- Litecoin price had a significant breakout from a descending triangle pattern.

- The digital asset re-tested the previous resistance level and has resumed its uptrend towards $200.

- LTC faces practically no barriers on the way up as bulls hold all the momentum.

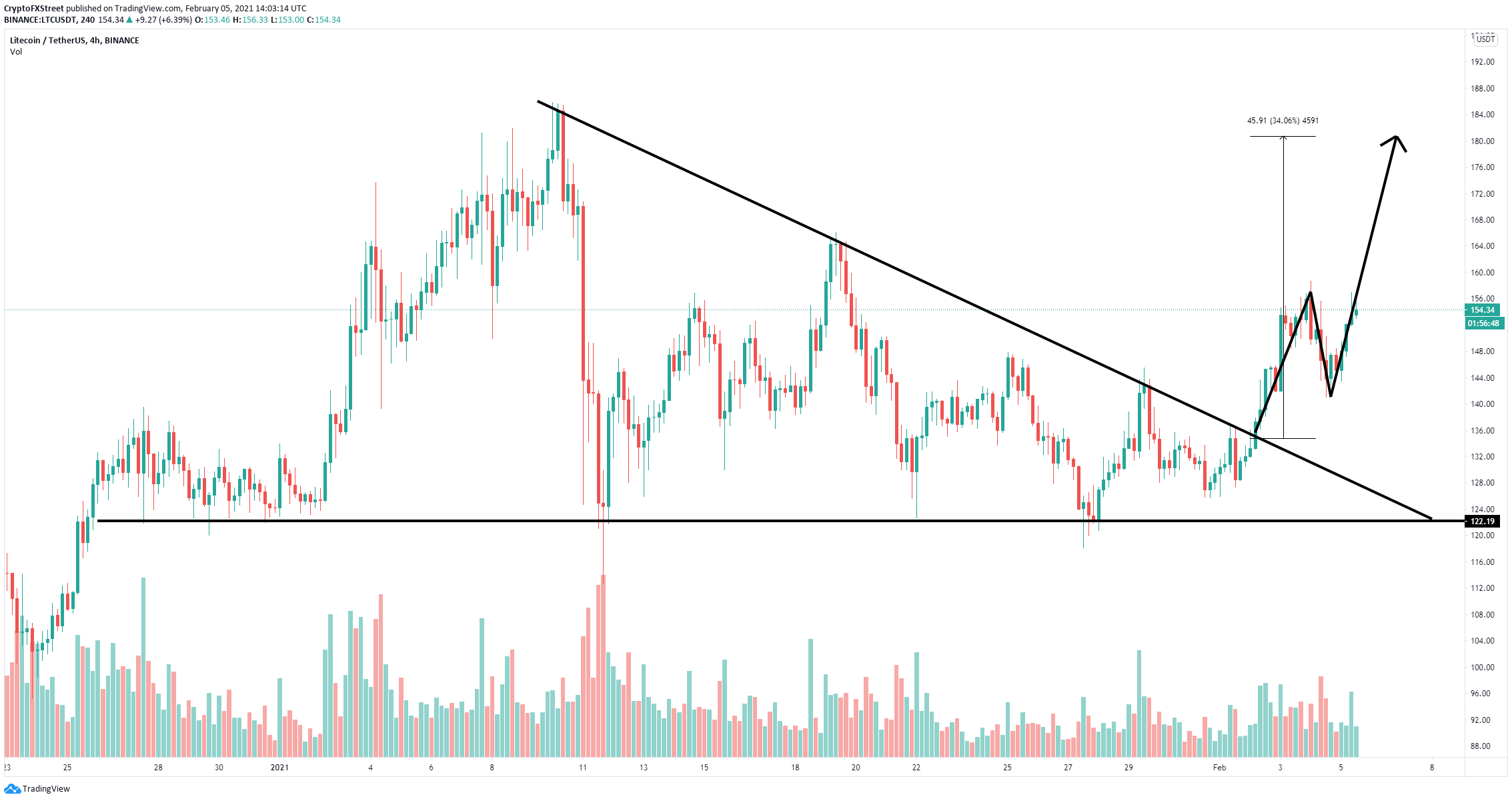

Litecoin had a major breakout from a descending triangle pattern on the 4-hour chart with a price target of $185. After a small drop towards the previous resistance trendline, LTC bulls quickly bought the dip and have pushed Litecoin price up to $154.

