![]()

Hello traders! In this week’s newsletter-the first of a two-part series-I’d like to show a little bit about how some currency pairs in the spot forex market seem to move together, and how we can use this to help make a few extra pips in the market.

First of all, I’d like to define what correlations are in trading. As usual, I’ll rely on Investopedia for help in this department:

DEFINITION of ‘Correlation’

In the world of finance, a statistical measure of how two securities move in relation to each other. Correlations are used in advanced portfolio management.

INVESTOPEDIA EXPLAINS ‘Correlation’

Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. Perfect positive correlation (a correlation co-efficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random.

In real life, perfectly correlated securities are rare, rather you will find securities with some degree of correlation.

Additionally, you may have heard positive correlation referred to as “direct” correlation and negative correlation referred to as “inverse” correlation. In the following chart, you can see that the AUDUSD (represented by the blue line) and the USDCAD (represented by the red line) overall tend to move in the opposite direction-which would mean a negative correlation. A couple of positively correlated areas are marked with black lines, and negatively correlated areas are marked with blue. Obviously, the overall negative correlation is more frequent than the positive correlation periods. Can you spot a few more periods where the correlation is very strong?

Anyone want to take a guess as to WHY these two currency pairs offer such obvious negative correlations? There are two main reasons, actually. The first is that both the AUD and the CAD are what we call “commodity currencies.” Because both Australia and Canada are producers of raw materials, commodities, if those prices go up it is normally good for these two economies. If the prices go down, normally that would be bad for the raw material producers. The second reason is because of the SIDE of the currency pair they are on. In the AUDUSD, the AUD is the base currency; in the USDCAD, the CAD is the quote currency. Because they are on opposite sides of the teeter totter of the symbol, it would cause the charts to move how they do.

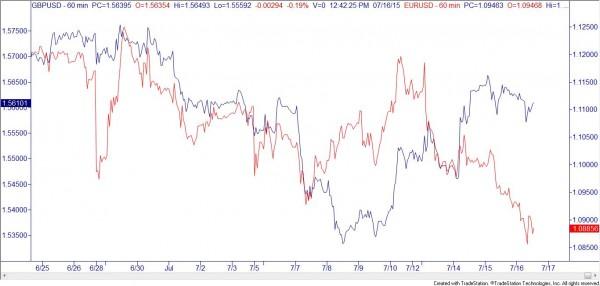

In this chart, we see the GBPUSD in blue and the EURUSD in red on a 60 minute time frame. Notice the very obvious positive/direct correlation! It’s so obvious I’m not even going to mark them on the chart.

Now that you’ve seen examples of both positive and negative correlation you must be fascinated with the wiggly lines and are dying to put them on your computer. However, what will you do with this information? I’m glad you asked. There are actually several potential ways that you could use strong correlations in your trading. The first way to use these correlations is to remind you to not “double up” on a position. For example, if you went long the AUDUSD, what did you really do? You purchased the AUD and simultaneously sold the USD. If you were to go short the USDCAD, you sold the USD and went long the CAD-essentially doubling up on a short USD trade. Now, that isn’t in and of itself unheard of, but it is something professionals are at least aware of. What about if you were long the AUDUSD and were considering going long the USDCAD? That would mean that you bought the AUD, sold the USD, then turned around and BOUGHT the USD and sold the CAD. So, you actually went long the AUDCAD currency pair, as the USD parts of the two trades cancelled each other out! This is commonly called a “synthetic” currency pair. There are some valid reasons for doing this on purpose, for example the “synthetic pair” might have low liquidity while the two legs that created the synthetic have good liquidity; if you didn’t plan on doing the synthetic trade you might not get the outcome you expected.

In my next article, I’ll show another couple of ways to use correlations to help squeeze out a few extra pips!

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.