![]()

This week I would like to discuss a topic which comes into question a great deal during every Professional Forex Trader class I teach with Online Trading Academy, and that is on the subject of profit targets. I think that setting good solid profit targets and learning to take the right action at the targets is a vital skill that must be understood and put into practice by anyone looking to achieve consistency in their speculative currency trading. Let’s face it, if you don’t learn how to take a profit on a trade, then how much progress are you ever really going to make? Now, while I have stated that this is a vital skill to learn, we should also note that it can be a challenging one as well; mainly due to the fact that your emotions are likely to be challenged when you are in a position, especially if you constantly gaze at your profit and loss numbers. To overcome this issue, I always teach my student to pre-define their targets before they actually take a trade in the hope that this will help them to have a plan to follow and remove any doubt from their heads once they are in a position.

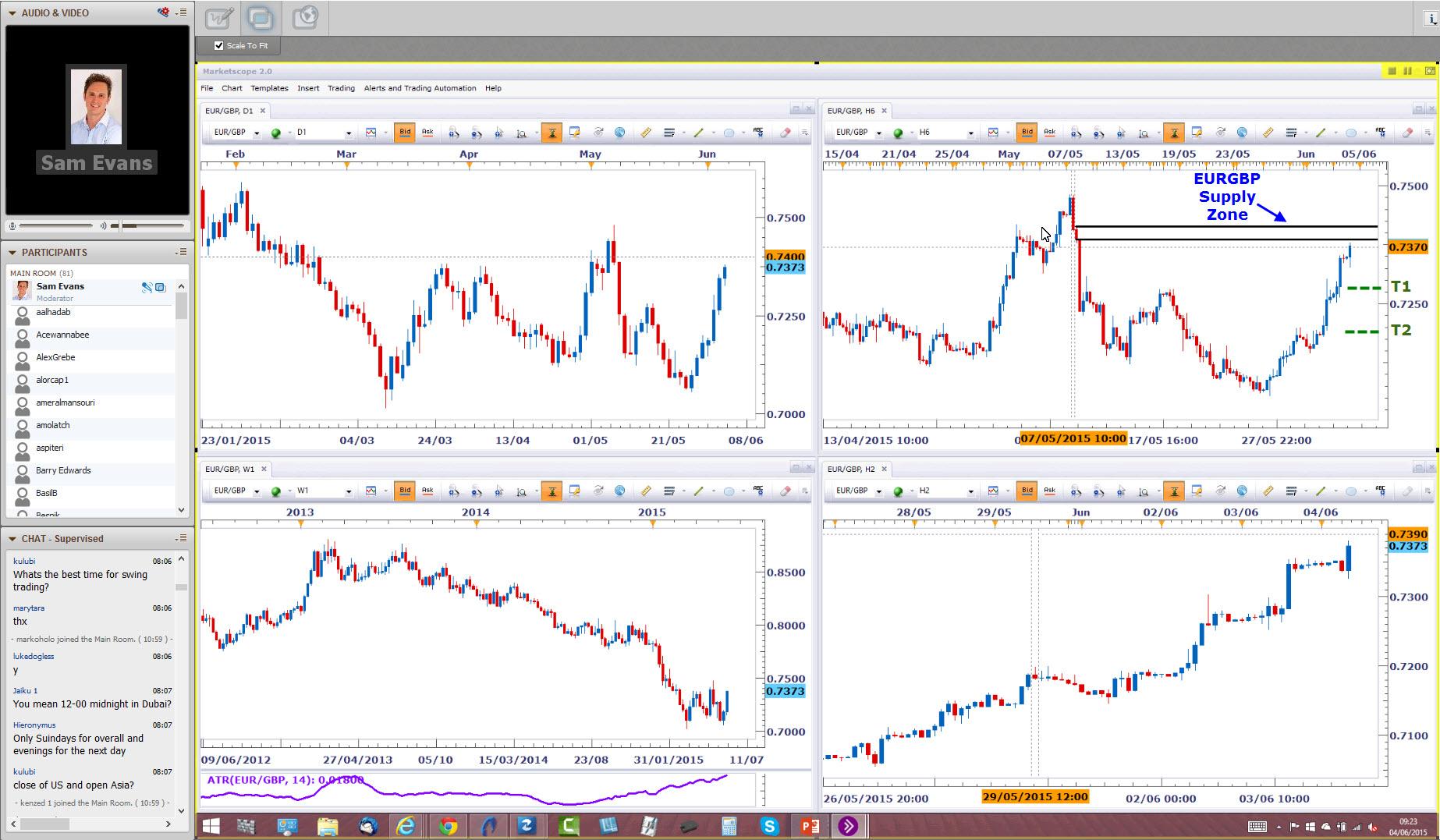

Once in the trade these targets may or may not be hit. This will always remain something we can never be truly sure of, so the next thing we can decide upon before entering a trade is what action we will take if the trade does reach 1 or more of the targets during its duration. Notice how again this is all decided upon before actually getting filled on the trade we are looking to take. I cannot emphasize the importance of this enough if you are hoping to be as rule-based and systematic as possible in your currency trading. Remember that plenty can happen during your time in a trade which will tempt you to change your plan, so you must do as much as you can to overcome this and it all starts with the plan. To demonstrate this more clearly let’s take a look at an example from an XLT I did on 4th June. In this session I highlighted some potential trading opportunities I found using our Core Strategy principles and rules. After finding them, I shared with the class in the Live trading room on the prep screen:

