The listed options market in its current form exists because some people are willing to make a business of being option dealers. The job of each option dealer, or market maker, is to make a two-sided market in the options of certain stocks. Making a two-sided market means that at all times the firm is willing both to buy and to sell those options. Their computer systems continuously feed their quotes – the prices at which they are willing to buy and to sell – to the options exchanges where they operate. The market makers’ profit comes from the difference between the prices at which they buy and those at which they sell.

At one time, being an option market maker was something that could be done profitably on a pretty small scale by an individual trader using his own capital. In recent years, though this has changed so that now only bigger firms can afford the required technology. Large banks and brokerages like Goldman Sachs, JP Morgan, Barclays Bank and so on are the kinds of companies that make up the majority in this business today.

When we want to know what options are available for a particular stock or exchange-traded fund, we consult the option chain for that stock. The information for the chain is provided by a central agency called the Options Price Reporting Authority. OPRA’s computers receive the information from all market makers, other traders and option exchange, consolidate it and feed it back out again. Here is OPRA’s own explanation, from their website:

“All of the transactions executed on, and price quotations for options generated by, each options exchange are communicated to the public by OPRA… Each trade that is executed on an options exchange, as well as each price change quoted on an options exchange, is reported to OPRA as a ‘message.’ … The messages are sent to OPRA and distributed to market data vendors on a consolidated basis for use by options market participants, including retail investors, broker-dealers, and the exchanges themselves.”

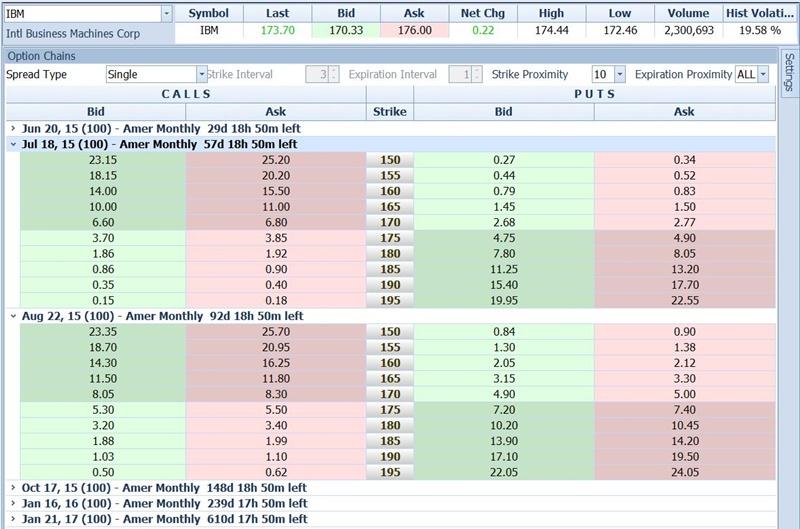

We can get access to OPRA’s data through our option broker or in delayed form online through various web sites. Here is an option chain from one broker (Tradestation) in its most minimal form:

This option chain lists some of the available put and call options for the stock of IBM.

Down the middle of the screen, the “Strike” column lists different option strike prices. At each strike price (each row in the table) information for the Call (option to buy IBM) is listed on the left and information for the Put (option to sell IBM) is listed on the right.

For each individual Call or Put option, the Bid column shows the level of the highest limit order to buy that exists at that time for that option (consolidated from worldwide data by OPRA). In the first set of options above, July 2015 for example, the number in the green column under “Bid” for the Call at the Strike of 170 is $6.60. This means that in the whole world at that moment, the highest price at which anyone had committed to buy that option was $6.60. This quote might be from one of the market makers for IBM options. It might also be from some other institutional trader or even a retail trader like us.

The “Ask” column shows the lowest price at which any trader anywhere has committed to sell the option. For our July 170 call, the Ask is $6.80. Again, this quote might be from anyone, including possibly (but not necessarily) the same market maker who is simultaneously bidding $6.60.

The market maker’s profit comes from buying at the Bid price and selling at the Ask price. Our July 170 call provides a $.20 profit margin ($6.60 vs $6.80).

Notice that we see a fully populated matrix here, with no holes. Every option has both a Bid and an Ask price. This is true whether there have been any actual trades on a particular option or not. The reason for a complete and fully populated chain at all times is that the market makers are always quoting every option whether anyone else is or not. They literally make the market.

If many other people aside from the market makers are also interested in buying and selling a company’s options, they of course will be placing their own orders. If they want to buy at a price that is a touch higher than the Bid price shown, they are free to place a limit order to buy accordingly. If we wanted to buy some of those July calls for example, there is nothing stopping us from placing a limit order to buy at $6.65, $.05 more than the current $6.60 bid. We then become the best bid, rather than the market maker. We are in line in front of the market maker, and he will get less business. If he wants to get more he will have to raise his bid. This will narrow his spread. The same thing is true in reverse for Ask prices. If the market makers are quoting a high price others are free to offer to sell at lower prices. Again the market makers will have to narrow their spreads to compete.

In stocks where many thousands of traders participate, the bid-ask spread can narrow to as little as a penny. This is the case, for example, on options of heavily traded index exchange-traded funds like QQQ (NASDAQ 100 index fund) or SPY (S&P 500 index fund).

As a general rule, the narrower the spreads on options are the better it is for the retail traders like us. That spread is the markup between wholesale and retail. Friends don’t let friends pay retail. In our Professional Options Trader class we teach our traders always to look for narrow spreads and to give options with wide bid-ask spreads a pass. I suggest that you also follow this example.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.