Market Overview

After the incredible sell-off has come the recovery. Although by any stretch of the imagination, it is difficult to feel all that positive at the moment, technical, Wall Street is back into a bull market. Rallying over 20% off its lows, the volatility on equities continues huge but for now, the momentum is with a recovery. What was encouraging yesterday was that in the shock of the weekly jobless claims coming in with an eye-watering 3.3m claims, traders did not seem to be overly phased by this. When bad news is taken well, this suggests that there could be some sustainability to a recovery. Treasury yields continue to consolidate and this is also helping to reduce the propensity for panic selling. With swaps rates on major forex falling back, the dollar has turned corrective and this is also playing into the sense of risk recovery. Today is likely to see the House of Representatives pass the huge $2 trillion fiscal support package and although there is a sense of moderation to the recovery on markets this morning, major forex and commodities appear to be relatively stable. This should be seen as a positive for the prospect of steady recovery as markets settle down.

Wall Street closed another huge session of gains with the biggest three day winning streak since the 1930s. The S&P 500 closed 6.2% higher at 2630. However, US futures are giving back some of these gains this morning, down by -1.3% (although US futures were also lower yesterday morning). Asian markets were strong overnight , with the Nikkei +3.9% and the Shanghai Composite +0.3%. In Europe the markets are following US futures right now, with FTSE futures -1.7% and DAX futures -1.6%. Forex majors show mixed moves this morning, with only really JPY which is performing well. Other markets are very much mixed, even quiet. In commodities, gold is slipping back by -$10 after yesterday’s gains, whilst silver is flat and oil is also mixed.

There are a couple of US data points to be aware of on the economic calendar today. The Fed’s preferred inflation measure, the Core Personal Consumption Expenditure (Core PCE) is at 1230GMT and is expected to show +0.2% in the month of February which would pull the year on year reading up to +1.7% (from +1.6% in January). Then the final University of Michigan Sentiment for March is expected to show a significant downward revision to down to 90.0 from the prelim of 95.9. This would therefore be a sizeable decline from February’s 101.0 and also be around the August 2019 multi-year low (which was 89.8).

