-

European shares open lower as EU looks to ban US travellers

-

South Korea’s Kospi rallies after North suspends military action

-

NZD/USD drops after RNBZ touts buying foreign assets if needed

-

Oil prices slide after big US inventories build

Inspiration

“The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.” – Ed Seykota

Opening Calls

Dow Jones: 26,152 (-4 pts)

S&P 500: 3,128 (-3 pts)

US travellers

European shares have opened with a softer tone on Wednesday after it was reported the EU might consider blocking travellers from the US because of a surge in cases. Wall Street looks set for a flat open following another record-breaking day for the Nasdaq. Blocking US travellers would heighten the risks for travel and hospitality industries that badly need every tourist dollar possible.

Korea

The MSCI All Asia index (ex Japan) rose to its highest level in 4-months. The Gains were led by the Kospi 200 which was benefiting from reduced political risk after Kim Jong Un backed away from deploying the military on the border with the South. The risk of actual conflict always seemed low but without some big gesture toward denuclearisation / cutting sanctions, tense relations with the North is a drag on South Korean assets.

RBNZ

The Kiwi dollar dropped after the RBNZ suggested more stimulus might be needed including the use of new tools such as foreign asset purchases. The RBNZ is already discussing the pros and cons of expanding its LSAP (bond-buying) program. The general refrain from central banks at the moment is that the economy is rebounding but that ‘risks are tilted to the downside’ – meaning stimulus measures need to be maintained.

Oil drops

The price of oil nudged up on Wednesday after having dropped the day prior. A much bigger than expected rise in US inventories shows the situation of over-supply in the US is still unresolved. While many rigs are going offline, those left are pumping much more than the semi-locked down economy needs.

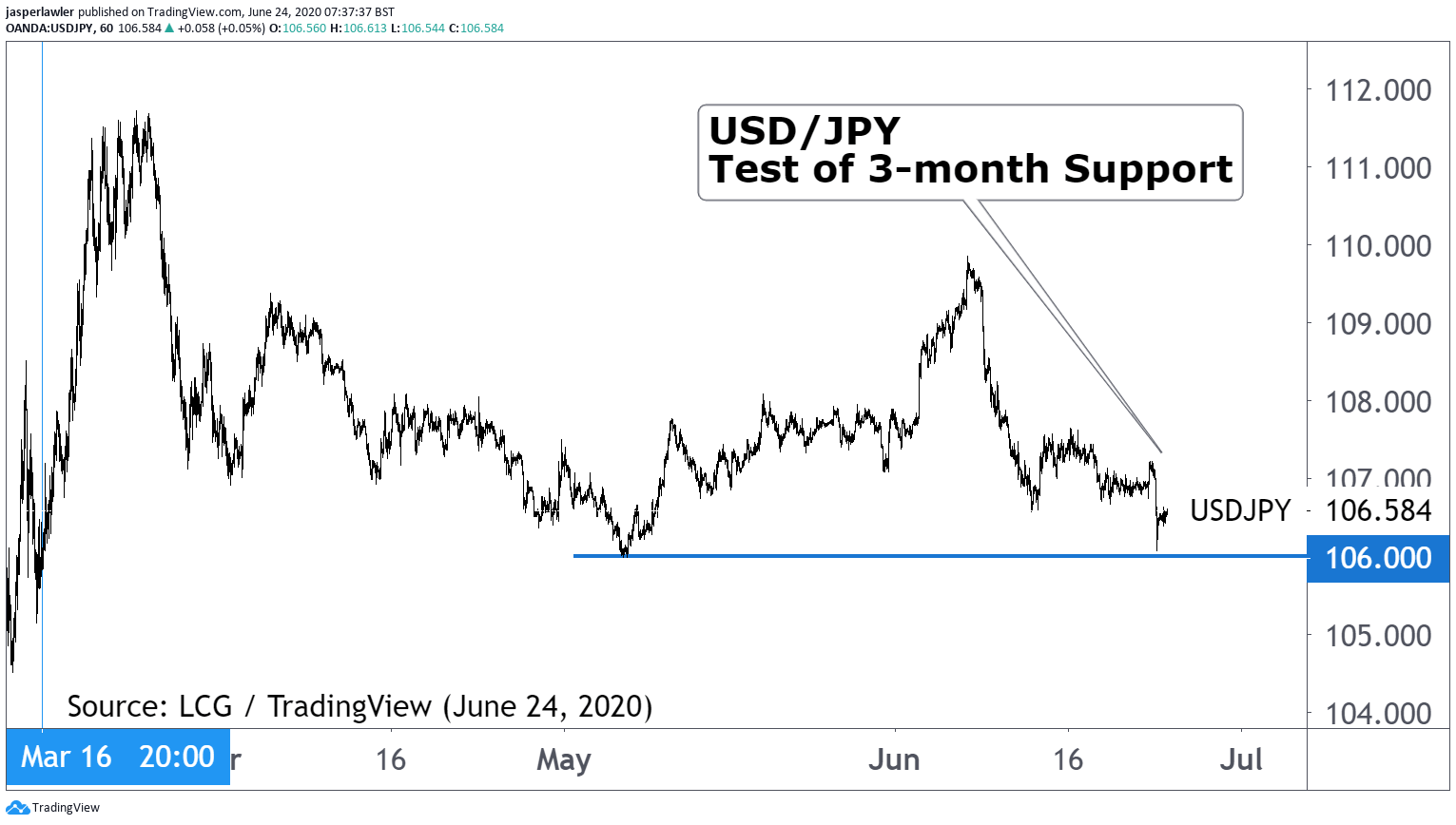

Chart

The dollar is on the cusp of a break lower versus the yen - but remains in a wider trading range, contained by the volatile price action in March.

This information has been prepared by London Capital Group Ltd (LCG). The material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. LCG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Spread betting and CFD trading carry a high level of risk to your capital and can result in losses that exceed your initial deposit. They may not be suitable for everyone, so please ensure that you fully understand the risks involved.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.