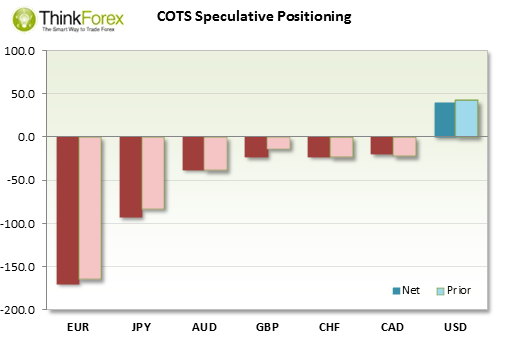

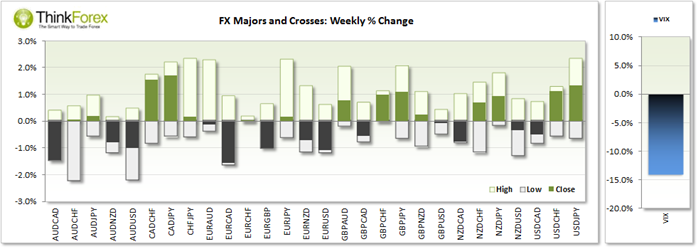

The decline of the Euro accelerated across the board following Mario Draghi's 'all it can take' comment on Friday. The question now is if it can sustain the move.

KEY EVENTS THIS WEEK:

ALL: OPEC Meetings

AUD: Construction; New House Sales; Private Capital Expenditure;

CAD: Retail Sales; Current Account; GDP

CHF: SNB Jordan Speaks

EUR: CPI; Unemployment; GER Business climate, employment CPI;

GBP: Mortgage Approvals; Inflation Report; Business Investment

JPY: BoJ Kuroda Speaks;

NZD: Trade Balance; Building Consents; Business Confidence

USD: Prelim GDP; Consumer Confidence; Core Durables; Core PCE; Unemployment; New Homes

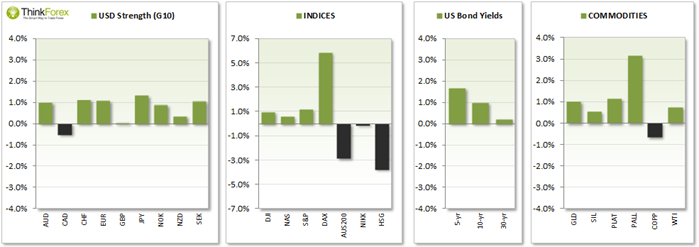

USD Dollar

Core PCE (Personal Consumer Expenditure) is the main inflation guage for the FED. As they have previously stated they expect inflation to tail off slightly then any strength here is likely to further fuel the increasingly bullish fire. The trend remain in tact but you can view an overall analysis for USD pairs.

Australian Dollar:

AUDNZD: With W1 not technically trending, remains within a broad sideways range of 109 - 113 and produced a Morning Star Reversal on D1, at the lows of this range.

EURAUD: on the back of Euro weakness the pair appears poised to break to a 1.421 (a 3 month low).

AUDJPY: Rikshaw Man Doji on W1 warns of weakness at the 18-month highs. However as long as D1 remain above 101.20 then further upside is likely, with a break below likely to target 100.26 and maybe 100.

Euro

Traders are sure to be watching the Euro following last week’s events. The Euro sold off heavily against all currencies last week following ECB President Mario Draghi’s ‘all it takes’ comments regarding the Eurozone to avoid deflation. This bearish sentiment has carried over to Asia trading, seeing the Euro gap down and continue its decline. Traders will now focus on German and Eurozone inflation data this week. With Germany being the largest economy in the Eurozone and narrowly escaping recession recently, any signs of inflationary weakness will fuel further deflationary fears for ECB, to see Traders continue shorting Euro as they anticipate more aggressive QE from ECB.

British Pound

GBPAUD: The original target of 2AUD has taken several setback but not completely over yet. With BoE printing weaker data and lowering growth targets we suspect the low has not been seen with any risk-on environment likely to favour AUD strength. However any downside is likely to be support around 1.773 which is the 61.8% retracement and April 2014 lows.

GBPNZD: Resistance was found at 2.0 with a Shooting Star Reversal and subsequent roll-over to signal a significant swing high. Now targeting 1.961 and seeking to sell into any retracements.

New Zealand Dollar

NZDCAD: This is an interesting one because both NZD and CAD have been gaining strength of late. That said, this pair has retraced 61.8% from the November highs which also houses the Monthly Pivot and horizontal S/R level. A Bullish Peering line has formed to suggest a swing low and price may be forming a bullish wedge. One to watch to either trade, or provide clues for which one will come out stronger. Based on this chart alone it would suggest NZD may have the upper hand this week.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.