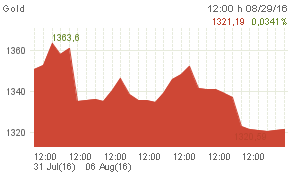

Having faced rejection at $1342 on Friday, Gold resumed with its near-term corrective move and dropped to monthly low level of $1315 before recovering its lost ground to currently trade around $1320 level.

Rising greenback exerted de-facto selling pressure across dollar-denominated commodities, including gold. The US Dollar got a strong boost after hawkish comments from the Fed Chair Janet Yellen and Vice Chairman Stanley Fischer hinted towards an imminent Fed rate-hike action by the end of 2016. Increasing Fed rate-hike bets drove the USD/JPY pair higher and took along the US longer-term (30-years) Treasury bond yields higher, which dented demand for assets that don't provide any yield - like gold.

Meanwhile, a sudden spurt in the Volatility Index (VIX), leading to weakness in the broader US equity index (S&P 500) extended some support to the safe-haven appeal of the yellow metal and restricted further downslide. However, the prevalent US Dollar strength, as depicted by bid tone surrounding the USD/JPY major, is likely to restrict any attempts of recovery in the precious metal.

Focus now shift to Friday's monthly employment details from the US (NFP), which would be the final jobs report heading into the FOMC September monetary policy meeting. A strong NFP print will keep doors open for a September Fed rate-hike action and should continue to weigh on the yellow metal. In the meantime, bullion traders are like to derive intermediate move from broader sentiment surrounding the greenback and prevalent risk-sentiment.

From technical perspective, sustained weakness below $1315 is likely to drag the commodity below June lows support near $1305 level, towards testing 100-day SMA strong support near $1295 region. Conversely, any recovery attempts might now confront immediate strong resistance near $1330 level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.