Litecoin price faces no significant barriers on the way up

The initial breakout took Litecoin price up to $158.68 and the digital asset is currently trading at $154. Climbing above $158.68 is bound to push LTC towards its initial price target of $185 and the psychological level of $200.

LTC/USD 4-hour chart

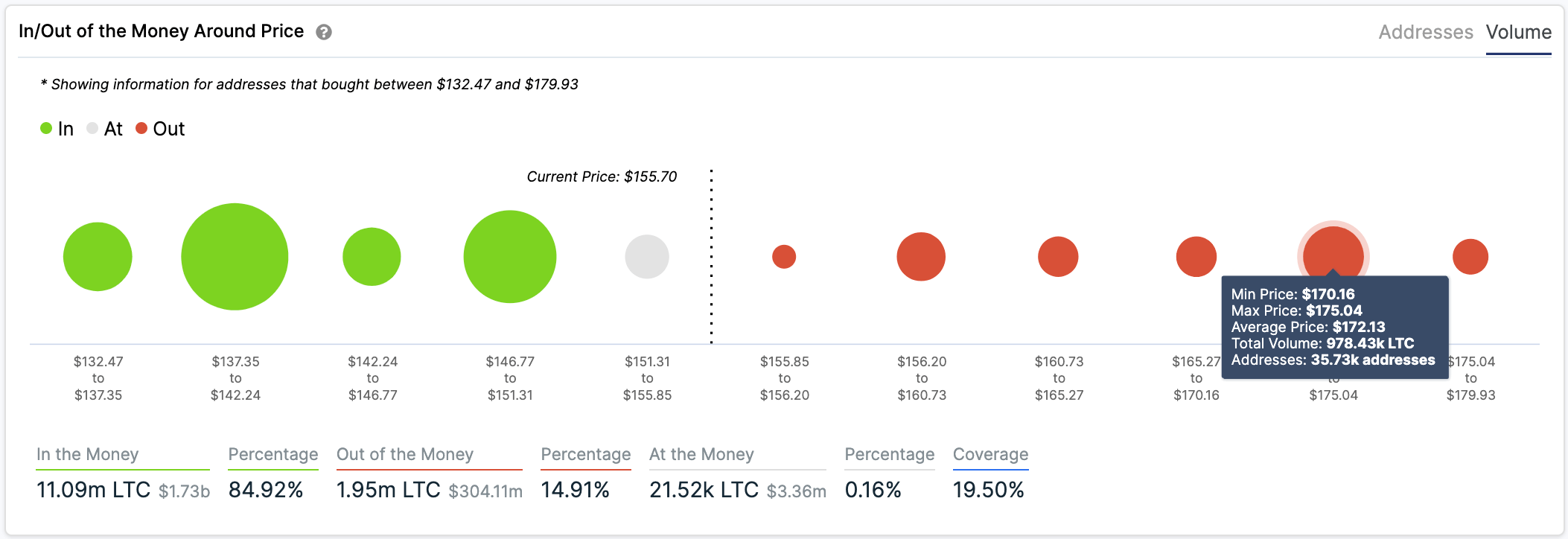

The In/Out of the Money Around Price (IOMAP) chart shows practically no resistance above $155. The most significant resistance area is located between $170 and $175 with close to 1 million LTC in volume from 35,000 addresses.

LTC IOMAP chart

Additionally, the number of whales holding at least 10,000 LTC coins has increased significantly over the past month from a low of 512 on December 27, 2020 to 527 currently. This metric shows that large holders have been accumulating Litecoin for the past month and continue doing so.

