The USD touched a new 4-year high on Friday before quickly reversing to remain well within the 120-pip range it has been stuck in this past week.

KEY EVENTS THIS WEEK:

AUD: Motor Vehicle Sales; Monetary Policy Minutes; RBA Stevens speaks; MI Leading Index

CAD: Wholesale Sales; Core CPI

CHF: Trade Balance; Zurbrugg speaks

CNY: HSBC Flash Manufacturing PMI

EUR: ECB Draghi Speaks; Ger/Fra Flash Manufacturing and Services PMI

GBP: CPI; MPC Asset Purchase and Bank Rate votes; Retail Sales

JPY: Prelim GDP; Monetary Policy Statement; BOJ Press Conference

NZD: Retail Sales; GDT Price Index

USD: PPI; Building Permits; FOMC minutes; CPI; Philly Fed Manufacturing Index

USD Dollar

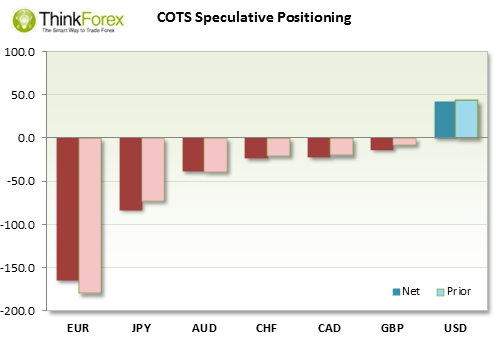

A slight reduction of both long and short contracts by large speculators at the highs suggests a hesitancy to commit at current levels.

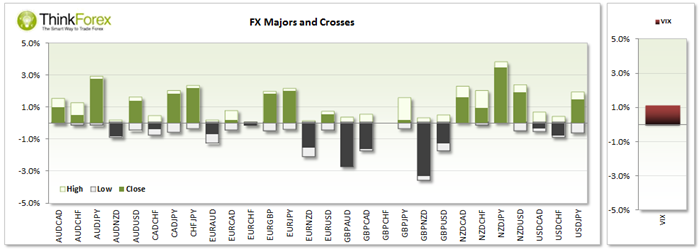

Bearish outside day on Friday and a Rikshaw Man Doji candle on W1 warn of weakness at the 88.30 high. A break below 87.28 warns of a deeper correction and may target the 86.9 and 86.5 support. Until a break lower than the Dollar is likely to trade sideways in the 120 pip range it has been stuck for the past 7 sessions.

USDCAD: 2nd consecutive Shooting Star at the 5-year highs warns of weakness at current levels. Friday's Bearish Engulfing also points to further downside, although we approach a zone of support between 1.123-56 and potential bullish trendline from September lows. A break below here targets 1.11 but foe now the bias is for the D1 bullish trend to remain intact.

Australian Dollar:

The RBA minutes are not expected to offer traders much, if any, new information. Perhaps Glenn Stevens may shed more light on the housing situation and macro-prudential tools, but if recent history is anything to go by this is also likely to leave traders disappointed.

Friday's candle for AUDUSD was a mixture of volatility and indecision, closing up only 20 pips from the open yet seeing a 127 pip daily range. The Aussie has since gapped up above last week's high, to its highest level in 11 sessions. At current levels it is testing the limits of an important cluster of resistance, with a break above 0.787 likely to trigger a run up to 0.878 and 89c.

If 0.878 holds as resistance then the bears are likely to target 0.864 and 0.854, the 4-year low we tested only 6 sessions ago.

Euro

14k short contracts were closed by large speculators and the week closed with a 2nd consecutive Bullish Hammer. Whilst this does not signify a market bottom it is worthy of noting as investor sentiment is clearly changin around current levels. With German and French Flash Manufacting PMI data due out htis week, any surprise upside data could see an extention of the bullish move towards 1.263.

British Pound

GBPUSD has continued to unwind as investors readjust their positions as they realise the Bank of England won't be raising rates any time soon. Cable printed a fresh 14-month low and the bearish momentum favours for this trend to continue, with traders likely to sell into any rallies. Currently on the 5th consecutive bearish monthly candle, at the current rate of decline we could be testing 1.50 in as little as 2 weeks.

MPC votes are revealed this week with the expectation to remain 9-2 in favour of keeping rate son hold.

Resistance to consider fading is 1.573, 1.578 and 1.583.

Support to target is 1.542 and 1.51 on D1.

New Zealand Dollar

GDT price index is the headline figure for the Kiwi Dollar this week. Following months of reduced prices the past two releases have held relatively steady to suggest the declilne is forming a base. Any upsode surprise here will be bullish for the Kiwi Dollar and may help it taker advantage of a weakening USD.

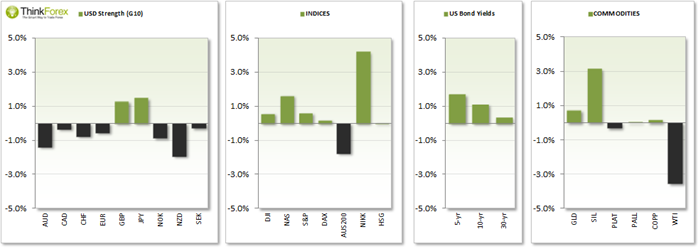

Gold

A 2nd consecutive Bullish Hammer suggests buyers above $1133 and have now pushed us back above the $1180 resistance (now support). Trend remains bearish below $1253 swing high with $1192, $1200 and $1222 likely to attract bearish interest and bullish profit taking.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.