- Economists expect ADP's private-sector jobs report to show an increase of 200,000 jobs.

- Investors lean toward selling the Dollar ahead of a speech by Fed Chair Powell.

- Only an increase of over 300,000 would boost the Greenback.

Houston, we have a correlation – ADP's jobs report has finally come in line with the official Nonfarm Payrolls (NFP) report. It took a hiatus and a change in formula to make that happen, but what matters is that this release finally matters. Investors will be closely watching the upcoming publication for November.

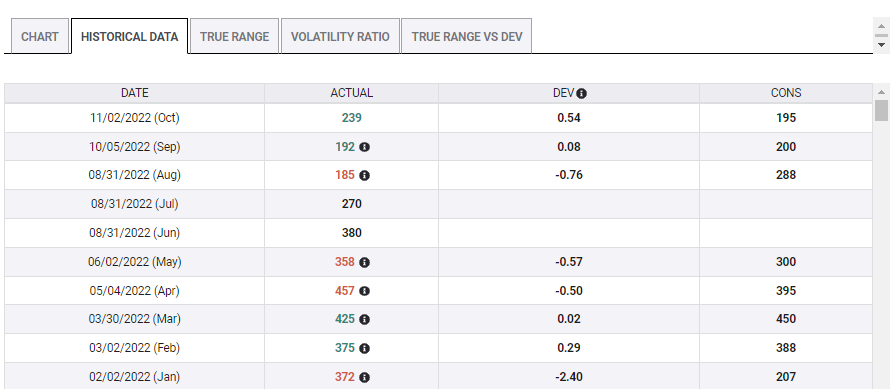

America's largest payroll provider reported an increase of 239,000 private-sector jobs in October, and the official read came out at 261,000 total jobs, both public and private. This time, economists expect an increase of 200,000 in both, but if ADP's number significantly differs, it will shape estimates for the NFP.

Source: FXStreet

The Federal Reserve and markets want to see the labor market cool down after the reopening-driven boom, which caused substantial shortages. There are still two jobs for each vacant worker. While the pace of hiring has slowed in recent months, there is still a long way to go.

Weekly jobless claims have remained low and retail sales are on the rise – showing that consumers still have spare cash to spend. That means a significant drop in hiring – or job losses – seems highly unlikely at this juncture.

Expected market reaction

A disappointing increase of fewer than 200,000 would hit the US Dollar, as it would lower expectations for a fast pace of rate hikes by the Fed.

What would happen if the ADP's data met expectations? Here is where market biases come into play, and I see them as negative.

Since the US reported a weak inflation report on November 10, US 10-year yields have been trending lower. This move has seen its bumps in the road, but the direction has been clear – down.

Another reason is the timing of ADP's report. It is released a few hours before Fed Chairman of the Federal Reserve Jerome Powell speaks. The world's most powerful central banker will likely be dovish – or at least that is what markets expect after a preview by Bloomberg on the topic.

It is not only that news outlet – the Federal Open Meeting Committee (FOMC) Meeting Minutes leaned toward slowing the pace of hikes, much more than the final peak, which could be higher. These expectations will limit any upside.

I will go further and argue that it would take an increase of no fewer than 300,000 jobs to trigger an upside move in the Dollar. Only such a leap in hiring would cause markets to pause and rethink.

Final thoughts

ADP's jobs report has grown in importance after providing guidance last month, overshadowing the second release of US GDP due only 15 minutes afterward. Markets want to sell the Dollar and the bar is high to buy it.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.