In last week’s article, about visualizing the Greeks in options, we looked at the payoff graph for a potential option trade on XOP. I said that that graph had more to tell than we had space for there. Today we’ll look at that a little more.

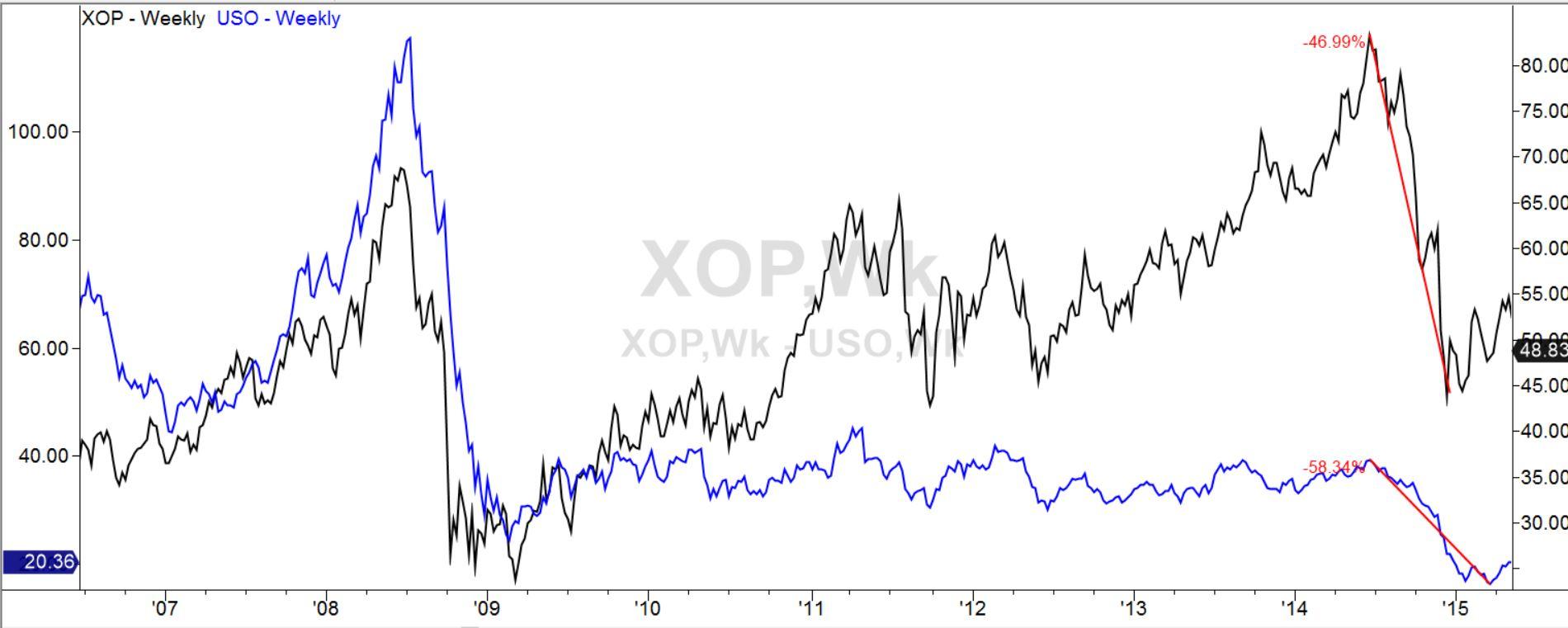

XOP is an oil-related exchange-traded fund. It largely tracks the price of oil. But unlike the fund USO, which does so by holding oil futures contracts, XOP owns stock in oil exploration companies. Over time, it has shown itself to be a bit less of a wild ride than USO, just a little less dizzying in the upswings and marginally less terrifying in the downswings. Here is a comparative chart of XOP and USO:

XOP has been somewhat more resilient, standing 33% above where it was in 2006, compared to USO, which has lost 70% of its value in that time. In the recent oil crash XOP lost 47% of its value while USO lost 58%. XOP pays a small dividend yield of about 1.3%, while USO pays none.

If we believed that oil has bottomed out in price and is likely to advance from here, then XOP could give us a way to benefit from that with a bit less drama than USO.

Last week I showed a chart of XOP alone, which appeared as follows.