You will see a setup on EURGBP in the top right of the above prep screen with specific Entry, Stop Loss and Target prices. Notice that there are 2 targets? This is so that if the trade works partly in our favor, to a certain point we can decide upon a plan to either take a partial profit or reduce risk. That choice would come down to the individual’s plan at the end of the day. At the time of the session, the EURGBP short came into play as shown below:

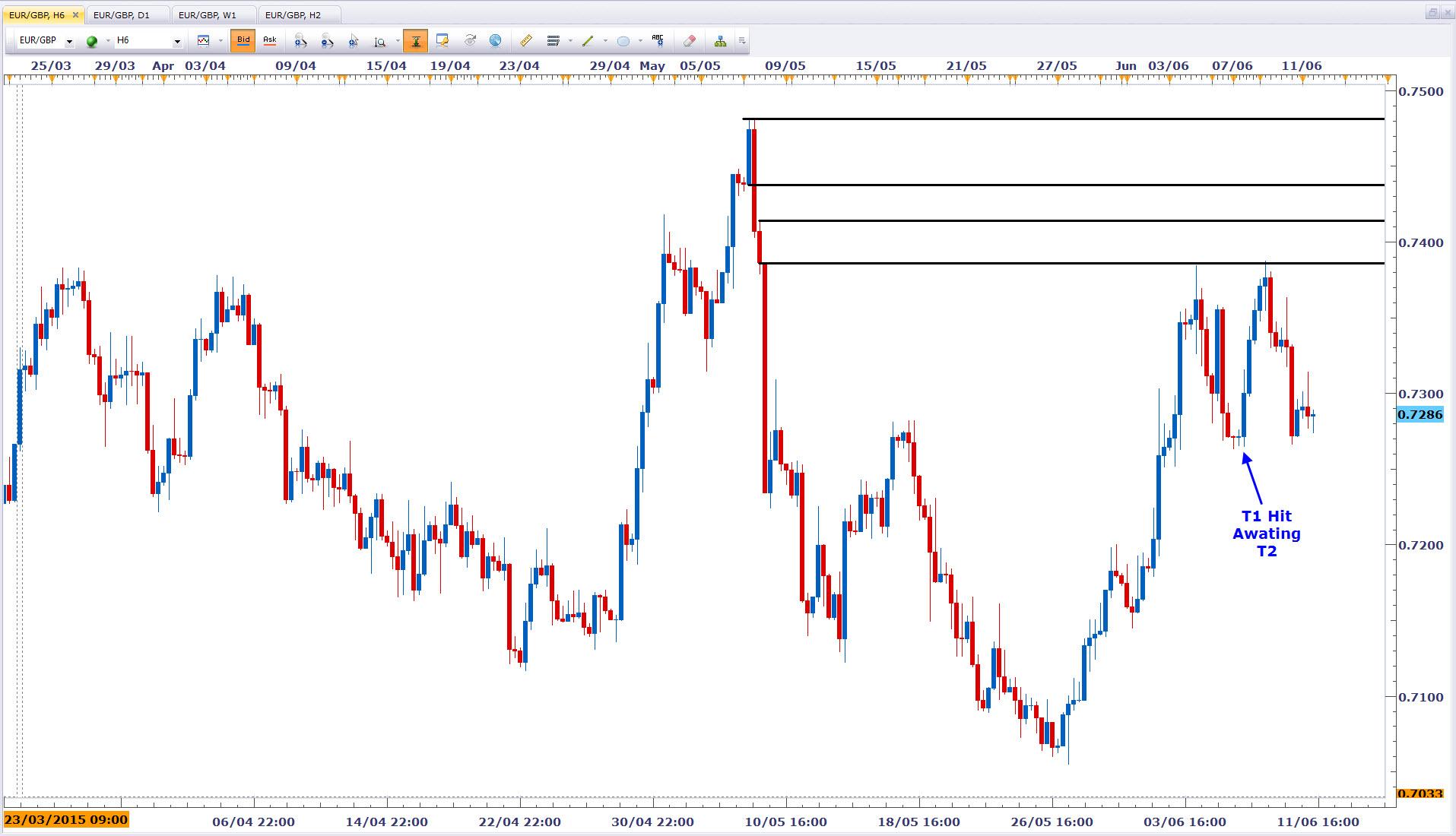

Prices had rallied nicely to our level of Supply where I had highlighted a major imbalance of orders between the buyers and the sellers, with the shorts currently in control. With this is mind we had a low risk and high potential reward trade on our hands. The pair went 1 pip higher to reach 0.7385 with our actually entry posted at 0.7384. As posted on the prep screen, Target 1 was at 0.7303 and Target 2 at 0.7205, both are marked on the chart above. By having 2 targets as opposed to 1, we have more options and flexibility on the trade as well. This is how things turned out:

When I did the above screen-grab, target 1 had been clearly achieved but then the market rallied all the way back to the entry only to fall back to the same price again. At the time of writing this article, the EURGBP had actually fallen further and hit Target 2 at 0.7205.

There could be many different outcomes of this trade, depending on how it was managed. Some may have closed out their trades fully at Target 1, while I know others who would have taken a partial profit at that point and left their trade alone knowing that they may hit Target 2 and make more or just get stopped out for a breakeven or maybe a small win. The choices are many and depend upon the individual trader of course. Yet if we strive to set multiple targets we have many more choices to evolve the trade to our level of comfort. Not every trade will happen to work out in the time span we want it to, but when left alone it is typically amazing how a position can develop when you are not looking at it every 5 minutes (trust me I’ve been there), especially when you have a plan beforehand and stick to it throughout. I hope you found this helpful.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.