So far we’ve defined some key terms and described why options are an attractive vehicle for leveraged speculation, for hedging a stock position or for conservative income generation. Last week’s emphasis was on the use of options as a leveraged leveraged speculation. Its main lesson was that if we use options for this purpose we have to be correct on the direction of the movement of the stock. Standing still won’t do – the stock must move the way we believe it will and it must do it soon.

Let’s continue in that facet of options with another example.

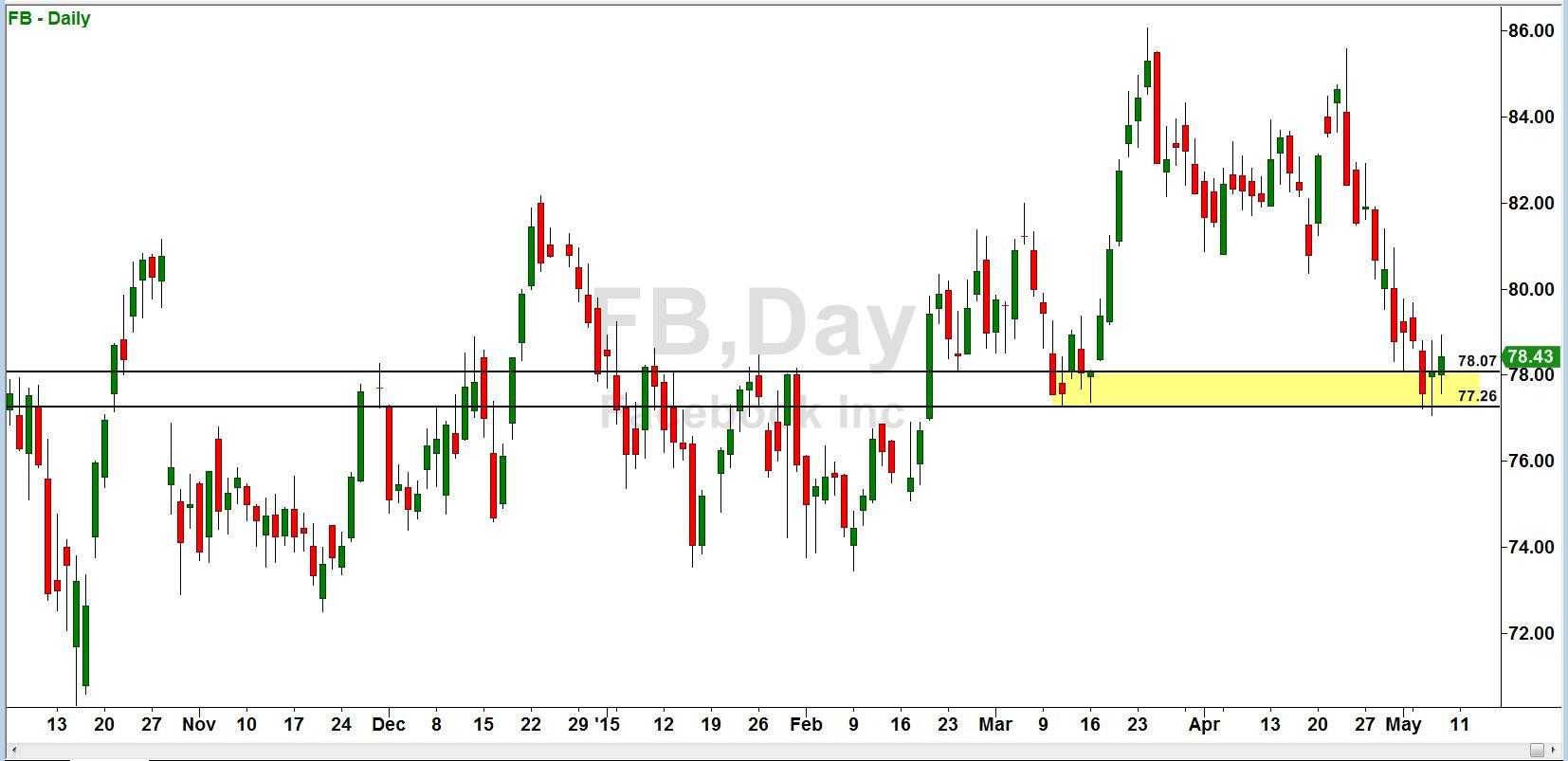

Facebook went public three years ago with an incredible amount of hype. After the IPO the shares dropped by about sixty per cent over the next five months. Ever since, though, the stock has been in a strong long-term uptrend. Recently there was a pullback following disappointing earnings. That appears to have bottomed out and the stock is now at a level that looks like it could provide strong support for a new leg up. Here is its chart as of May 7:

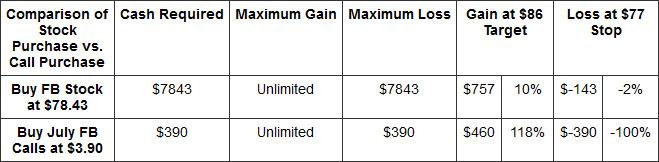

Let’s now compare the purchase of call options to the purchase of the stock itself.

A hundred shares of the stock would cost $7,843. If we bought the stock we’d look for a rally back up to the area of the recent highs, say to $86.00 per share. If that occurred we could make $8600 – $7843 = $757 on our $7843 investment. That is a profit of 9.7%. Looking at Facebook’s chart, in the past a move of this magnitude has taken between one and two months to complete. If we allow two months, that 9.7% profit equates to an annual return of almost 60%. Not bad!

If Facebook were to drop below the current demand zone, say to $77.00, we would exit the trade. In that case our loss would be $7843 – $7700, or $143.

Now let’s look at the possibility with options.

The July 77.50 call options could be bought for $3.90 per share, or $390 for a 100-share contract (almost all options are in 100-share contracts). If Facebook did reach $86.00 per share when these options expired in July, the call options would be worth about $8.50 per share, or $850 for the contract. This is because they allow the holder of the calls to buy the stock at what would then be an $8.50 per share discount (the $77.50 options strike price vs. the $86.00 market price). We could realize that profit in one of two ways.

