It has just been announced that Cyril Ramaphosa has been elected new president of the African National Congress (ANC) party winning 2440 votes against the other front running candidate Dlamini-Zuma who got 2261 votes, thereby marking a defeat for Jacob Zuma who supported his ex-wife Ms. Dlamini-Zuma.

The election of Mr. Ramaphosa, the current deputy president of South Africa and a former successful businessman, is clearly market positive as he has run on a pro-business and anti-corruption campaign, trying to distinguish himself from President Jacob Zuma. In a recent important policy speech by Mr. Ramaphosa at a ANC Meeting in November (see here), he stressed the need for improving investor sentiment, promoting manufacturing-led growth through tax reforms and SME development, maintaining fiscal discipline, reforming of state-owned enterprises, and combating corruption etc. However, the speech is absent concrete policy proposals to tackle the significant structural obstacles which is undermining the growth prospects of the South African economy.

However, before getting too carried away, we need more clarity on a number of issues over the next days and weeks, including:

1) How easy the transition of power is to Mr. Ramaphosa from Jacob Zuma (who technically can remain SA president to the 2019 election) and how well the divisions within the ANC party are bridged.

2) What economic team is picked by Mr. Ramaphosa—in general it should be a fairly well-respected finance minister.

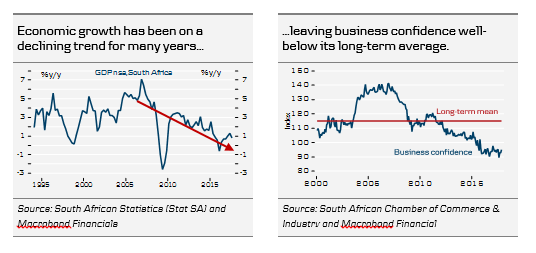

3) What concrete reform proposals he intends to pursue (so far the policy speeches have been fairly vague as mentioned above) to improve the current weak growth potential of the South African economy.

The market had more or less priced in the likely victory of the Mr. Ramaphosa. Hence, in the aftermath of the announcement of the election result tonight, the Rand gave up some of the gains against the USD, as investors took profits but probably also weighed in some of the unknowns mentioned above. Yet, the USD/ZAR is still down by 3.5% at 12.7 on the day and almost 9% over the past month. After the surge of the ZAR, we think that it is fairly valued.

We think that the USD/ZAR could move a bit higher over the next months, seeing the cross at 13.00 in 3M as the euphoria evaporates a bit. After that the cross may head modestly lower as the new ANC leader is able to lay out his policy programme in more details and getting a better grip on the ANC party, seeing the USD/ZAR at 12.75 in 6M and 12.5 in 12M. However, it is clear that uncertainty remain significant at this stage.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.