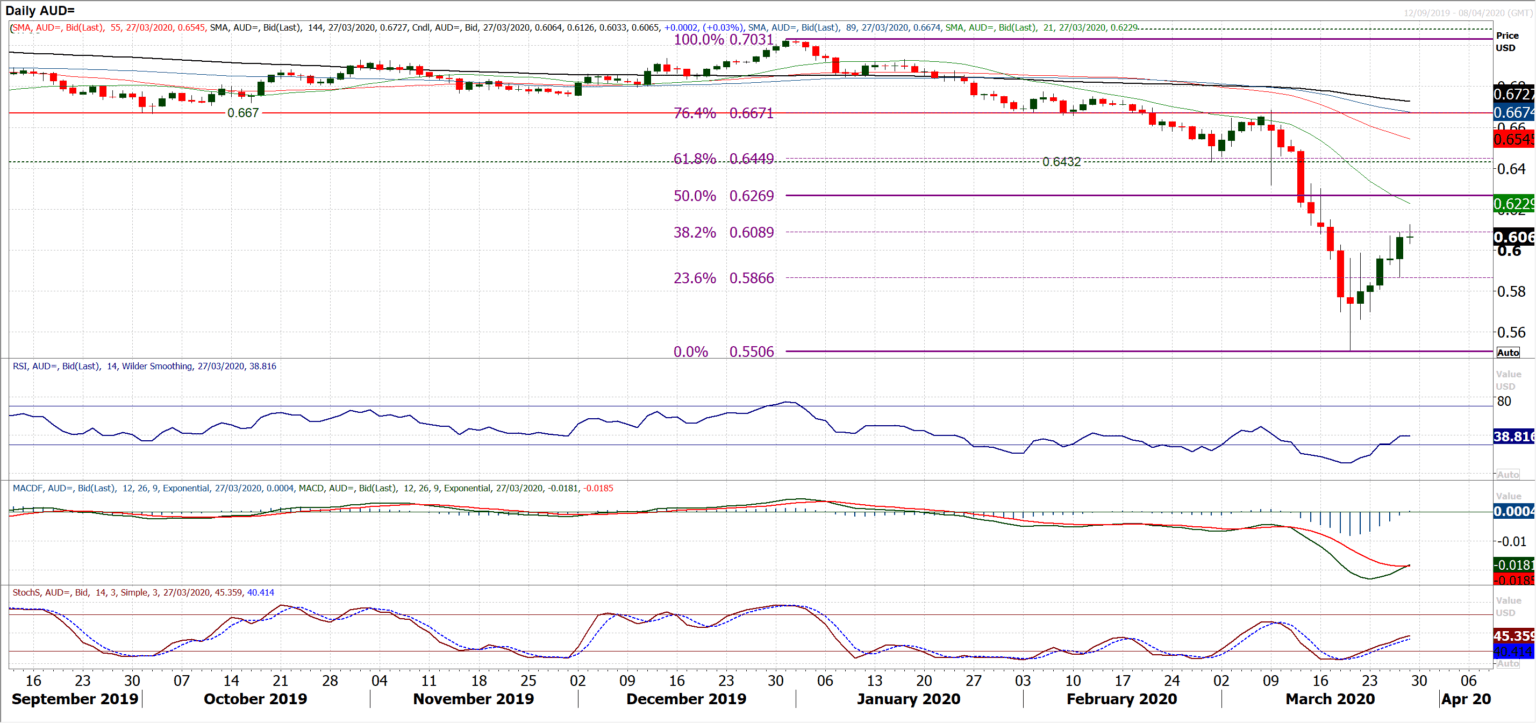

Chart of the Day – AUD/USD

With risk appetite on the rebound, the US dollar has turned corrective. At the forefront of the recovery amongst the forex is the Aussie. This is driving a considerable rebound on AUD/USD. The move has formed positive closes in each of the past five sessions and an array of positive candlesticks. Momentum indicators are now in recovery mode, with the Stochastics rising strongly, RSI posting a buy signal (above 30) from its deepest ever oversold position (of 10) and MACD lines are on the brink of a bull cross. The Fibonacci retracements of the big January to March sell-off (from $0.7031/$0.5506) are interesting gauges. Support formed at yesterday’s low almost to the pip of the 23.6% Fib at $0.5866. Furthermore, the 38.2% Fib around $0.6090 was a basis of resistance. This level is being tested again today, but given the momentum of the rally, a confirmed closing breakout would open the 50% Fib as the next target (around $0.6270). Seeing as there is little real resistance of note, the prospect of continued recovery is strong. We look to use weakness as a chance to buy. The hourly chart shows strong progression in the recovery with a run of higher lows and higher highs. Initial support is between $0.6035/$0.6075, whilst holding above $0.5985 maintains momentum of the rally. The first key higher low is at $0.5870. The next real resistance not until $0.6300.

