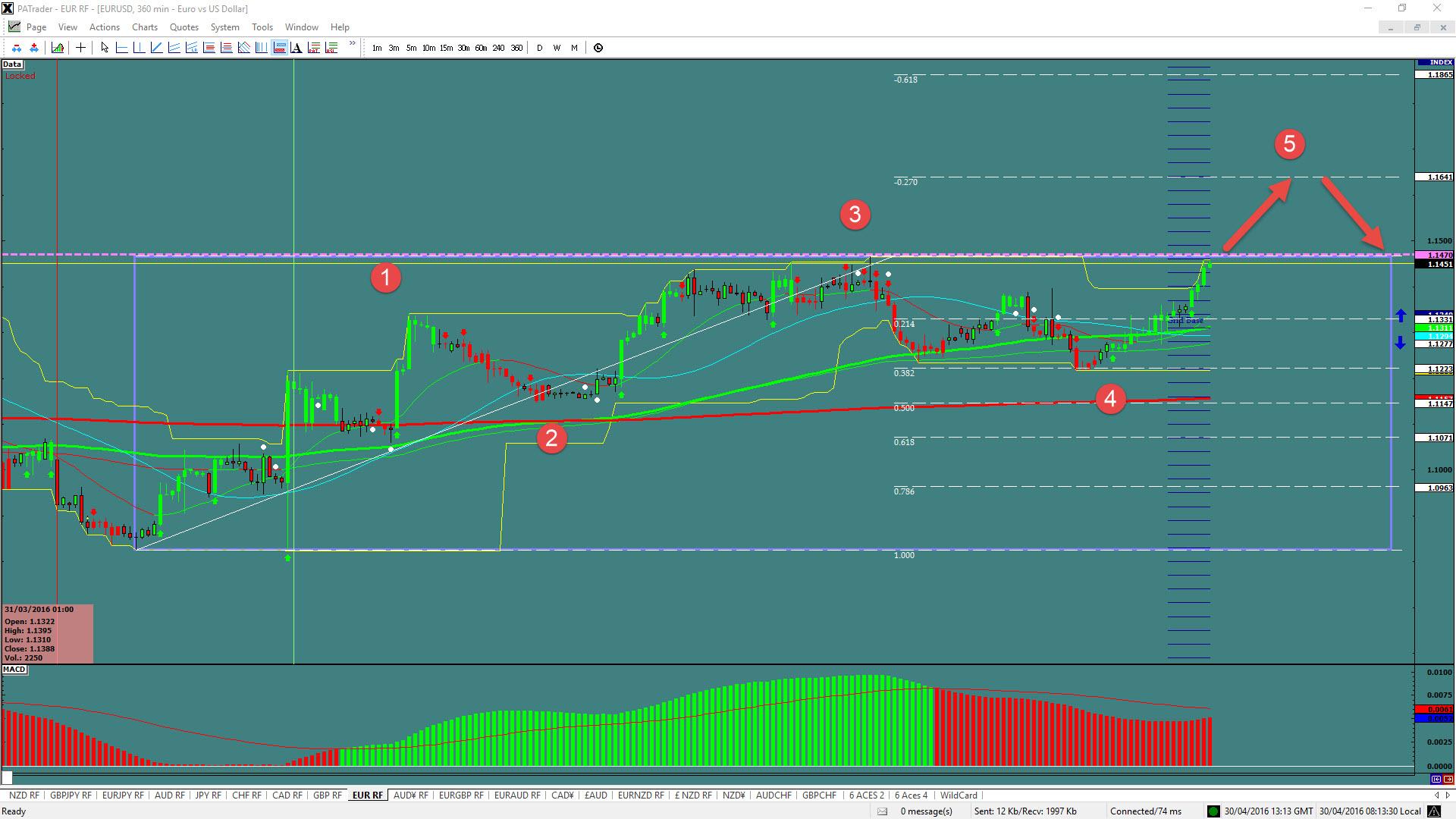

$EURUSD

What ProAct Forex Target Traders See: We are currently sitting @ 1.1222 in a range. As long as USDX is shorting we are looking for a continuation move up to the 1.270 Fibo@ 1.1641 and then a correction. The break up would confirm a fifth wave in place. The average daily true range (ATR) for the pair currently is 86 pips.

