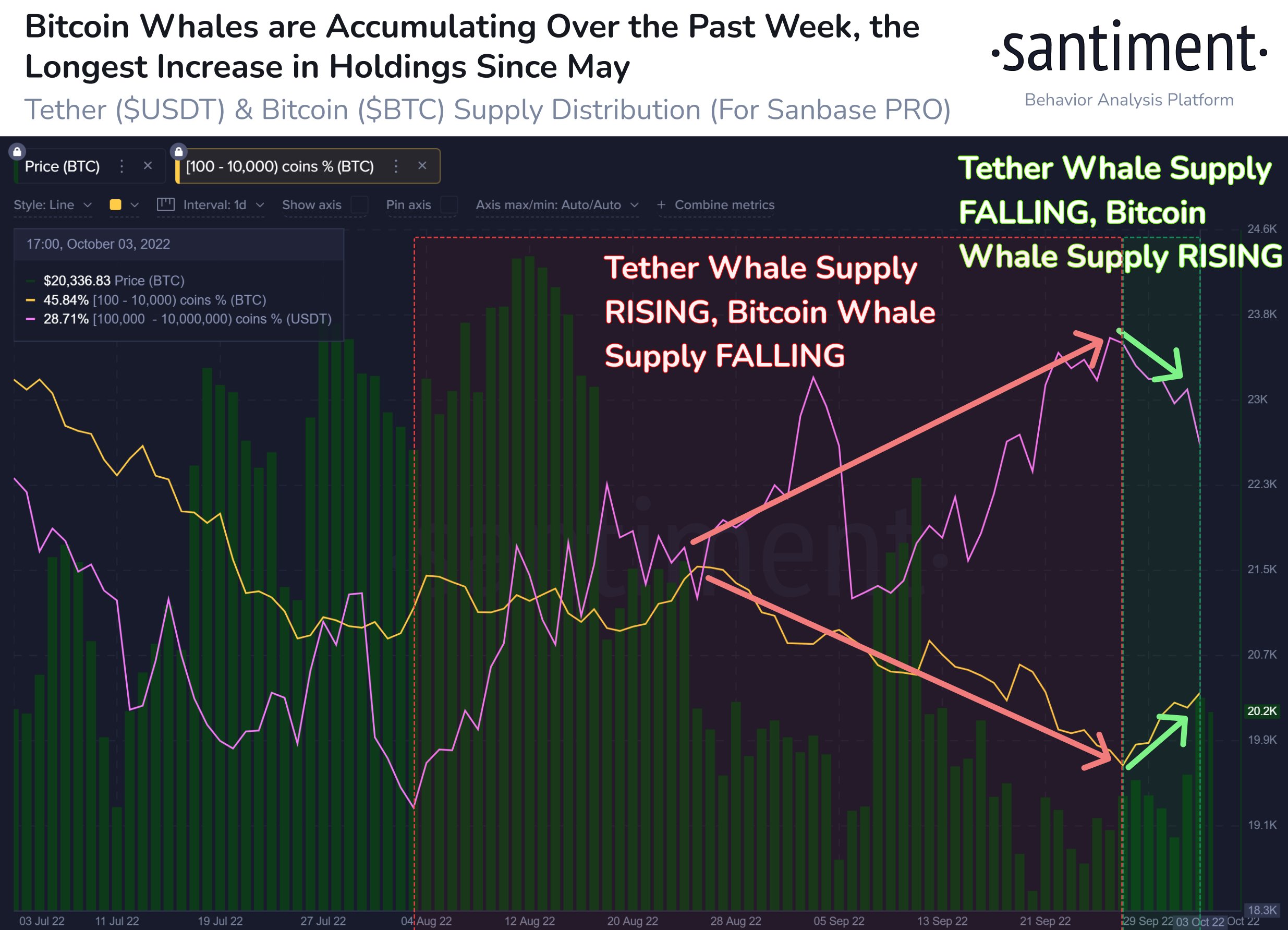

- Tether whales have been reducing their holdings, while Bitcoin whales have been increasing theirs for weeks.

- Bitcoin is possibly going to sustain the active bullishness to flip $20,000 into support by the end of this week.

- Consequently, the king coin’s market value could also note a boost and rise above the 44-months lows.

The crypto market has been in a suspended state for the last couple of months, and that effect does not seem to have gone away.

Micro fluctuations do take place every now and then. However, on the macro time frame, crypto assets need a major boost. Interestingly in the case of Bitcoin, a change in a particular pattern could be the signal of a trend reversal.

Bitcoin whales are back

Since the end of August, Tether whales had been consistently accumulating as Bitcoin whales’ supply kept declining. This could be due to the persistent market conditions, but these whales’ behavior has been notably changing over the last couple of days.

While Tether whales’ supply has begun falling, Bitcoin whales have returned to accumulating. A rare sight this year, this cohort has been amassing BTC significantly. Since September 27, the BTC addresses holding 100 to 10,000 BTC have added about 46,173 BTC worth over $934 million to their wallets.

BTC price has been in consistent recovery in the same duration, with the biggest 24-hour rise in almost a month observed yesterday as it increased by 6.73%. Currently trading at $20,034, Bitcoin might be on track to register recovery as the Parabolic SAR indicated an uptrend for the first time in a month.