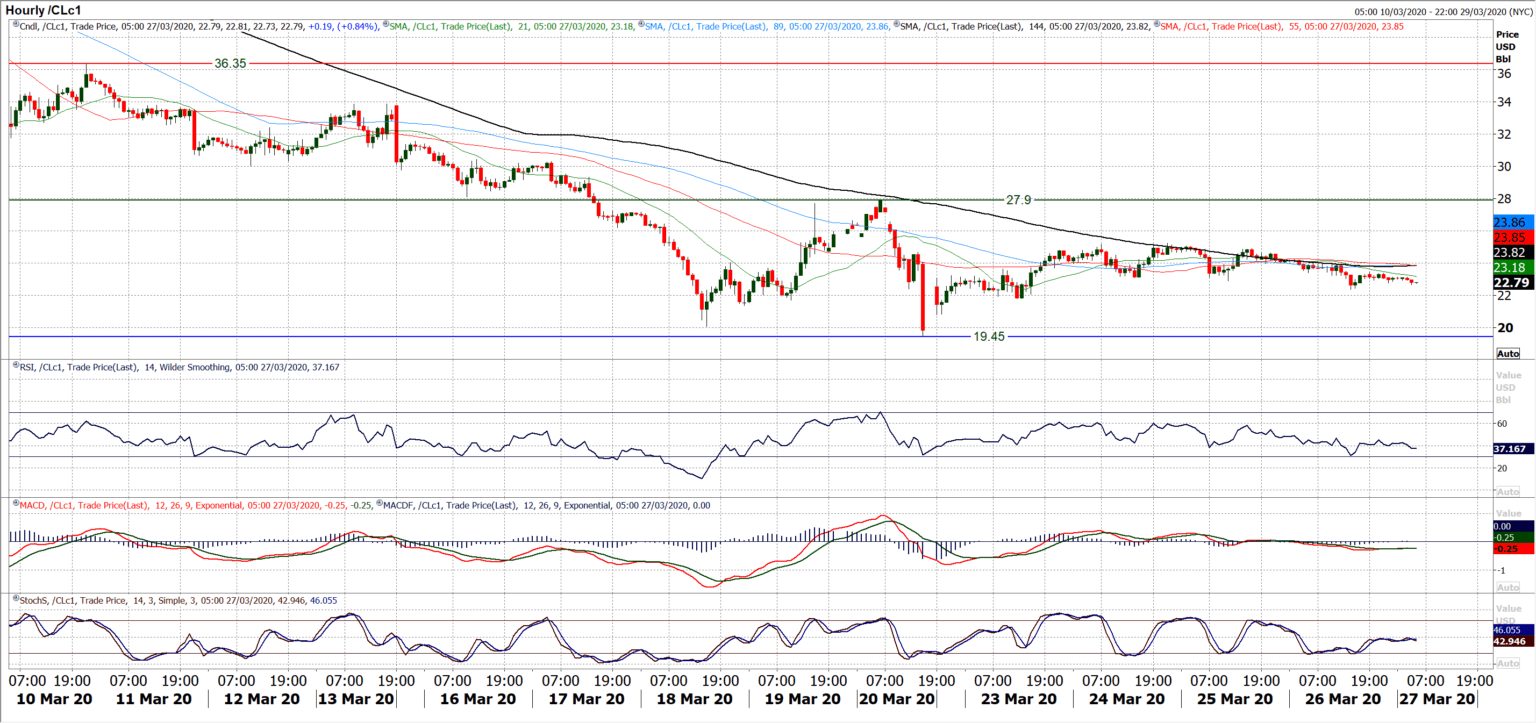

WTI Oil

It was interesting to see that even as the dollar saw a sharp corrective move and risk appetite recovered yesterday, oil did not take part in the rebound. The bulls are still struggling to get going in a recovery. After a couple of small bodied candlestick gains, yesterday’s move back lower will have been concerning for the bulls. There is still the potential for a recovery as momentum indicators have picked up in the past week, but they lack any sense of conviction and are struggling in negative configuration still. The MACD lines may be close to crossing higher, but in the absence of any bull signals on RSI or Stochastics, it is a move to be cautious of. The hourly chart shows the market beginning to leave mini lower highs and lower lows, with initial support at $22.40 and deteriorating momentum. However, the higher low at $21.80 is the key level that the bulls really need to hold on to in order to prevent a fall back to retest the key low at $19.45. Resistance at $25.25 is growing ever more important now and a move towards completing a big base pattern above $27.90 becomes increasingly harder to see in the near term as a negative bias seems to be taking hold once more.

