The Rio Tinto Earnings Report is out on Tuesday, October 16, 2018 with expectations suggesting that this will be a good year for the mining giant. The Reuters survey of analysts suggests that they hold an overall positive view of the company, with only 3 out of 26 analysts reviewed suggesting that earnings should underperform the market. The overall positive outlook of the company is also seen in the annual forecasts, which expect sales to rise by approximately 9% compared to the 2017 figure. Earnings Per Share (EPS) are also expected to rise, with average expectations suggesting that they will reach $4.92, compared to $3.71 a year before.

The Nasdaq pool of analysts suggests that the company is a Buy recommendation, with just one analyst suggesting selling it. Consensus EPS forecast is lower than the Reuters one but still estimating it to rise to $4.59, at a P/E (Price over Earnings) ratio of approximately 10. Similarly, Yahoo!Finance suggests that recommendations average at Buy, with no sell recommendations by analysts. The major investment banks (Goldman Sachs, JP Morgan, HSBC) have upgraded their views regarding holding Rio Tinto stock and suggest that portfolios should add more weight to the firm. Vuma consensus estimates, on the basis of the forecasts made by 15 analysts are also suggestive of a continuous increase in the quantity of mining output.

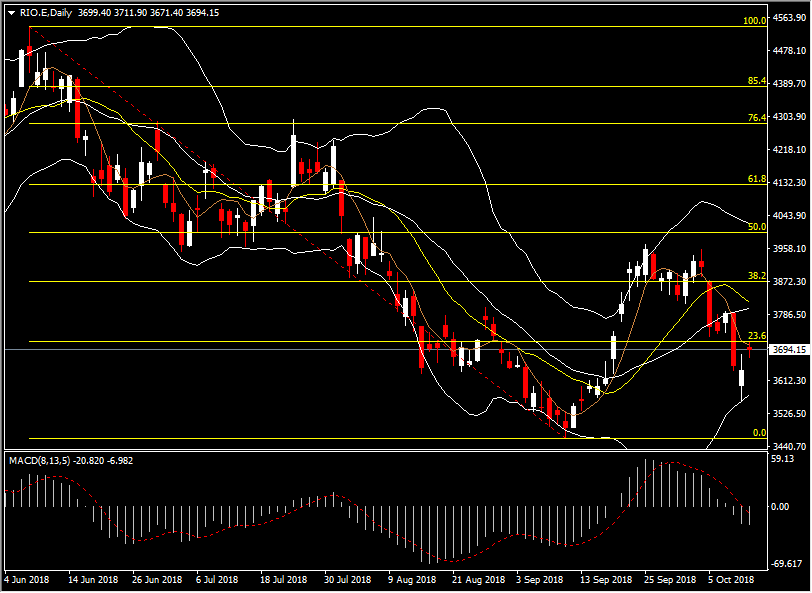

Technically, the Rio Tinto share came of two tops at approximately 3970, and then returned to lower levels. The current price is trading at approximately 3690, just below the Fib. 23.6% level of 3714, which could prove to be a Support level if the stock surpasses it, heading to the new Resistance level of 3875 (Fib. 38.2%). On the downside, the Fib. 0% support level of the September low stands at 3461.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.