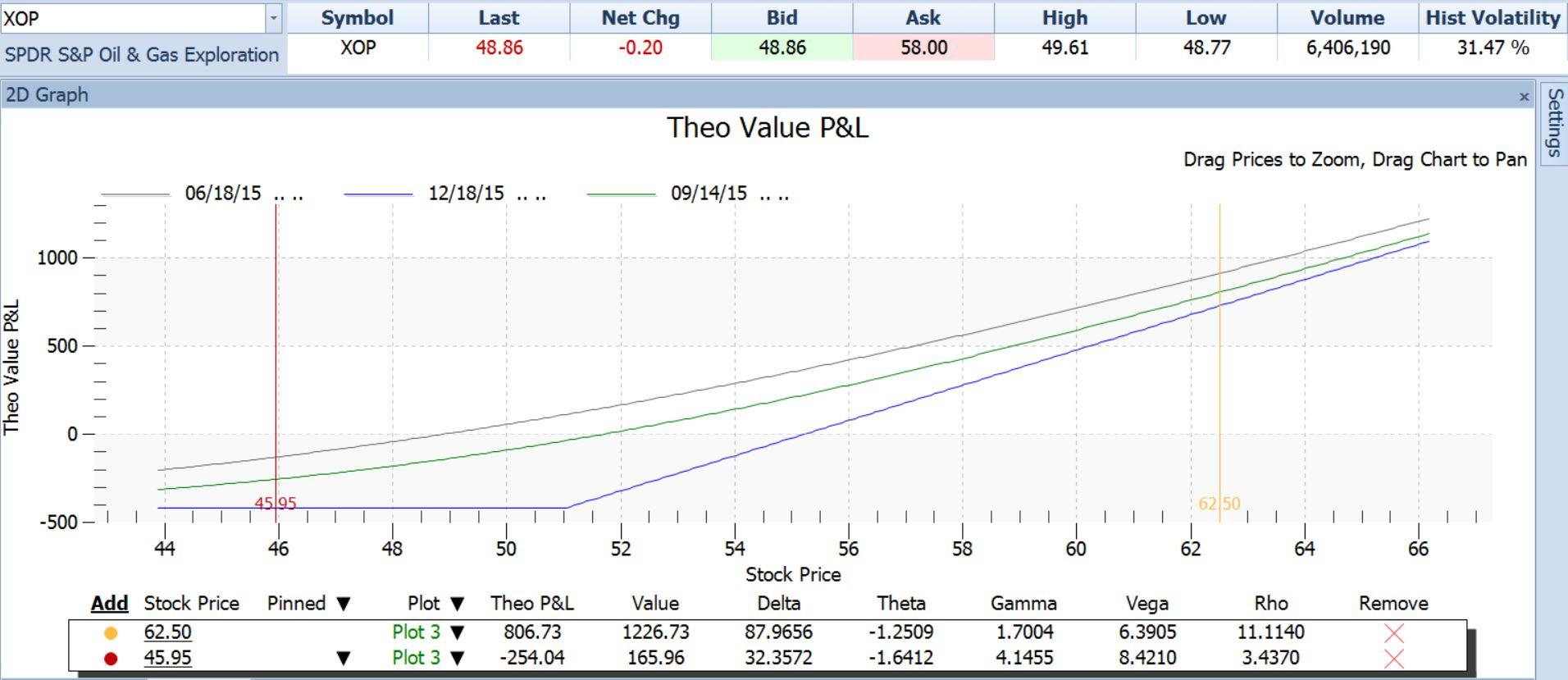

We looked at the payoff graph of a 50-strike call on XOP:

The chart and its associated table tell us that if XOP were to make it to a near-term target of $62.50 in the next three months, then this call option could make a profit of $806.73 per contract (the cost of the call option was $420). If XOP dropped below its recent low of $45.95, the value of our $50 call would be expected to drop to $165.96. We would sell the calls and take our loss, which would amount to $254.

Note that these estimates are possible even though we are talking about prices and dates quite different from where we are today. The reason we are able to compute those future prices is because of the Greeks.

- We know the effect of stock price movement on the call because of the combination of the Greeks Delta (ratio of call price change to stock price change for the next $1.00 increase) and Gamma (rate of change in the Delta as price continues to increase). Delta and Gamma together account for the upward slope of the P/L graph.

- We know the effect of the passage of time on the call – this value is given by Theta. By incorporating Theta into the drawing of the P/L curves, we are able to see how this position would look not only at any stock price, but also at any future time between now and expiration. In the graph above, the blue straight lines show what the P/L would be at any stock price as of the December expiration day. The gray line shows what the P/L would be at any stock price if it were reached today. Note that the gray line is higher at every point than the blue (expiration) P/L line. The difference is due to the erosion of the option’s value as it approaches its expiration. We have also plotted another P/L curve, the green line, at an intermediate time, three months away at September 14, 2015. The three lines together show us visually how time affects this position.

