![]()

I want to explore a question that is asked of colleagues and me time and time again. It is a good question, such that it warrants a deeper look and further understanding. Let’s face it, most individuals think of investing in the stock markets when they first become interested in the financial markets; and this is very different to what we at the Online Trading Academy would classify as actual “trading.” In a nutshell, when we invest in the markets we tend to buy shares or stock in companies and hold them for a long term duration as part of our portfolio. This portfolio is then cashed in at the age of retirement. Whether or not this is a good strategy is a discussion for another time. For now I just want us to be clear on the terms and what they mean.

When we trade we actually define specific entry and exit points ahead of time, waiting for the very best time to get in and get out. We not only buy the market but we also sell short when we can and trades can be held for various durations of time, anywhere from minutes to hours to days or maybe a few months. However, each decision is made ahead of time with a plan and rules that prepare us to get out when we are wrong to limit our financial losses so we can get out when we are right for a gain.

Once people get their head around trading the stock market they tend to gain an interest in other financial asset classes, like Options, Futures and, of course, Forex. This is mainly due to the advantages that these other asset classes offer such as smaller accounts, various trading times and attractive leverage, with FX being the most economical of them all. So the question is; can we take the same trading approach to the world of Forex as we use for stocks? Well, the answer is both yes and no! Let’s take a deeper look into it.

As you may already know, our core strategy recognizes institutional Supply and Demand on a price chart. It highlights the areas of unfilled orders and imbalances across all markets. Be it stocks, futures or currency, these rules stay the same: the lowest risk and highest reward trades with the odds in our favor can be found by buying at demand and selling at supply. This remains the same no matter what you are trading, in my humble opinion. If there are more willing buyers than sellers at any given price level in any given market, prices must rally or fall to correct this lack of equilibrium. This does not change whether trading stocks or FX. Sure, there are some specific characteristics we must be aware of that are different in each market and can help with putting the odds in our favor, but when this is taken care of the rest remains pretty much the same.

With this in mind though, we do need to manage our expectations in respect to market behavior when looking at the ways we need to approach our FX trading as opposed to stocks. To explain this, let’s take a look at a monthly chart of the Dow Jones Index:

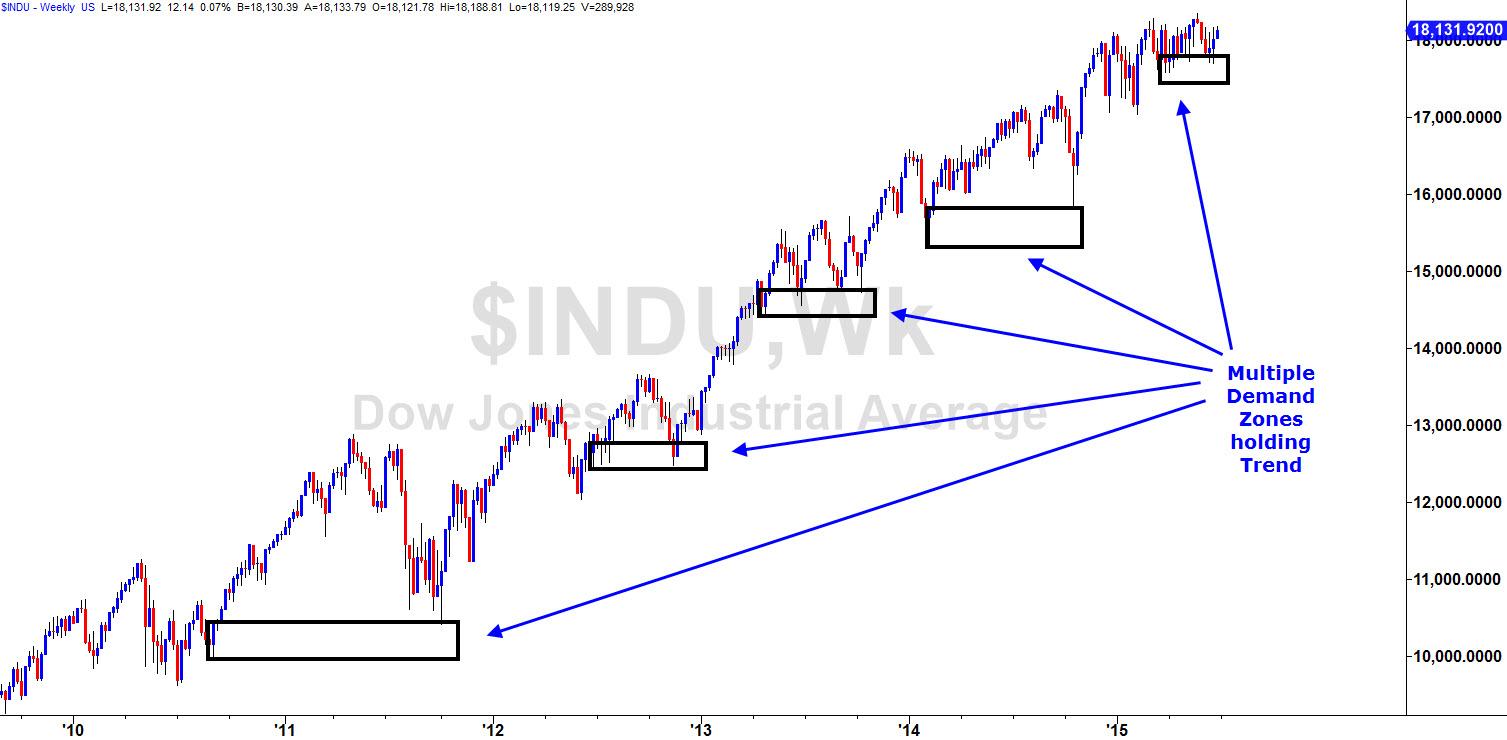

As we can clearly see, the overall equity market has been rising for 35 years now; in fact it has gone up ever since it started trading. You can see why investors like to “Buy and Hold.” The market has had its corrections too, the last major one being the Credit Crunch in 2007/08, but it has still risen over time. If we look to the Weekly chart, we can see levels of Demand which would have been low risk entry points in the latest Bull run:

There have been some great Supply levels which have pushed prices lower too that a trader would make good use of these but overall, the upside has worked better than the downside as is often the case with stocks. Using this approach to “upside bias” is not quite so practical in the FX markets though, as we can see when we take a look at the weekly charts for the GBPUSD:

This weekly chart is nowhere near as clean as our Dow Jones is it? Notice the longer-term sideways price action on the currency pair? If we were to take a longer term directional bias on this chart over the last 5 years by either buying or selling the pair, we would be right back to where we would have started. Now, I’m not suggesting this means we can’t take longer term positions in the currency market at all. Personally, I love to take Swing and Position trades whenever I can in FX but we do need to rethink our approach to what exactly is long term in this arena of FX. What it means is that we have to be open to the idea that the average currency pair is likely to go through bigger swings and changes in longer term direction more so than stock would, which we can see clearly on this monthly chart of GBPUSD:

In this chart example we can see that levels of Supply and Demand work just like they do in stocks but the pair is in a range in the longer term. Ranges like this are very common in FX due to the fact that there are 2 currencies in each pairing and it is highly unlikely that either will go to zero resulting in the above price action on the bigger picture, unlike a stock which could go to zero more easily in theory.

So in conclusion, we can see that it is perfectly ok to use the same trading techniques when trading FX or stocks, as long as we remain open to the fact that prices do not trade in one directional trend for too long. In 2 weeks I would like to continue this discussion further with a look into various ways to embrace the FX markets for longer term wealth but with a respect for price directional change.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.