Outlook:

First thing this morning we get the second estimate of US GDP. Nobody is paying the slightest attention, with all eyes on Yellen. Note that the Atlanta Fed reported GDP Now at 3.4% yesterday, from 3.6% in Aug 16. The dip was due to the NAR's forecast of a drop in residential investment growth, aka existing home sales. Also, there might be some sideways glances at next Fri-day's nonfarm payrolls, although it's still a bit early for that.

But forget hard data. The central risk event is today's speech by Fed chief Yellen at the Jackson Hole symposium. Her topic is the "monetary policy tool kit," although what people really want is information about the next rate hike. Some analysts speak of a "dovish hike" stance, meaning she will hint that the hike will, indeed, come this year, but the statement will be so ring-fenced with qualifications as to dilute the effect down to a nub. Besides, last year we had a Fed forecast of four hikes this year and now we are down to one, and maybe not even that. Whatever Yellen says, it can't help but be a disappointment.

Traditionally, Fed chiefs prefer not to make a splash. In 2007, FOMC member Mishkin spoke about the housing bubble (and we all missed it). Mishkin later resigned 5 years early for reasons we never got. In 2010, Bernanke introduced "unconventional measures" and in 2012, more measures (and Q3 came a month later). On the whole, the Jackson Hole event is a chance for Fed officials to strut their economist credentials. Trying to read the papers afterwards is usually a tiresome math exercise. If Yellen really does stick to the topic—policy tools—we might get a suggestion of some new initiative, but it may take a day or two to be able to detect it. As we wrote yesterday, we should probably be worried about any acceptance of negative rates.

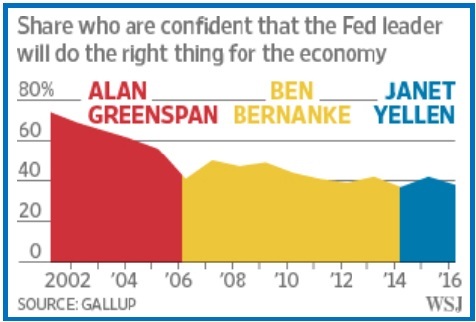

One job for Yellen at Jackson Hole is to try to restore confidence in the Fed as an institution. In an arti-cle headlined "The Great Unravelling: Years of Fed Missteps Fueled Disillusion With the Economy and Washington," the WSJ Fed-watcher Hilsenrath writes that "Once-revered central bank failed to foresee the [sub-prime] crisis and has struggled in its aftermath, fostering the rise of populism and distrust of institutions." In a Gallup poll of 1020 general public respondents (covering the FBI, ERA, IRS, NASA, et al.), people say trust in the Fed has fallen. See the chart. "Confidence in the central bank's leadership has dropped. An April Gallup poll found 38% of Americans had a great deal or fair amount of confi-dence in Ms. Yellen, while 35% had little or none. In the early 2000s, confidence in Chairman Alan Greenspan often exceeded 70%."

Fed officials (including Yellen) have admitted that their models were wrong. The Fed failed to see that ultra-low rates feed bubbles. They failed to note the drop in labor productivity, which limits growth, and they failed to acknowledge inflation is not responding to the job market the way the Fed expected. Also, the Fed assumed greater stability in the financial system than actually exists. Promises of rate hikes that never come also damage the Fed's credibility.

We may quibble about asking 1020 people from the general public about confidence in government institutions, especially ones like the Fed where probably only about 5% have any clue what it does, but the analysis is quite thorough and was clearly a long time in the making. Hilsenrath is obnoxious but an excellent analyst. One question is why it took the WSJ so long (from the April date of the Gallup poll) to write about it. Releasing it on the same day as the Yellen speech is interesting timing. It will be fun to see how late in the next press conference Yellen selects Hilsenrath.

And now let's consider sterling, which is up and then down but more or less ranging around the 20-day moving average for the last month (now around 1.3100). As noted above, GDP this morning was a bet-ter-than-expected 2.2% y/y, but it's Q3 and Q4 data that will tell the tale. So far consumer spending is holding up well, and a survey by YouGov/CEBR on consumer morale today shows confidence is not dented. But, as former BoE member Goodhart told Reuters, we need more data on investment, invento-ry levels and construction. We still just don't know whether Brexit fears were overdone—or maybe underestimated.

Now that we know Article 50 won't be invoked this year, uncertainty can hang on for many more months and perhaps quarters. Here's a crackpot idea—sterling will retrace 50% of the Brexit drop. Traders are attracted to 50% retracements like moths to the flame. If so, we should be looking for 1.3900. Economists tell us to wait for the long game. Well, that's the long game in sterling. Don't take it too seriously, please.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 100.44 | SHORT USD | WEAK | 08/01/2016 | 102.18 | 1.70% |

| GBP/USD | 1.3199 | SHORT GBP | WEAK | 07/20/2016 | 1.3187 | -0.09% |

| EUR/USD | 1.1292 | LONG EUR | WEAK | 08/22/2016 | 1.1296 | -0.04% |

| EUR/JPY | 113.41 | SHORT EURO | WEAK | 05/02/2016 | 122.33 | 7.29% |

| EUR/GBP | 0.8555 | LONG EURO | STRONG | 06/24/2016 | 0.8006 | 6.86% |

| USD/CHF | 0.9661 | LONG USD | WEAK | 08/08/2016 | 0.9817 | -1.59% |

| USD/CAD | 1.2895 | LONG USD | WEAK | 06/27/2016 | 1.3010 | -0.88% |

| NZD/USD | 0.7318 | LONG NZD | WEAK | 08/02/2016 | 0.7204 | 1.58% |

| AUD/USD | 0.7635 | LONG AUD | WEAK | 08/02/2016 | 0.7576 | 0.78% |

| AUD/JPY | 76.68 | SHORT AUD | STRONG | 08/02/2016 | 77.02 | 0.44% |

| USD/MXN | 18.3947 | LONG USD | WEAK | 05/06/2016 | 17.9418 | 2.52% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.