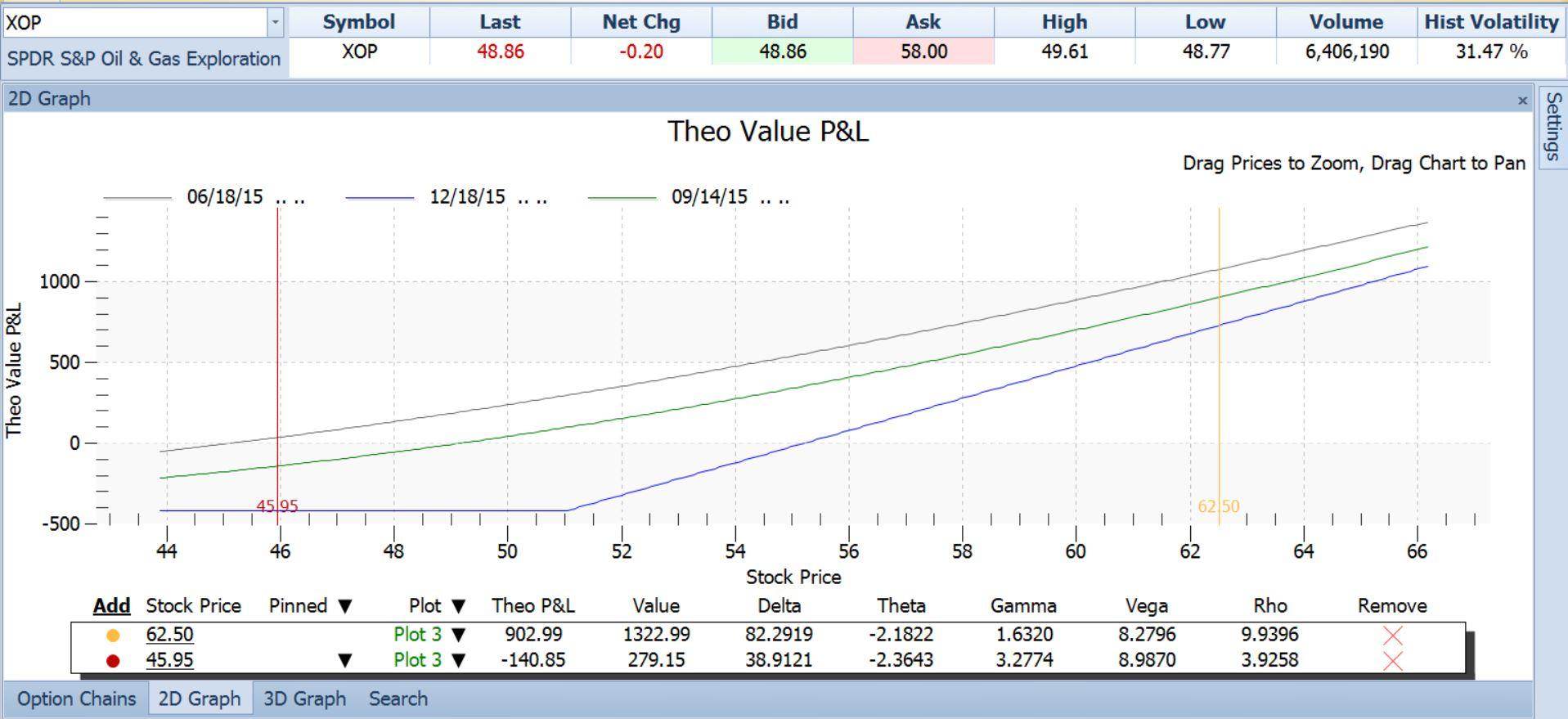

Having taken into account stock price movement (Delta, Gamma) and time passing (Theta), there is just one of the three main forces left unaccounted for in the payoff graph so far. That is changes in investors’ expectations. If they come to believe that XOP will move faster, they will pay more for its options. If they think it will slow down, then they will pay less.

We can incorporate this as well. The Greek named Vega shows the effect on an option’s price of changed market expectations. The price at which an option is actually trading can be translated into an expected rate of volatility. Right now, for example, XOP’s option prices are indicating an expected volatility rate of 28% per year. This expected volatility rate, called implied volatility, has varied over the last year between 20% and 61%, so the current 28% reading is on the low side. The Greek called Vega allows us to estimate what would happen to our $50 strike call if implied volatility were to go back to the middle of its range, say to 40% (halfway between 20% and 61%).

By dialing in this hypothetical increase in volatility, we can generate new P/L curves like so:

If such an increase in implied volatility were to occur, the new lines above show a healthy increase in our profit potential. Our profit at our $62.50 target rises to $903, while our loss at our $45.95 stop-out price goes down to just $140.

So, using the Greeks via a software tool that is user-friendly and intuitive (once you get the hang of it), we can make very detailed estimates of how this trade will behave under different conditions.

The payoff graph is a powerful tool in the right hands. It saves us enormous amounts of time and allows us to concentrate on the real keys to option Profits: finding stocks on whose direction we have confident opinions, and identifying stocks where expectations are out of line.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.