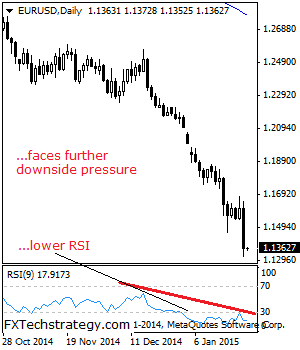

EURUSD: With EUR declining strongly further the past week, further downside is likely in the days ahead..Support is seen at 1.1150 level with a cut through here opening the door for more downside towards the 1.1110 level. Further down, support lies at the 1.1050 level where a break will expose the 1.1000 level. On the upside, resistance lies at the 1.1250 level where a violation will aim at the 1.1300 level where a break will aim at the 1.1350 level, its psycho level followed by the 1.1400 level. Further out, resistance comes in at the 1.1450 level. All in all, EUR remains biased to the downside in the medium term.

USDCAD: Extends Bullish Offensive

USDCAD: With price extension seen the past week, USDCAD faces further bullishness in the new week. However, a corrective pullback may develop following its recent upside run. On the upside, resistance is seen at the 1.2500 level followed by the 1.2550 level. Further out, resistance comes in at the 1.2600 level where a turn lower may occur. But if further recovery is triggered resistance comes in at the 1.2650 level. Its weekly RSI is bullish and pointing higher supporting this view. On the downside, support lies at the 1.2350 level followed by the 1.2300 level. Further out, support resides at the 1.2250 level and then the 1.2200 level. All in all, USDCAD continues to face bullish offensive medium term.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.