One way would be to exercise the call options (i.e. surrender the options plus $7,750 in cash and receive 100 shares of Facebook in exchange). We could then sell the Facebook shares at the market price of $86.00 per share. Our gross profit on the exercise would be our $8600 sale price, less our $7750 cost, or $850 total. From this we would have to subtract our $390 cost for the option, leaving a net profit of $850 – $390 = $460.

The second, easier way to realize our profit would be simply to sell the call options themselves. Since they would provide the right to exercise and collect the $850 per 100 shares positive cash flow, they would be selling at $850 per contract at that time. We could simply sell the calls themselves for $850 and realize the same gross and net profit without ever owning the Facebook stock at all – and without ever going out of pocket by more than $390.

Either way, with FB at $86.00, our $460 profit on a $390 investment would equal a 118% gain in 71 days, which is over a 600% annualized return. There’s your leverage!

But if the stock was below the $77.50 call strike price on July 17 when the call options expired, then the options would be worth nothing. In that case we would have lost our $390 investment. So this is how these two alternatives compare:

The calls’ much larger potential percentage gain at our target is not free. In this example, should the stock not go our way, we could lose $390, which is more than the stock position would lose if we got out at our $77.00 stop-loss price. Note though that the $390 loss on the call is the absolute maximum, even if we should wake up one morning and find that Facebook had gone out of business. In that unhappy event the call would be worth nothing, and we would be out $390. But if we had owned the stock instead, our stop-loss on the stock would not have helped us, and we could theoretically lose the entire $7843 investment.

In summary, the call position has a much larger potential profit percentage; and it comes with a risk that is small in absolute dollar terms, is much smaller than the risk of owning the stock itself, but large as a percentage of the amount invested. Compared to the investment in the stock, the call purchase is much more aggressive.

We’ll check in on this trade next time, and continue with our exploration of option basics.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.