With U.S. equity markets at all-time highs, many people are thinking about how to protect profits on a stock, or a portfolio, against the inevitable day when the next bear market begins. I have discussed various ways to do this using options, in the articles that you can read here and here. Today’s article will wrap up this subject for now. Several of the methods we explored earlier involved continuing to hold the stocks. The one we’ll look at today involves selling the stocks, and replacing them with a combination of interest-bearing deposits and call options.

Let’s say we have a portfolio of stocks worth one million dollars, and we are concerned that the market could drop substantially from here. Despite our concern, we also know that the market could continue to rise, and so we are reluctant to sell out and then be left behind completely.

I’ve left this method for last, because the current environment is not the most favorable one for it. I’ll explain why below.

In its simplest form here’s what it would involve:

Sell the stocks.

Calculate the amount of money that could be earned in the next year on a risk-free interest-bearing account, on the cash generated from the stock sale.

Deposit the amount of cash in that interest-bearing account that will grow back to the full portfolio value in a year, at the risk-free rate now available.

Use the balance of the cash to buy call options.

In a year, the interest-bearing account alone will once again be equal to the full current value of the portfolio.

If stocks have gone down, the call options will be worthless, and the net profit/loss will be zero. There will be no net loss in the portfolio, no matter how low stock prices have dropped.

If stock prices have gone up in a year, the call options will show a profit, which is unlimited. The value of the call options at that time, if any, will be the net return on the portfolio.

Using our million-dollar portfolio example:

First, we sell the stocks, generating a million dollars in cash. (We’ll also generate a taxable capital gain, if this is in a taxable account. This will be a factor in determining whether we want to use this method).

Next, we determine how much interest income we could earn with zero principal risk in a year. In the U.S., the rates paid by the U.S. treasury are used as the risk-free rate. Suppose one-year treasury rates were at their historical average of around 4%. [That is currently not the case, of course. 1-year treasuries are now paying about 0.3%. That’s why this is not the best environment for this method]. In that case, with a 4% yield, our principal size needs to be $1,000,000 / 1.04, or $961,539, to grow into one million dollars in a year. This is another way of saying that at 4%, the present value of one million dollars a year from now is $961,539.

Third, we use the $961,539 present value amount to purchase the treasury securities.

Finally, we use the balance of the cash, $38,461 to buy one-year call options on one or more stocks or exchange-traded funds. Our principal is safe in any case in the treasuries. So if we choose to do so, and we accept the risks, we could afford to be more speculative in our choice of the underlying stocks. Considering just a selected few alternatives ranging from less speculative to more speculative, we might decide, for example to use the exchange-traded funds for the NASDAQ 100 (QQQ); the Russell 2000 small-cap index (IWM); the oil drillers fund (XOP); the biotech index fund (IBB); and/or individual stocks in any companies we thought had good prospects.

At the end of a year, our $965K worth of treasury securities will be worth $1 million in any case.

In the worst case, all of our stocks will have gone down, and all our call options will be worthless; we will once again be left with a million dollars in our portfolio. Yet, if any of our stocks or ETFs have gone up in price, then our call options will be in the money and will have value. Whatever that value is will be the net return on our portfolio.

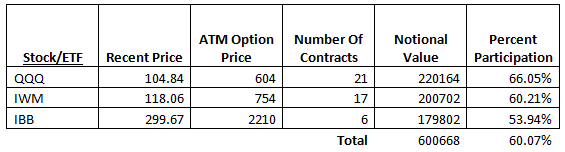

Let’s look at a hypothetical example where we divide up our option portfolio into three equal portions of the options of QQQ (NASDAQ), IWM (Small Caps) and IBB (Biotechs). We would use 1/3 of our $38,461 option budget, or about $12,800 to buy as many at-the-money (ATM) option contracts on each stock as it would buy. Using options that are as close as we could get to a year away, here are some figures. The column headings in the table are explained below.

In the above table, the Recent Price is the closing price of each ETF as of November 25, 2014.

ATM Option Price is the price per contract of the options with a strike price closest to the Recent Price.

Number of Contracts is the number of option contracts that could be purchased with 1/3 of our option budget, which was $38,461 altogether. This is different than the number of shares we could buy if we used 1/3 of our total $1,000,000 portfolio value to actually buy the stock. How many contracts we can buy depends on how much money we have available to use (higher with a higher risk-free rate of interest income) and on the price of the specific options. These will vary greatly.

Notional Value is the Number of Contracts, times 100 shares per contract, times the Recent Price. This is the amount of stock value that we are “controlling” with the options that we can afford to buy.

Percent Participation is roughly the percentage of the increase in the stock’s price that our options will provide to us. This is the Notional Value divided by the $333,333 that we would be able to spend on each stock, if we were using all of our money to buy the stocks.

When it’s all said and done, this particular combination would allow us to participate in about 60% of the profits (if any) on these stocks; and zero percent of the losses. A year from now, this would seem a genius move if all of our stocks have gone down, since we will have no net loss. If any of them have gone up, we will have made money. But we will have traded off 40% of our potential profit, in exchange for being completely sheltered against any losses. Whether this is a good deal depends on how much we value the shelter from a bear market.

In summary, here are the pros and cons of this trade:

PRO:

Bomb-proofs our portfolio, so there can be no net loss of principal.

Allows us to participate on the upside if markets continue to go up.

In times of high interest rates, our potential upside is large (although not quite in proportion, since higher interest rates also increase the cost of call options).

CON:

Generates immediate taxable capital gains from the stock sales, if done in a taxable account.

Our upside participation is usually less than 100%, because of the limited number of option contracts that can be bought with the available interest earnings.

In times of low interest rates, the strategy is not really workable, because the amount of available funds with which to buy options is very small.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.