Bitcoin 24-hour price chart

Bitcoin 24-hour price chart

The presence of the black dots below the candlesticks is evidence of the same. Additionally, over the last few weeks, the Relative Strength Index (RSI) has also been flashing bullish signs as the buying pressure increased.

If the bullishness is sustained, BTC might be on track to flipping $20,000 into support.

Bitcoin’s market value to go up?

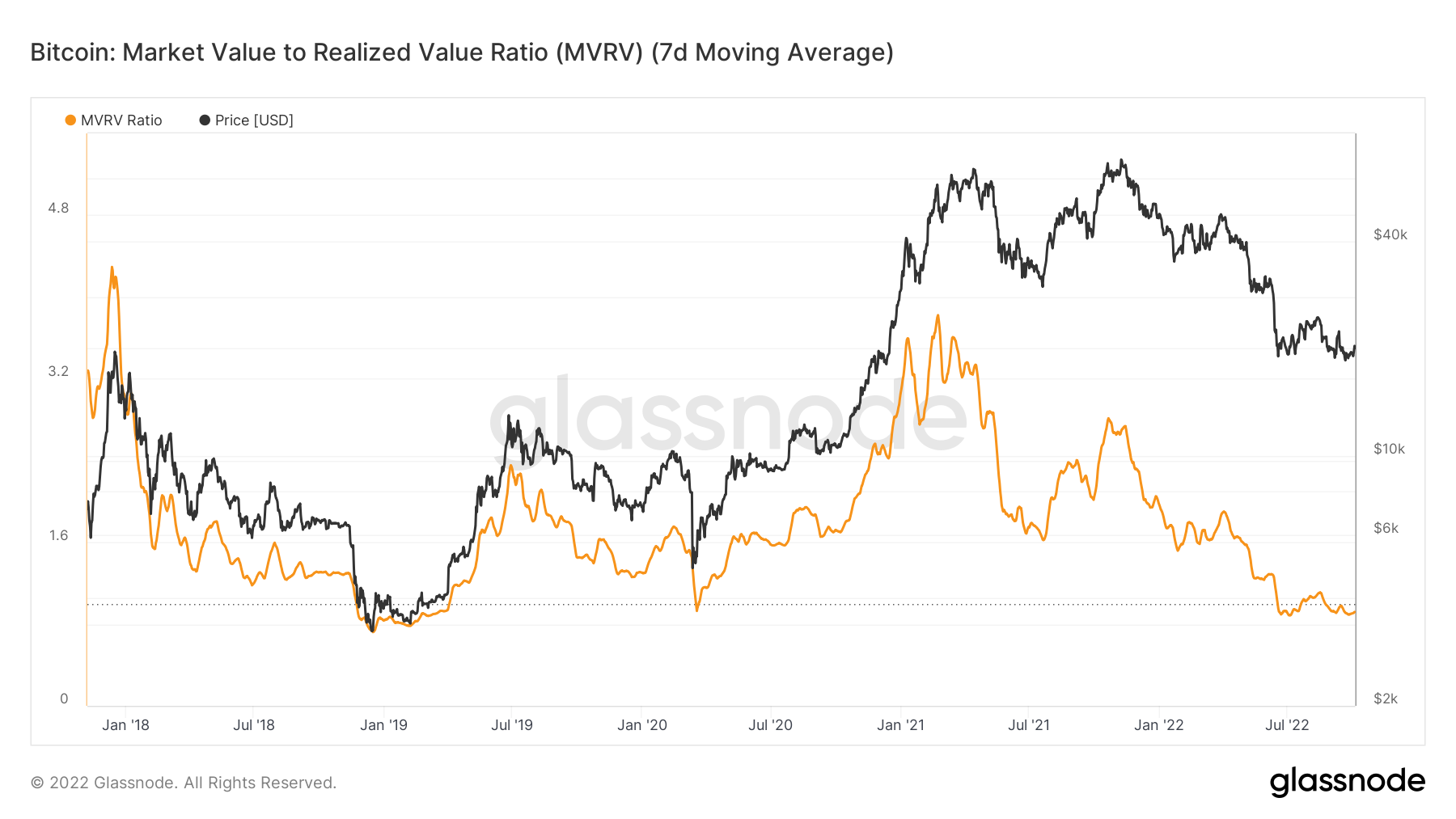

Following the bearishness, BTC’s market value has been under the bar for almost two months, even falling to the same level the market value to realized value (MVRV) ratio was at, back in March 2019.

If the king coin’s price rises, its demand will potentially observe an increase as well. Consequently, the market value of the asset will recover, bringing it above the neutral level of 1.0.

This would act as a crucial bullish signal going forward.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Uniswap nears $3 billion in daily trading volume despite Wells notice and fee hike

Uniswap's (UNI) price witnessed a double-fold crash in the past week after it received a Wells notice from the SEC and later due to the general crypto market crash over the weekend. In the past week, UNI has decreased more than 38%.

Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply.

Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Ethereum's (ETH) price slightly improved on Monday after Hong Kong approved applications for a spot Bitcoin and Ethereum ETF. Whales have also been accumulating ETH after the market dip over the weekend.

Bitcoin price delays pre-halving rally as US and China battle for BTC supremacy ahead of halving

Bitcoin has failed to showcase an enticing pre-halving rally. As the event remains less than a week out, traders and investors remain at the edge of their seats, with thoughts on whether the impact of the fourth cycle will be different than what has been seen before.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.