A snapshot view of last week's money flow and technical notes for the week ahead.

KEY EVENTS THIS WEEK:

AUD: Building approvals; Import prices; Producer Price Index; Commodity Prices

CAD: GDP

CNY: CFLP Manufacturing PMI; HSBC Final PMI; Services PMI

EUR: German Preliminary CPI; German Retail sales; Euro Flash Estimate; Core CPI Flash

GBP: Met Lending to Individuals; Manufacturing PMI

JPY: Household spending; Retail Sales; BoJ Kuroda Speaks

NZD: Building Consents

USD: Advance GDP; FOMC Statement; Nonfarm Payroll; ISM Manufacturing PMI

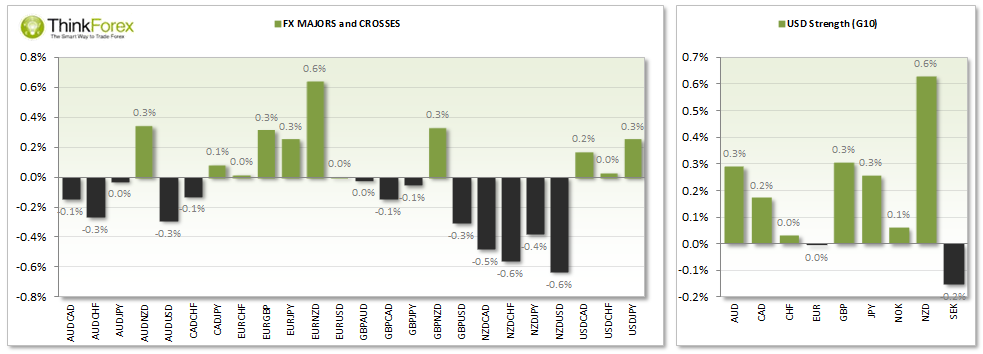

FOREX:

DXY Closed above 81, its highest in 24-weeks and seemingly forming a bullish trend; D1 support at 81

AUDUSD W1 Rikshaw Man Doji and trading sideways; Suspect topping pattern is in place but D1 lacks direction or momentum

EURUSD Bearish move accelerates but stalls just above 200-week MA; D1 remains bearish with resistance at 1.346 and 1.35

GBPUSD Most bearish close in 18-week; Support close by at 1.695 and from bullish trendline from Feb lows; looking to return to the bullish trend over coming week/s

USDCAD Closed above 1.081 resistance to add further weight to June lows being a multi-month low

USDCHF Closed at a 24-weekhigh and above 0.9037 resistance

USDJPY W1 Morning Star Reversal closed at 2-week high; Needs to break above 102.26 highs to break out of range; D1 saw Rikshaw Man Doji

NZDUSD Most bearish 2-week decline since mid-April; Resistance at 0.860 and targeting 0.850

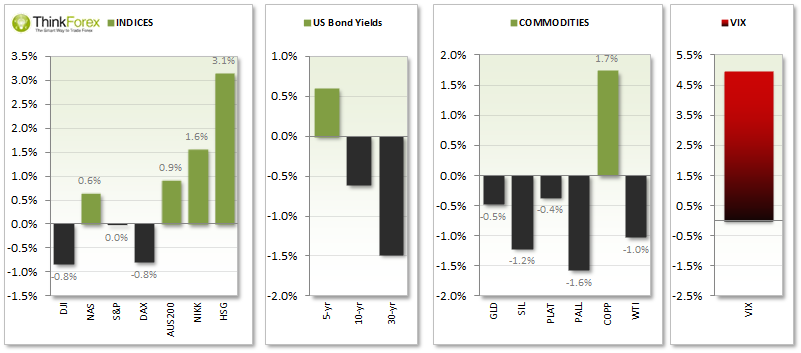

COMMODITIES:

GOLD W1 Rikshaw Man Doji; D1continues to meander around $1300; Holding above 50/200 MA and above $1300 again with near-term bullish bias

SILVER Retracement to $20.30 achieved and suspect correction may be over;

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.