————————————————————————--

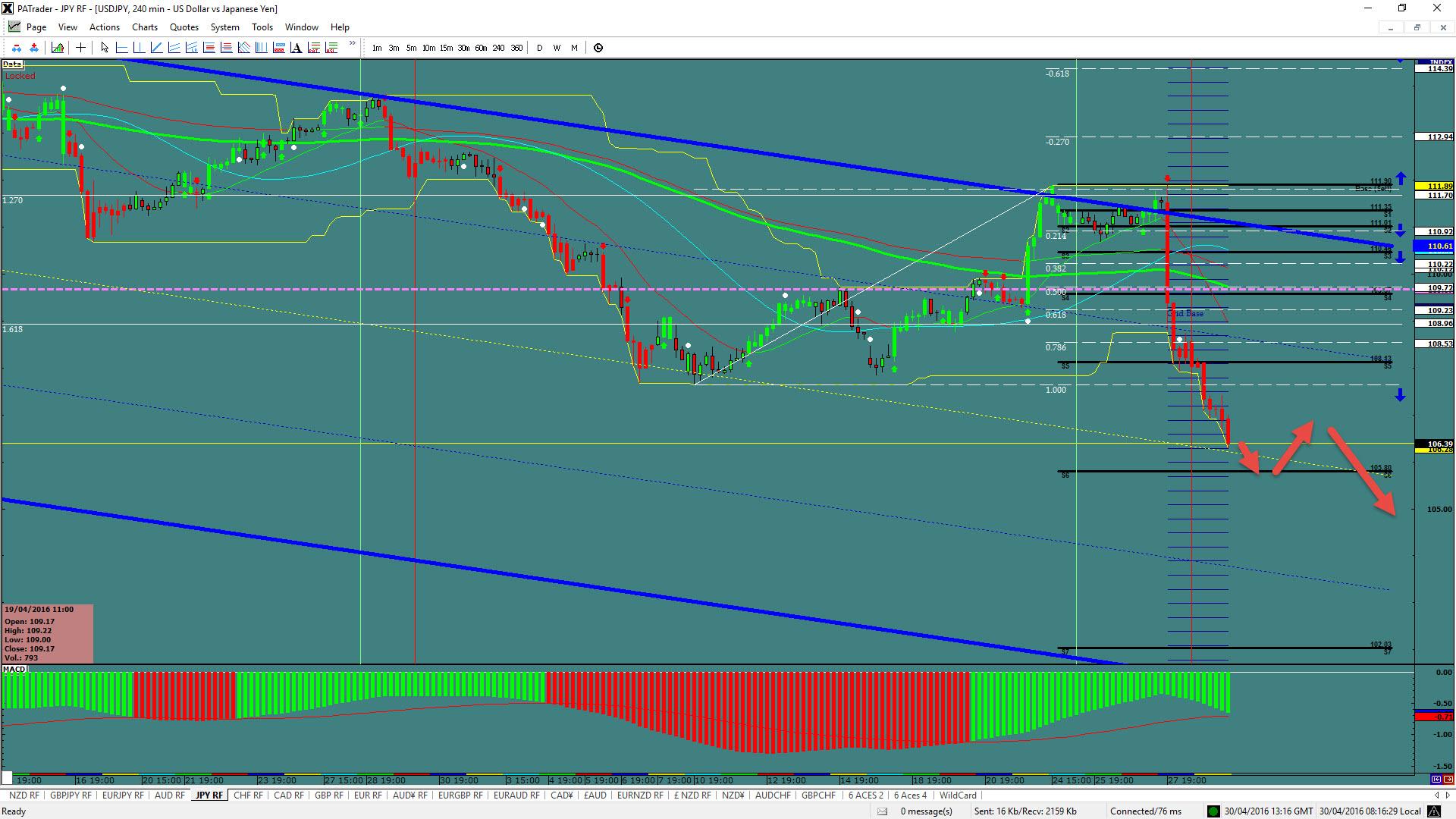

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 106.39. We are looking to the S8 @ 105.82 with a bounce there and possible continuation to the 105.00 Psychological number. The average daily true range (ATR) for the pair currently is 122 pips.