LTC Holders Distribution chart

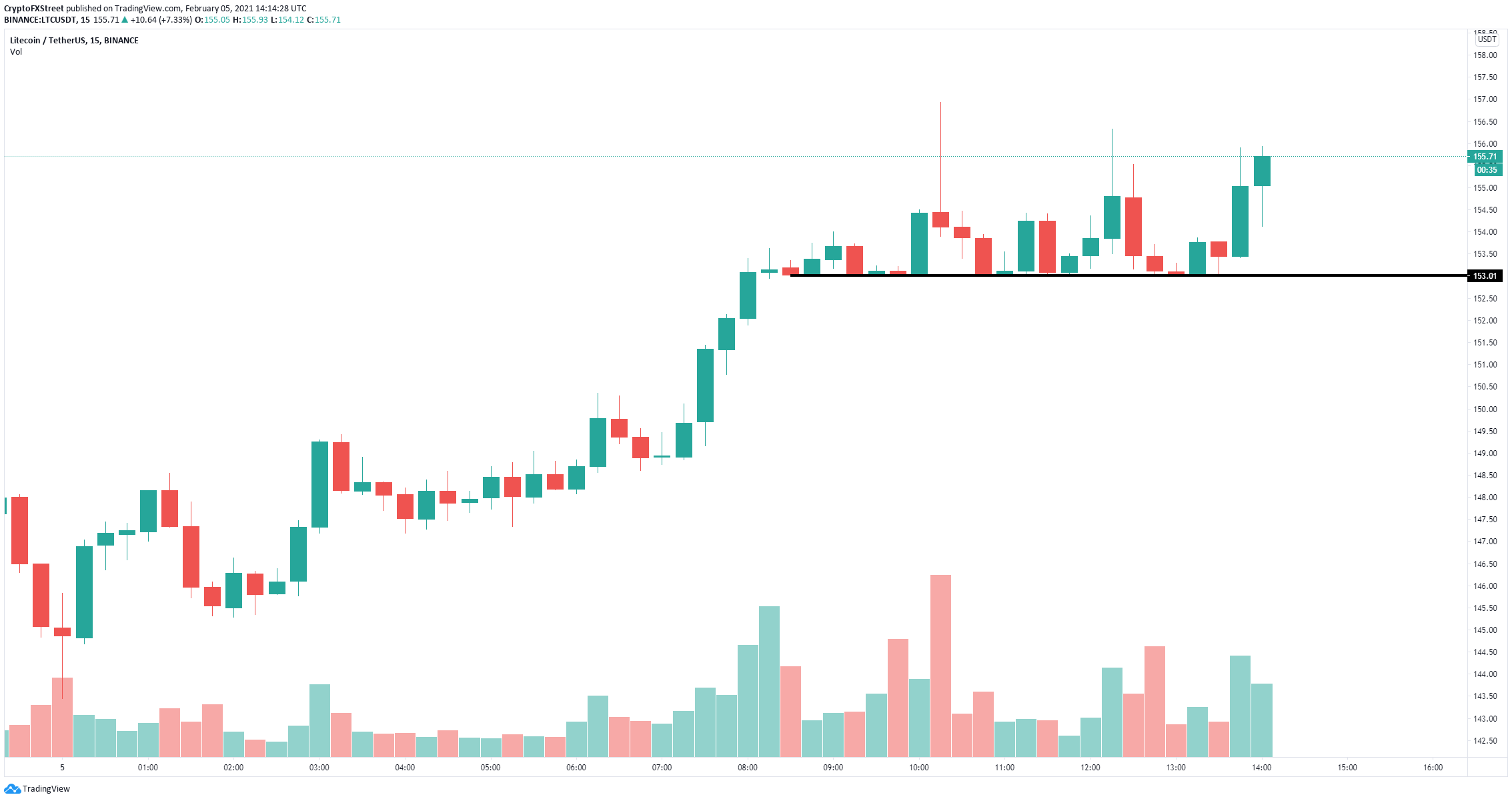

However, on the 15-minute chart, Litecoin has established a crucial support level at $153 in the short-term and it’s having a lot of trouble climbing above $156.

LTC/USD 15-minute chart

Another rejection from $156 would quickly push Litecoin price down to $153. Losing this critical support level will drive LTC down to $149 in the short-term.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

%20[15.07.11,%2005%20Feb,%202021]-637481314141059396.png)