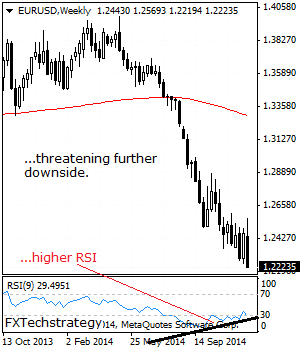

EURUSD: Vulnerable, Reverses Gains

EURUSD: Outlook for EUR continues to point lower following a reversal of its previous week gains the past week. However, a mild recovery higher may occur before more strength is seen in the new week. Support is seen at 1.2150 level with a cut through here opening the door for more downside towards the 1.2100 level. Further down, support lies at the 1.2050 level where a break will expose the 1.2000 level. Below here will pave the way for a move lower towards the 1.1950 level. On the upside, resistance lies at the 1.2700 level where a violation will aim at the 1.2750 level where a break will aim at the 1.2800 level, its psycho level followed by the 1.2850 level. Further out, resistance comes in at the 1.2900 level. All in all, EUR remains biased to the downside in the medium term.

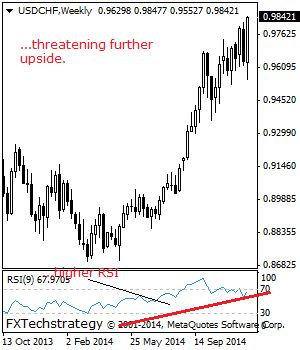

USDCHF: Closes Higher, Targets Further Strength

USDCHF: With USDCHF reversing its previous week declines to close higher, it faces further upside threats in the new week. On the upside, resistance resides at the 0.9900 level where a break will aim at the 0.9950 level. Further out, resistance resides at the 1.0000 level. A breather may occur here and turn the pair lower but if taken out, expect a push towards the 1.1050 level. On the downside, support lies at the 0.9800 level with a break targeting the 0.9750 level and then the 0.9700 level. Further down, support comes in at the 0.9650 level. All in all, the pair remains biased to the downside medium term.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.