- ETH/USD dropped by 8.5% within one hour.

- Bears took the price from $165.35 to $151.15 before it recovered to $153.

ETH/USD lost a staggering 8.5% of its price within a single hour this Thursday. In the process, bears managed to break below the $160-mark as the price plummeted from $165.35 to $151.15. The confluence detector shows weak support levels on the downside as the price is expected to drop even lower if the bears keep maintaining their momentum. For now, the bulls have managed to take the price up to $153.

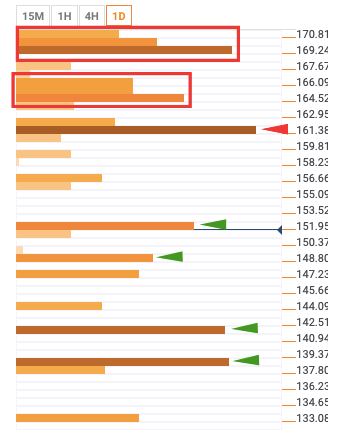

ETH/USD Confluence Detector

The resistance levels are at $162, $164.50-$166.50, $169-$171. At $162 we have a confluence of 15-min previous high, daily previous low, monthly pivot point resistance 2, daily pivot point support 1, and SMA 5.

From $164.50-$166.50 the confluences are Weekly 61.8% Fibonacci retracement level, hourly Bollinger band middle curve, 15-min Bollinger band middle curve, SMA 50, SMA 5, SMA 100, SMA 10, 4-hour previous low, daily 38.2% Fibonacci retracement level hourly previous high, and SMA 200.

Finally, at $169-$171, we have 4-hour Bollinger band middle curve, weekly 38.2% Fibonacci retracement level, SMA 100, SMA 10, daily Bollinger band middle curve, SMA 5, 15-min Bollinger band upper curve, SMA 200, and SMA 50.

On the downside, there are support levels at $138, $141, $149, and $152. At $138, we have the monthly 38.2% Fibonacci retracement level while at $141, the confluences are the weekly pivot point support 3 and monthly 23.6% Fibonacci retracement level. We then observe the confluence of 15-min previous low, weekly pivot support 2, and SMA 200 ar $149. Finally, at $152 we have SMA 50 and monthly pivot point resistance 1.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

PancakeSwap loses nearly 3% value intraday as the DEX crosses $1 billion in trade volume

Decentralized exchange (DEX) PancakeSwap (CAKE) announced in an official tweet that it has crossed $1 billion in trade volume on the Layer 2 chain, Base. CAKE on-chain metrics support the thesis of a recovery in the DEX token’s price.

Shiba Inu hits new milestone, over $9 billion worth of SHIB tokens burnt

Shiba Inu (SHIB), the second-largest meme coin in the crypto ecosystem, recently hit a milestone in the volume of tokens burned. Shiba Inu has burnt over 410.72 trillion SHIB tokens since the inception of the burn mechanism in the project, worth over $9 billion.

Dogwifhat crashes 60%, but here's why you should not buy WIF yet Premium

Dogwifhat (WIF) price shows a slowdown in the bearish momentum as it sets up a potential range. This development could lead to a good buying opportunity from a long-term perspective.

XRP struggles to overcome $0.50 resistance, SEC vs. Ripple could enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.