In the last two weeks’ articles, links here, I discussed some strategies that can be used to protect a stock portfolio from market crashes. Today we’ll continue that discussion.

In the first of the two articles, I listed four possible protective strategies:

Hold long-term positions, and buy put options as insurance.

Add covered calls to the long stock and puts, creating collars.

Substitute bullish vertical spreads for the collars, reserving the excess cash.

Convert most of a portfolio to cash. Use a small percentage to buy long-term call options to maintain exposure.

Last week we discussed alternatives 1. and 4., and demonstrated why they are actually two forms of the same trade. Today let’s tackle alternative 2., the collar.

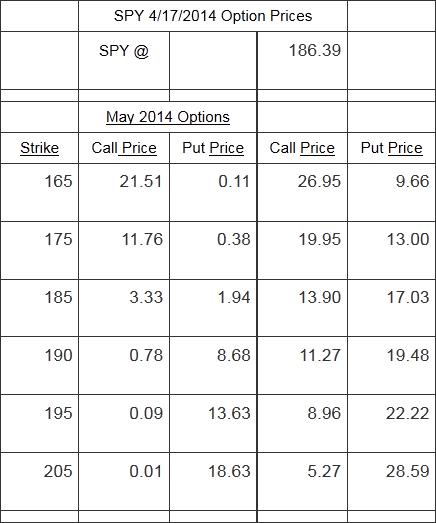

In the earlier articles, I listed some relevant option prices. Today I’ll update the example. The day of this writing happens to be an option expiration day, so it’s a nice cutoff point. The May options are now the next upcoming monthly options expiration, which is called the “front month.” Here are some selected current option prices:

It is estimated that SPY will pay $5.25 in dividends between now and the December 2015 expiration.

With the current risk-free interest rate of .25%, carrying a position worth $186.39 for 20 months would cost about $.78 in interest.

Let’s look at the collar strategy as an extension of the protective put strategy.

With the SPY currently at $186.39, we could buy December 2015 put options at the 185 strike price for 17.03. These put options give us the right to sell SPY shares at $185 at any time through December 19, 2015, 20 months away. Our maximum loss on this position would be the drop from $186.39 to the $185 strike price, or $1.39; plus the $17.03 cost of the puts, for a total of $18.42 per share. Against this we would collect $5.25 in dividends, and have to pay or forego about $.78 in interest to carry the position. Our maximum net loss is thus (Stock price – put strike + put cost – dividends received + interest paid) = ($186.39 – $185 + $17.03 – $5.25 + $.78) = $13.95. This is about 7.5% of the current value of SPY.

So far our upside would still be unlimited, after overcoming the extra overhead of the cost of the puts. The puts would increase our break-even price to (stock price + put cost – dividends received + interest paid) = ($186.39 + $17.03 – $5.25 + $.78) = $198.95. We would have a profit at any SPY price above that at the December 2015 expiration, and our profit would be unlimited.

This is called a married put position. It can be used on its own, or as a subassembly of other positions, including the collar position, described below.

We could now take steps to recover some of the money spent for the protective puts, in the process creating the collar.

The December 2015 205-strike calls are now selling for $5.27. If we sold those calls, together with our married put position, the resulting position would be a collar. This would cut our maximum loss down by the call proceeds of $5.27, from $13.95 to $8.68. It would also reduce our break-even price by the same amount, from $198.95 down to $193.68

We could still profit on the SPY stock until it exceeded the 205 call strike. We would not participate after that, since we would be obligated to sell the SPY at that $205 strike price if SPY exceeded it at the December 2015 expiration. Our maximum profit would be the $205 strike/sales price, less our break-even price of $193.68, or $11.32

The new collar position, then, would look like this:

Maximum profit (at $205 or more on SPY): $11.32

Maximum loss (at $185 or less on SPY): $8.68

Break-even: $193.68

This does not seem all that attractive. Although our loss is now limited, so is our profit. We could allow for higher profit by selling calls at higher strikes. But the cost reduction from those higher strike calls goes down pretty fast.

There is another way we could make this collar potentially work better. This is by diagonalizing it. This means that we would keep the stock and the December puts. But instead of selling one call 20 months out, we sell 20 one-month calls, one after the other.

This has a couple of benefits:

With the calls closer in time, we can select an appropriate strike price each month based on the then-current price of SPY. We can give ourselves just enough room overhead to keep the call strike above the probable range. These strike prices will be nearer the current price than the 205 strike is now.

Options with only one month to go decline in value much faster than options with a long time to go. We will be collecting time value at accelerated rates. Meanwhile the time decay of our long-term puts will be very slow.

Together, these two points combine to produce a high probability that we will eventually collect much more for the 20 combined one-month calls than we would have collected for the one 20-month call.

Let’s see how this might work.

The May 190 calls are currently at $.78. The 190 strike price is above the weekly Bollinger Band on the SPY, so it is outside the probable range. 190 is also above the recent high, so there is built-in resistance there. If we sold those May 190 calls instead of the December 205 calls, our cost would not be reduced very much in the short term. But if we sold calls at a similar distance away every month for 20 months, our cost would eventually be reduced by 20 * $.78 = $15.60, almost completely paying for the $17.03 cost of the long-term put protection. We would end up with the SPY free and clear, at whatever price it might be at the December 2015 expiration, and with the 20 months of dividends in our pocket.

There are a couple of caveats about this position:

If the price of SPY shoots up above any of our monthly strike prices, our profit for that month drops off and can go negative, as the put value falls. We would then be forced to roll the calls to maintain the position, possibly at a loss.

If implied volatility is very low in the future, the amounts received for the calls would be lower (on the other hand, if IV goes up, those amounts could be higher).

On the whole the diagonalized collar is a method worth considering for protecting the value of a stock portfolio at a low cost.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.