurrency has jumped to $5600 on Tuesday morning (+ 6.7%) After a breakout of resistance on $5300. In the case of growth momentum, the goal for Bulls could be the area $6000-$6100. However, it is necessary to remember, that the price is influenced by many factors, therefore abrupt jumps quite can be replaced with no less unpredictable failures.

Trade Responsibly. CFDs and Spread Betting are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.37% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider. The Analysts' opinions are for informational purposes only and should not be considered as a recommendation or trading advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.