——————————————————————————–

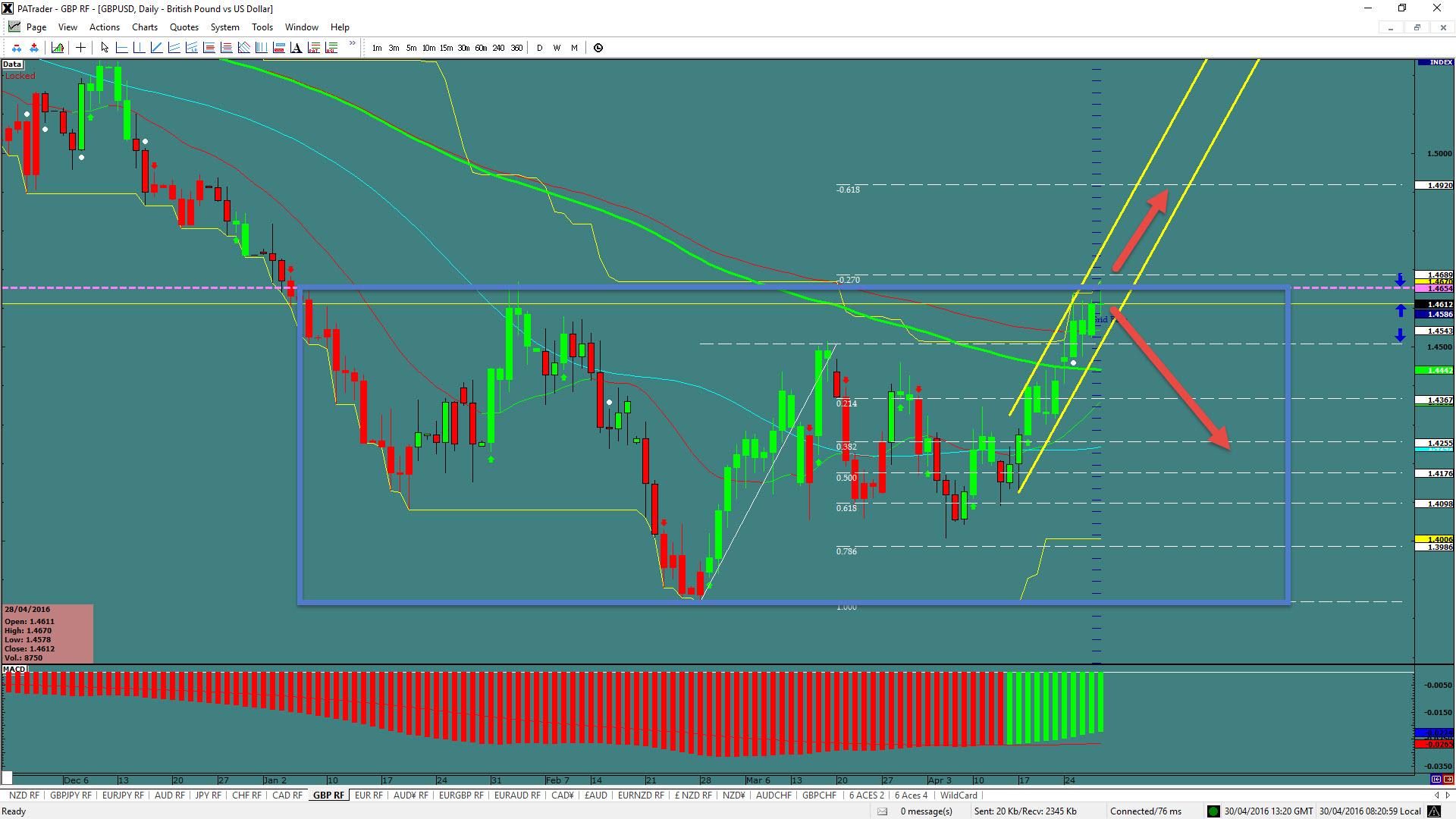

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently @ 1.4126 and in a large range. A couple of different scenarios: 1: As long as USDX is shorting Bullish: a move to the 1.618 Fibo @ 1.4920 area and 2: Bearish: A break down to the 0.382 Fibo support @ 1.4255. The average daily true range (ATR) for the pair currently is 129 pips.