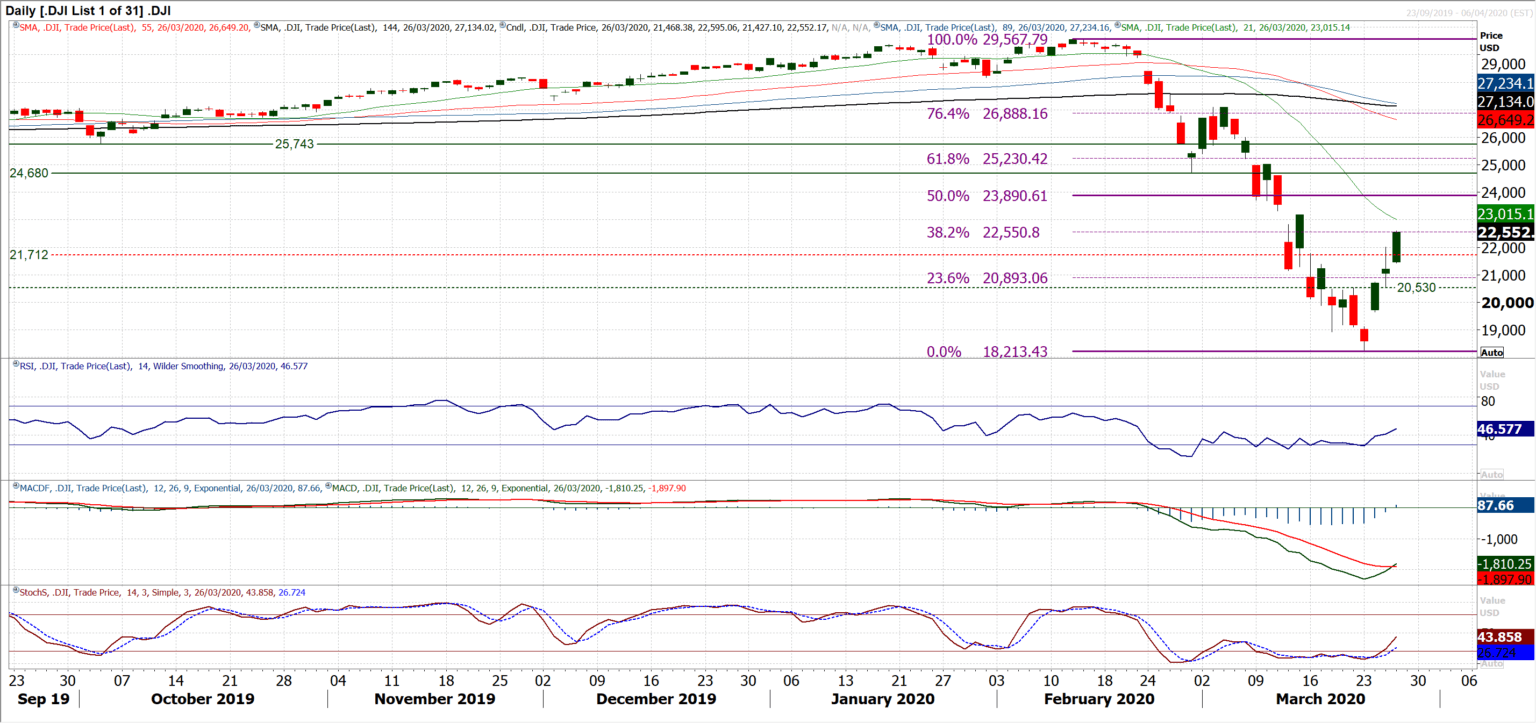

Dow Jones Industrial Average

The Dow is officially in a bull market. After just three days since a multi-year low, the Dow is over +20% higher from its low. Now having posted three days of consecutive gains, the Dow is now over +23% from its low of 18,213. Technically the move looks strong now, with buy signals across momentum indicators. Bull crosses now on Stochastics, MACD and RSI at 5 week highs. There is also upside potential in the move. All indicators still have plenty to unwind. Old downside gaps that had been left unfilled or unclosed by the precipitous sell-off are now being bull closed one by one. Watch the Fibonacci retracements (of 29,568/18,213) as key gauges in this rally, with 38.2% Fib capping yesterday’s rally. The is a support band between 23.6% Fib (at 20,892) and the near term pivot at 20,530 as key gauge for the development of the rally now. Volatility remains high in equities, and again it will be interesting to see how the bulls respond to renewed negative session. Whilst holding on to 20.530 the Dow should remain in recovery mode now. Above 38.2% Fib the 50% Fib at 23,890 is the next target area.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.