When trading options, we have quite a few moving parts to juggle. Fortunately, technology now gives us tools that make this much easier.

One of those tools is the option payoff graph, also called the risk graph. We’ll take a look at this tool today.

We have been using the stock of General Electric for our examples recently, so let’s continue with that. Here’s how GE’s chart looked on January 27, 2016:

Let’s say we were neutral-to-bullish on GE and expected it to hold or go higher from here in the next few weeks. We might consider the trade that I described last week, which was to sell (short) put options for the February 19, 2016 expiration at the $27 strike price. These could be sold for $.39 per share, or $39.00 per 100-share option contract.

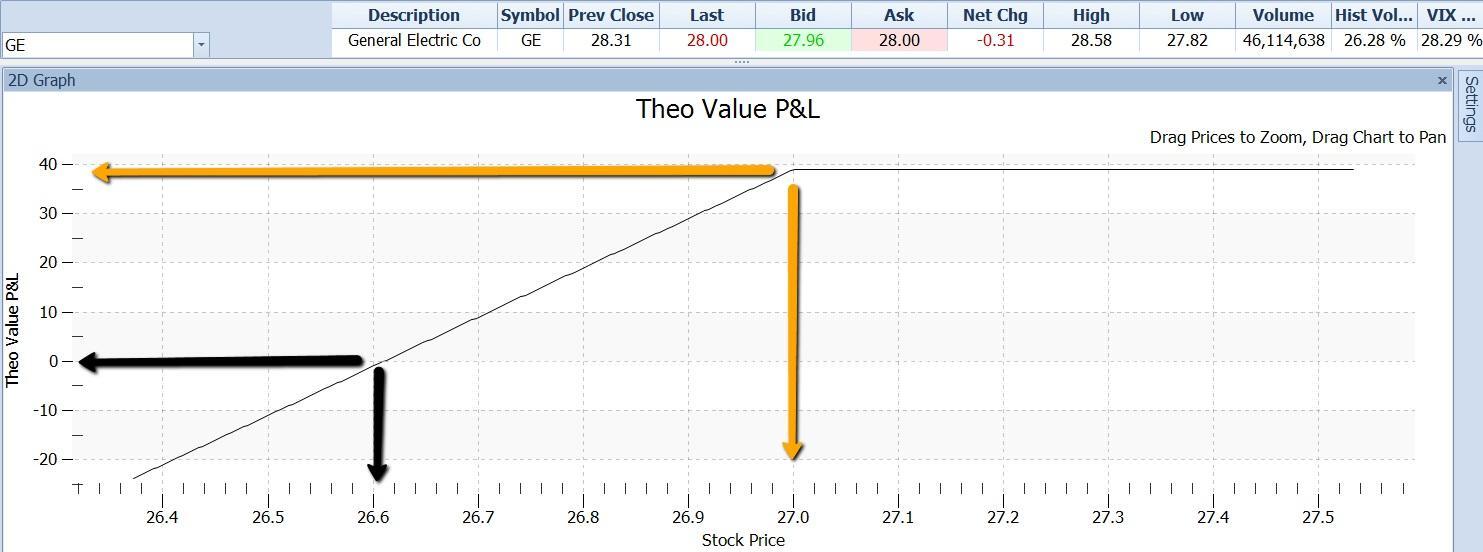

To view the profit and loss possibilities of an option position, there is a standard format for portraying them graphically. The option payoff graph for this short put trade looks like this:

The gray line on this graph relates the stock price at the option expiration date to the amount of profit or loss that the option position would make with the stock at that price. The system “knows” that we would receive $39 when we sold the puts to enter the position.

These graphs take a little getting used to for those of us accustomed to using stock price charts. Note these points about the payoff graph:

-

The price of the stock runs left to right (on the X or horizontal axis), not up and down on the Y or vertical axis, as price charts do.

-

The vertical axis is profit or loss on the position at the indicated stock price.

-

Not shown but, built into the graph is the amount of money paid out or taken in to open the position. In our example, we sold puts for $39.00 for the contract.

-

No time or movement is shown on the graph. The gray line is drawn as of a specific instant in time – the moment of option expiration, 23 days in the future. It shows what the amount of profit or loss would be if the stock were to be at the indicated price at that time.

In this case, the gray line slopes upward from left to right and then levels out at a profit of $39.00. This indicates that the maximum profit on the trade is $39.00 and that this would be the result if the stock were to be at any price at or above $27.00 at expiration. The gold arrows point to the amount of profit ($39.00) and to the corresponding stock price ($27.00).

This makes sense when we remember that the puts will be worthless when they expire unless the stock is below their strike price of $27.00. If they are worthless then we will not have to pay anything to buy them back and terminate the trade, and we will keep the $39.00 we received for them. This will be our profit.

The black arrows point to the zero point on the P/L axis and to the corresponding stock price of $26.61. This indicates that if at expiration the stock is at $26.61, our trade will break even. In that case the puts would be worth $.39 per share. They convey the right to their holders to force us to buy the stock and pay $27.00 (their strike price), which would certainly happen. Since $27.00 would be $.39 higher that the stock value at that point, we would have a loss at that time of $.39 per share. This would exactly absorb our original credit of $.39 per share, for no net gain or loss.

At stock prices between $26.61 and $27.00 our position shows positive values for profit of more than zero and less than the maximum profit of $39.00.

And at stock prices below the $26.61 break-even price the position would show a loss.

There is quite a bit more that the option payoff graph can tell us. Next time we’ll continue with that.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.