——————————————————————————–

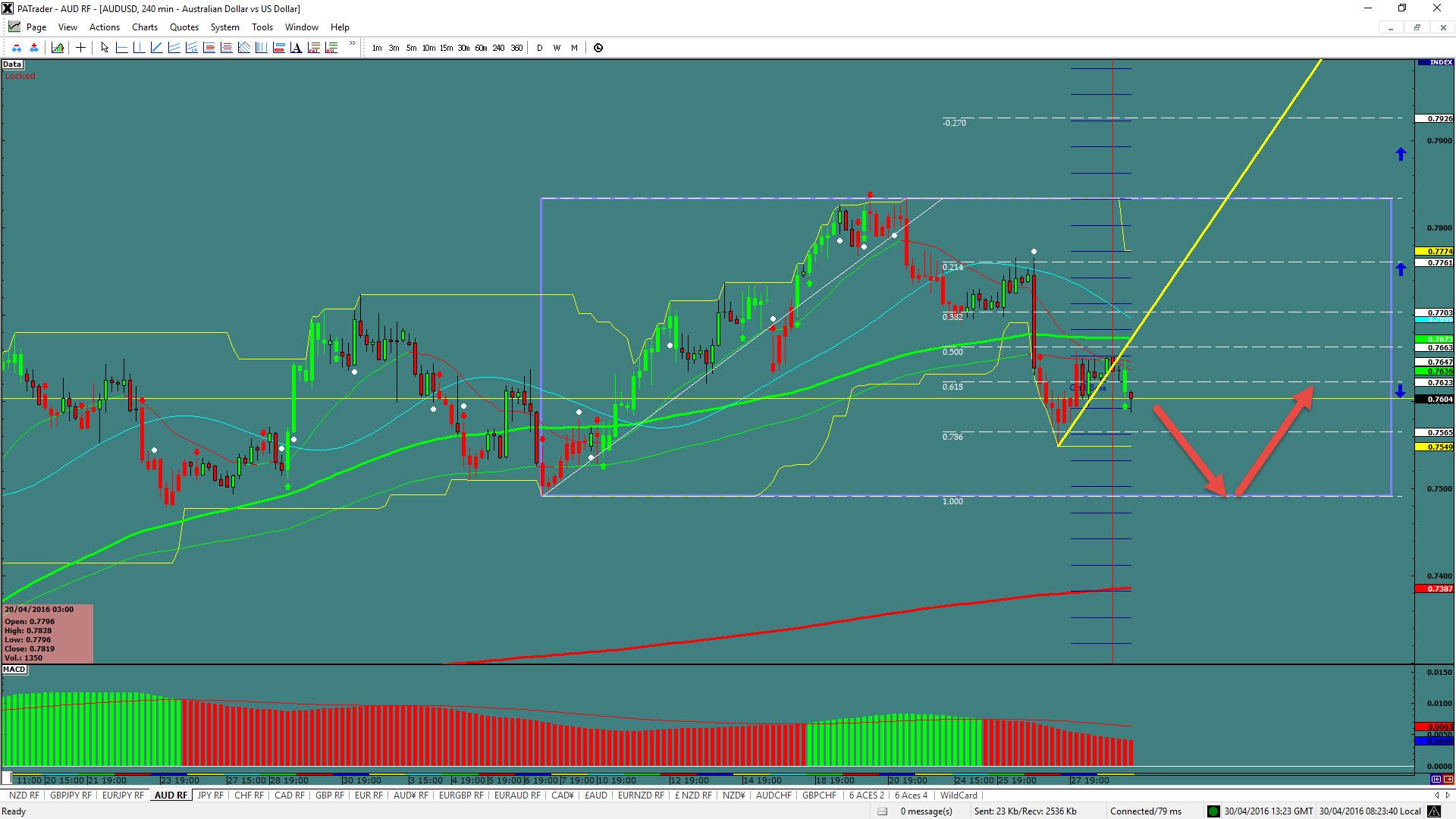

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7604 and in a range. We are looking for a continuation move down to the bottom @ 0.7500. A possible bounce to be expected there. The average daily true range (ATR) for the pair currently is 95 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.