With the US Presidential election coming up, a unique trade has developed called a synthetic cross pair with the Mexican Peso and the Russian Ruble. A synthetic cross pair is a trade between 2 currencies of which neither one of the currencies is referencing the US dollar. They do not directly trade against each other. This strategy is based off of one currency weakening against the US Dollar while at the same time another currency strengthens. The synthetic cross pair that has been gaining in popularity over the last few weeks has been dubbed the “Trump Trade”.

This synthetic cross pair is created when you buy a USDMXN and sell a USDRUB. In this trade, the Mexican Peso would weaken against the US Dollar while the Russian Ruble would strengthen against the US Dollar. This strategy can be utilized off of a macro/geo political event or a potential change in monetary policy. In this case, it is a geo political event. The two currencies involved should have an inverse relationship to each other against the US dollar, boosting the return of the trade. This type of trade should not be looked at as any sort of hedge.

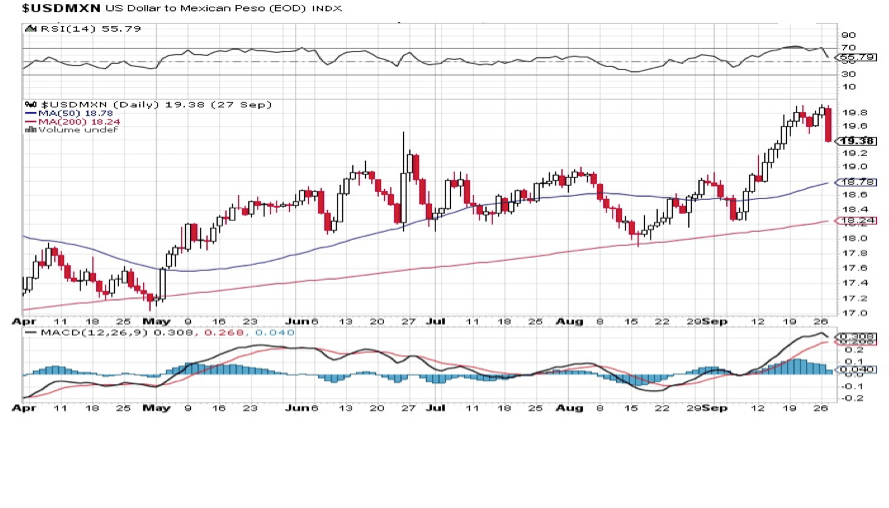

Their has been a direct correlation to a weakening of the Mexican Peso against the US Dollar as Presidential polling numbers show the Republican candidate, Donald Trump closing the lead against Democratic candidate, Hillary Clinton. With Trump’s rhetoric about building a wall on the Mexican border and altering NAFTA, Mexico’s economy would suffer sending the price of the Peso lower against the US dollar. In the last few weeks, as Trump’s polling numbers continue to climb, we saw the Mexican Peso hit an all-time low against the US Dollar the other week. However, with polls suggesting that Trump lost the first debate this past Monday, the Peso strengthened but is still down 6% for the month.

We can say the opposite for the Russian Ruble as that currency has strengthened as Trump makes Pro Russian statements, talks about a potential shift in NATO and would likely build a strong relationship with the Russian President Vladimir Putin. If Trump were President, sanctions against Russia by the US would be lifted strengthening Russia’s economy. This new US-Russian relationship would strengthen the Ruble against the US Dollar. Similar to Mexico, as recent polls showed Trump narrowing Clinton’s lead, the Ruble gained in strength. And as reiterated earlier, with polls suggesting that Trump lost the debate, the Ruble weakened as a vote for Clinton is a vote for the staus quo. Clinton and Putin are also not the biggest fans of eachother.

With the information given above, to now create this synthetic cross pair would include 2 trades. One downside to the potential boost in return is that you will have to pay more in bid offers since you are paying for both trades.

This blog represents the view/opinions of the author and not those of his employer.

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.